Arm, the leading chip designer, is preparing for a blockbuster IPO that could value it at up to $70 billion. The company, whose technology powers most of the world’s smartphones, tablets, and laptops, has attracted the interest of several tech giants, including Amazon, Intel, Google, and Nvidia. These firms are reportedly in discussions with Arm about possible investments before it goes public.

One of the most notable potential investors is Nvidia, the maker of the Grace data center processor that is based on Arm’s Neoverse V2 architecture. Nvidia had previously tried to buy Arm for $80 billion, but the deal was scrapped in February due to regulatory hurdles. Now, Nvidia may seek a stake in Arm to secure its access to its cutting-edge chip designs.

Arm’s designs are widely used by the semiconductor industry, as they offer high performance and low power consumption. Intel, AMD, Nvidia, and Qualcomm are some of the major customers of Arm, who license its designs to produce their own chips. Arm’s IPO could be a game-changer for the chip market, as it could give the company more resources and independence to innovate and compete.

In this article, we’ll delve into ARM’s vast patent portfolio, highlighting its significance for industry leaders like Nvidia. We’ll review the state of ARM’s patents, monetization prospects, challenges, and a comparison with Nvidia’s patents. Discover how these innovations strategically position both companies in the dynamic semiconductor industry.

Table of contents

- ARM’s Portfolios Status

- Potential Monetization opportunities and Challenges

- Arm’s patent portfolio is comparable to Nvidia’s, but Nvidia has more inventions in portfolio development

- Arm’s portfolio appears to be beneficial for Nvidia

- Conclusion

ARM’s Portfolios Status

Introduction

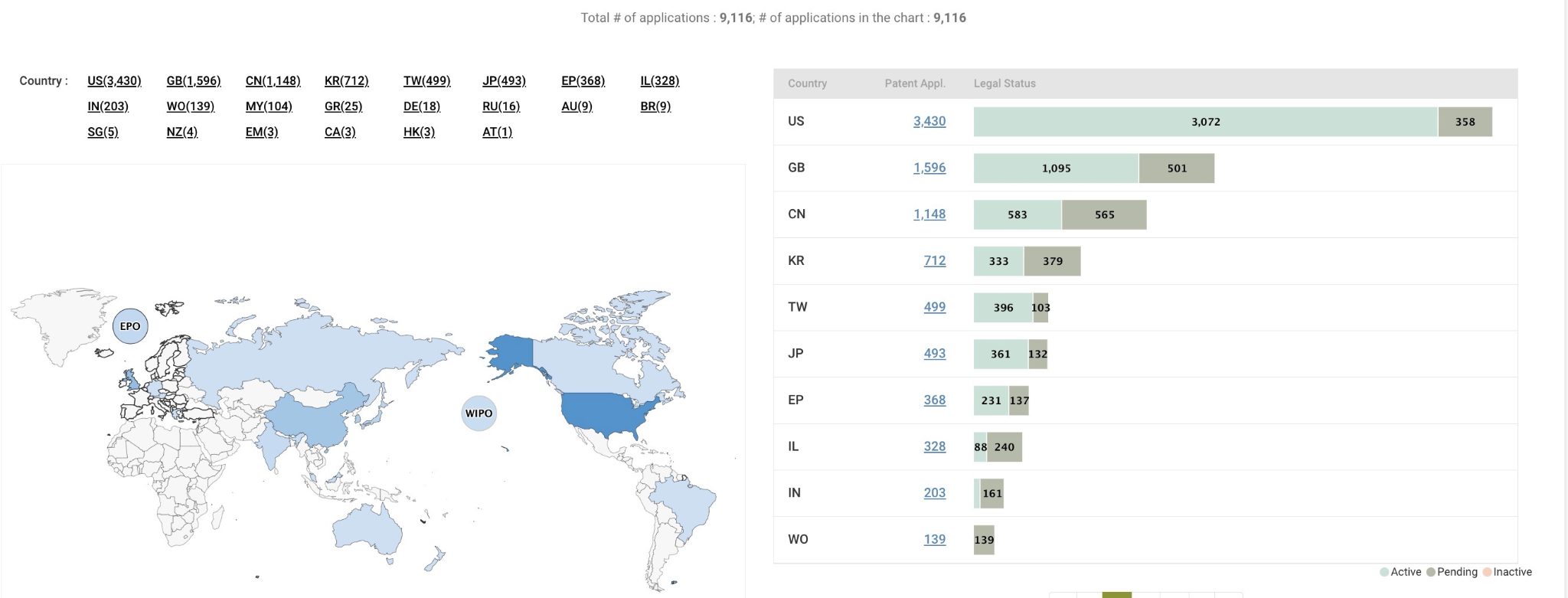

ARM’s 9,116 patent assets are found in 22 regional jurisdictions, in which U.S patents consist of 33% of the applications (3,034 out of 9,116). GB and China are where the 2nd and 3rd active patents are deployed.

Potential Monetization Opportunities and Challenges

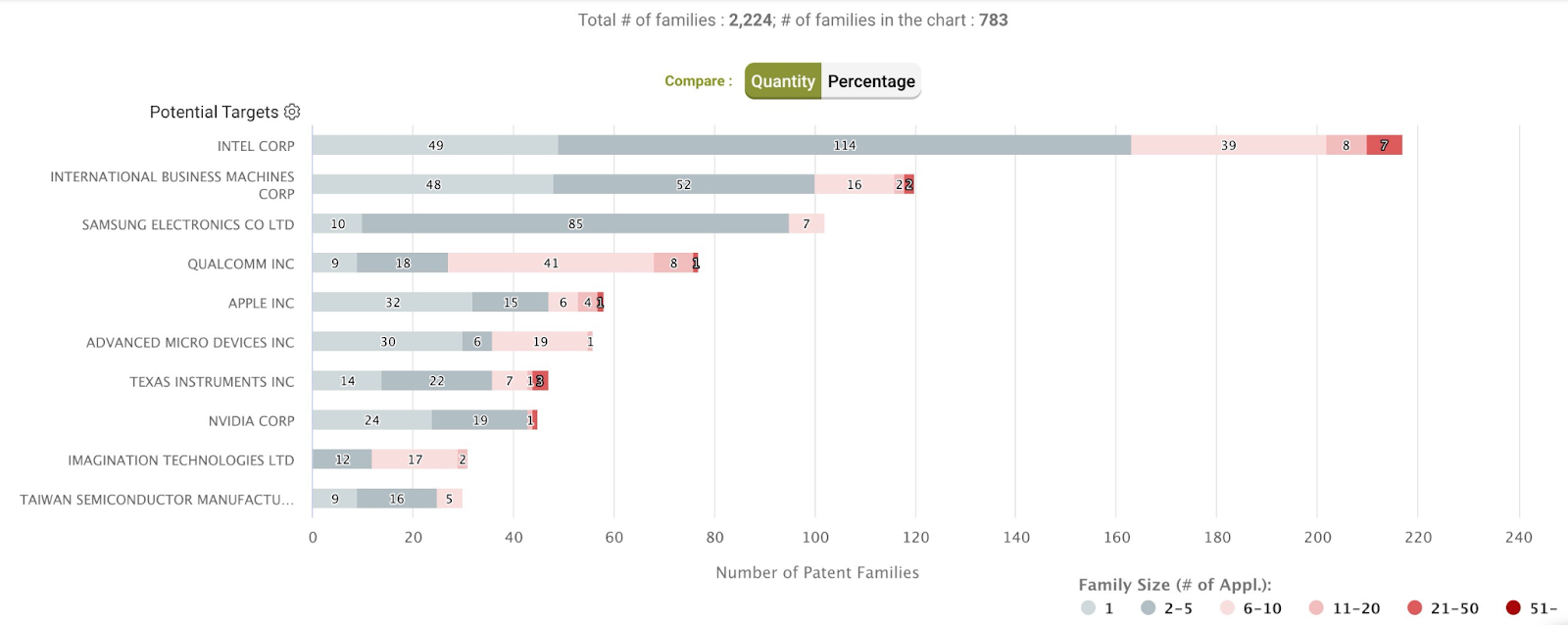

Arm’s Potential Targets of the Portfolio, based on forward citations, provides insight into potential transaction or enforcement targets within the semiconductor and technology industries.

Arm’s Potential Targets of the Portfolio, as represented by forward citations in the US, CN, EP, and WO patents, paints a comprehensive picture of the followers and possible monetization avenues for the company. The chart not only identifies major semiconductor companies such as Intel, IBM, Samsung, Qualcomm, Apple, AMD, TI, and Nvidia as potential targets but also represents various technological areas that could be of interest.

The family size of the forward citations can signify the extent of investment and may reflect the possibility of commercializing relevant inventions or interest in the portfolio. Moreover, the estimated likelihood of these targets practicing the patents is reflected in the size of their relevant patent portfolios. This comprehensive analysis helps in identifying potential transaction or enforcement targets within the industry and can guide strategic decisions around licensing, collaboration, or acquisition.

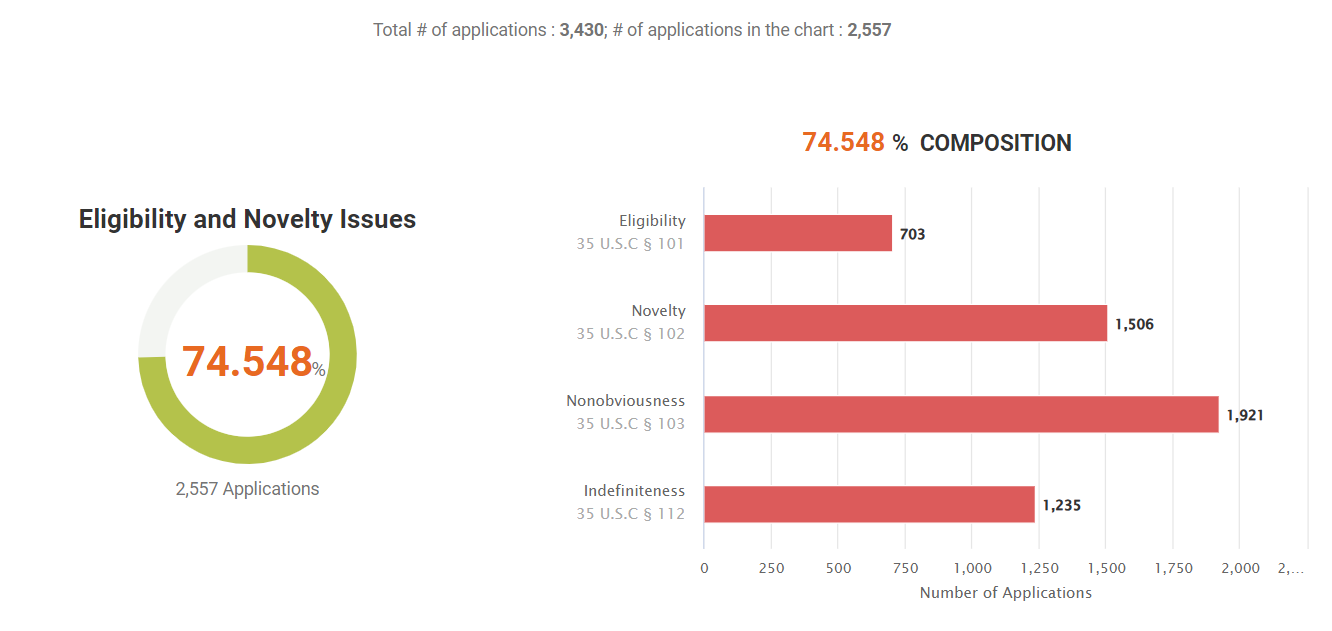

Hidden Concern: Novelty Issue

It’s worth noting that a significant percentage of ARM’s patent applications have been challenged for novelty. This could imply a need for vigilance in maintaining the quality and distinctiveness of the patent portfolio, to ensure that it remains a valuable and defendable asset.

Arm’s patent portfolio offers significant opportunities for monetization, as evidenced by the Potential Target chart. Key technology followers, including industry giants such as Intel, IBM, Qualcomm, Samsung, and others, have been identified as potential buyers or licensees.

Arm’s Patent Portfolio is Comparable to Nvidia’s, but Nvidia has More Inventions in Portfolio Development

Comparing Landscape

-

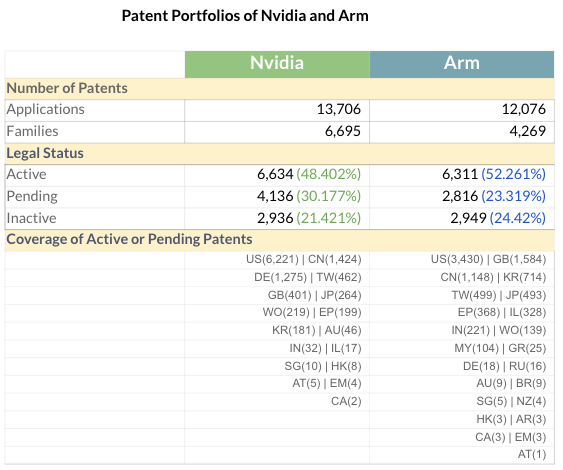

- With 13,706 applications in 6,695 patent families, Nvidia has a more extensive portfolio than Arm, which has 12,076 applications in 4,269 patent families.

- Looking only at active patents, the number of patent applications the two companies hold is closer. Nvidia has 6,634 active applications, and Arm has 6,311.

- Regarding regional deployment, Arm maintains its patent portfolio in more jurisdictions, with active or pending patents in 22 countries. On the other hand, Nvidia’s coverage is in 17 countries.

- Nvidia’s emphasis on quantity suggests a wide-ranging technological pursuit, while Arm’s focus on active patents and broad regional coverage highlights a commitment to safeguarding impactful innovations across key markets.

Source: Due Diligence

Arm’s portfolio appears to be beneficial for Nvidia

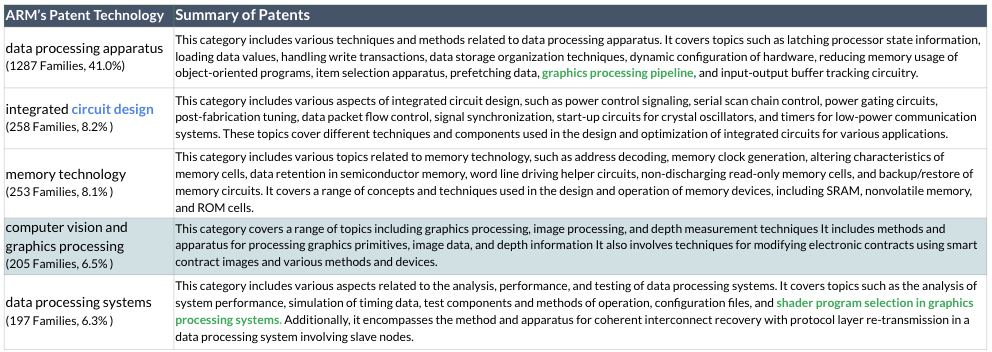

ARM’s Patented or Patent-Pending Technologies

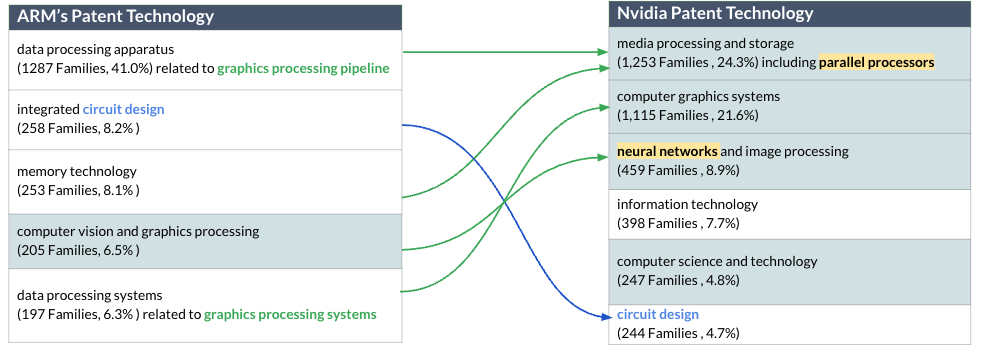

More than 40% of ARM’s patented or patent-pending technologies are concentrated in the field of data processors, demonstrating a high degree of internal relevance. Some of these technologies further extend to applications within the graphics processing pipeline. Additionally, ARM’s portfolio includes 200 patent families related to computer vision and graphics processing. This segment of their portfolio aligns closely with Nvidia’s core business, indicating areas of potential synergy and collaboration between the two companies.

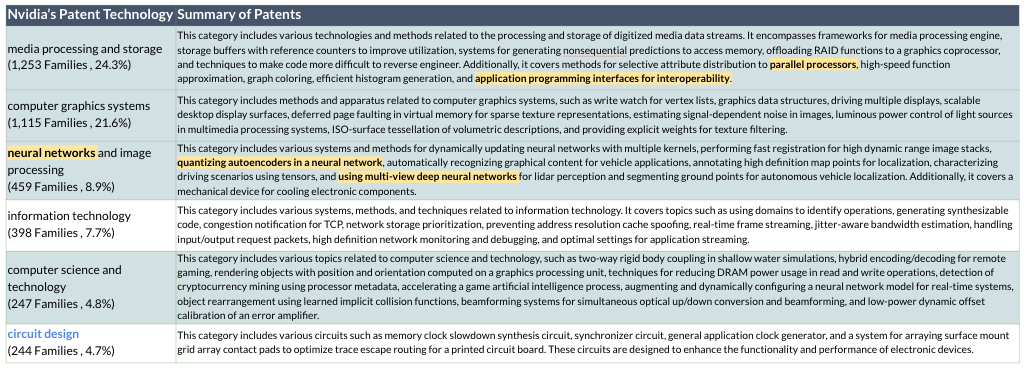

Nvidia’s Patented or Patent-Pending Technologies

We can identify most of Nvidia’s patented technologies (“patented technology”) are highly relevant to media or graphic processing. According to the summary, some of which are also applicable to artificial intelligence technology. In addition, there are 240 families that are related to circuit design which is also relevant to ARM’s top patented technologies.

Find more information on: Nvidia’s Patent Portfolio: Fueling the AI Revolution and Driving Market Success

Technological Relevance

The comparison between ARM and Nvidia’s patent portfolios reveals notable intersections in their technological domains. ARM’s patented technology in data processing and memory appears to align with Nvidia’s patents in media processing and storage. Furthermore, ARM’s patented innovation in integrated circuit design corresponds with one of Nvidia’s top patented technologies. This technological relevance between the companies may elucidate why Nvidia has consistently been seeking opportunities to acquire or invest in ARM.

Conclusion

- Diverse Technology Focus

ARM’s patent portfolio is robust and diverse, with significant holdings in data processing apparatus (41.0%), integrated circuit design (8.2%), memory technology (8.1%), computer vision, and graphics processing (6.5%). This wide array of patented technologies showcases ARM’s commitment to innovation across various technology domains. - High Relevance to Nvidia

Over 40% of ARM’s patented or patent-pending technologies are highly relevant in the field of data processors, with applicability to graphics processing pipelines. With 200 patent families related to computer vision and graphics processing, ARM’s portfolio aligns well with Nvidia’s core business, offering potential synergies. - Potential Monetization Targets

The analysis of forward citations uncovers potential targets for transactions or enforcement within the semiconductor and technology industries. This information may guide ARM in identifying potential buyers or licensees of its patent portfolio, reflecting opportunities for commercializing or monetizing its intellectual property. - Novelty Challenges

It’s worth noting that over 40% of ARM’s patent applications have been novelty challenged.

Want to check it out? Try the Patent Summary feature in our free interactive Due Diligence demo report for a limited time only!

Or schedule a demo to assess your patent portfolio.

*the Patent Summary Feature:

Please note that the Patent Summary feature within the Due Diligence is currently available at no extra cost as part of your Due Diligence subscription.

However, we would like to inform our valued customers that in the future, this particular feature may be subject to additional charges. Any changes to the pricing structure will be communicated in advance, and users will have the opportunity to review and accept the updated terms and conditions.

We encourage users to take advantage of this feature during this complimentary access period. If you have any questions or need further clarification, please don’t hesitate to contact our support team.