The article was written by Y.P. Jou, founder, and CEO of InQuartik, and was supplemented by Will Huang, InQuartik’s Product Growth Manager.

Table of contents

People from all walks of life are talking about the 5G era — an era that will bring opportunities for application and development in various industries, such as intelligent life, intelligent home, intelligent transportation, intelligent manufacturing, and intelligent medical care, as well as opportunities for the development of artificial intelligence (AI) and big data. Undoubtedly, these opportunities will not only drive new applications for existing software, hardware, and big data but will also facilitate the birth of new forms of products and services.

As 5G gradually penetrates each industry, however, there are some risks behind the scenes. Take Taiwan, for example; the 5G standard essential patents (SEPs) of Taiwan account for just 2% of the global total (in contrast to China, which accounts for roughly 30%). This relatively low percentage implies that Taiwan did not put much effort into 5G research and development over the past few years. Moreover, the concept of 5G and AIoT is still quite abstract in Taiwan’s industry and research circles, which means that most of the people in the industry do not know how 5G will impact their business model and daily operations, nor how to bring 5G and AIoT to their products to create new business opportunities.

From another aspect, Taiwan’s industries will face SEP litigation threats and will undoubtedly be required to pay licensing fees in various countries. How can these issues be dealt with? What problems and challenges will be faced? These questions also apply to other countries similar to Taiwan — countries with abundant industrial power but without strong SEP portfolios.

Therefore, the author, based on his experience in transforming 3G, LTE, and 5G R&D achievements into SEPs and monetizing them via licensing, trading, and litigation — experience amassed during both his extensive professional career and his work with WISPRO, MiiCs, and InQuartik — will briefly introduce the most critical problems and challenges faced relating to 5G+AIoT and their countermeasures as follows:

5G+AIoT Problems and Challenges

Some critical problems caused by 5G+AIOT exist, and they are usually unfamiliar to most enterprises, including:

- What are the form factors and their field of use opportunities? Where are they? What about their supply chains? What is the relationship between the form factor, SEP, and the technical standard (TS)? How should we go about accurately selecting the right ideas for productization?

- Among the SEPs declared by a SEP holder, which ones are mandatory, and which ones are optional? What is the total number of SEPs worldwide and the numbers/proportions per country? What do the SEP holders, legal statuses, and the RAN/CT/SA series look like globally? What are the numbers/proportions of all SEP holders and individual holders, and what are the numbers/proportions per country?

- What is the calculation basis for a SEP holder to claim royalties? Does it comply with the FRAND principles?

- Can all SEPs declared by the holder correspond to the TS to make a claim chart? What is the validity of the SEPs for which the claim chart is made?

- A SEP holder talks about a licensing scheme with the 5G implementer on the one hand but then threatens with a patent infringement lawsuit on the other hand. Most 5G implementers have never experienced talking about panic business with a knife held to their throat.

- Chinese courts have started to consider licensing fees from a global perspective, and have even introduced Anti-Suit-and-Injunction (ASI). In the meantime, German courts have also made Anti-Anti-Suit-and-Injunctions (AASI) against the ASI made by the Chinese courts. Moreover, British courts are also using global rates. How will the implementers deal with SEP holders by applying the judgment made by each country?

- Taiwan is relatively short of AIoT talents and has no stable environment for commercial software and big data operation.

5G+AIoT Countermeasures

The countermeasures required for 5G+AIoT issues are beyond the capabilities of individual enterprises in Taiwan. Subsequently, it is imperative to integrate resources from all walks of life with the government’s support to develop solutions. Therefore the industry and research circles can use these solutions to solve the problems and face the challenges as mentioned above:

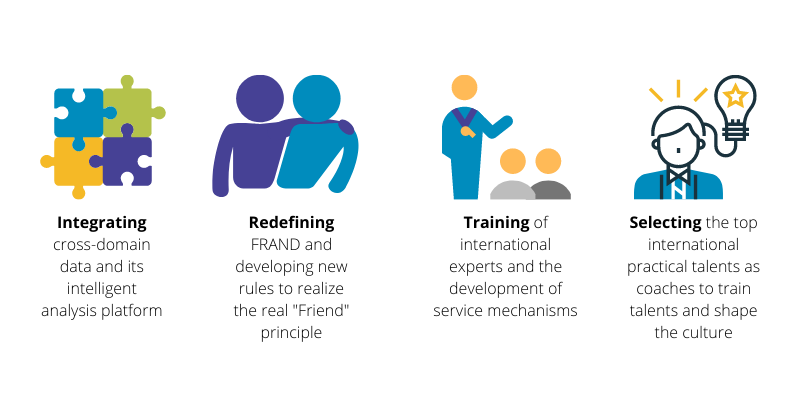

- Cross-domain data integration and its intelligent analysis platform, i.e., to integrate the data of chipsets, modules, form factors, and application fields of terminal products, technical documents (T-Doc), TS, patents, and their litigation. Developing an intelligent analysis platform that requires no cumbersome search methods will solve problems 1-5 as mentioned above — improving the situation of information asymmetry for 5G implementers, driving SEP holders to adhere to FRAND principles while monetizing their patents, accelerating the penetration rate of 5G in each field, and achieving the development goal of 5G and even the subsequent 6G.

- Redefining FRAND and developing new rules to realize the real “Friend” principle

- Training of international negotiation, contract, litigation, and SEP experts and the development of service mechanisms. It is difficult for most 5G implementers to have their own international SEP negotiation, contract, and litigation experts or obtain the services required from law firms and patent firms in Taiwan. Therefore, the government may build a team consisting of a few existing experts to train talents, develop professional service mechanisms, and provide services to all walks of life so that enterprises can hold reciprocal and effective negotiations and deal with contracts and lawsuits.

- Selecting the top international practical talents — with rich experience in commercial software, AI, big data, product planning, and business model design — as coaches to train talents and shape the commercial software culture will help to enable Taiwanese enterprises to effortlessly seize the development opportunities of the 5G era and drive the industry and research circles to invest in 6G research and development.

As of today (March 10), 60 companies worldwide have declared 5G standard essential patents at ETSI, reaching a total of 37,288 simple families, having 81,098 granted and active patents in 46 jurisdictions. Among which, 29,079 families are newly declared 5G SEPs (76.8%) made by 58 companies and held by 95 group companies as current owners.

Patentcloud’s SEP Omnilytics integrates ETSI SEP declaration data with the vast amount of quality patent data available in Patentcloud and delivers timely and transparent intelligence. SEP Omnilytics is the best platform that provides daily updates on SEP declaration activities — presented in intuitive dashboards.