In this article:

- Intro

- Why build a patent portfolio?

- What makes a strong patent portfolio?

- The principles of a great patent portfolio

Intro

“There is safety in numbers” according to the old English proverb – referring to the hypothesis that being part of a large group of people, an individual is much less likely to encounter a mishap, attack, or other bad event.

While this saying is usually associated with people and animals – conjuring up images of thousands of wildebeest charging down and fending off a small pack of lions on the Serengeti, it is also very relevant in the patent industry, particularly when discussing patent portfolios.

But, contrary to popular belief, quantity might not always be the best strategy. So, what makes the perfect global patent portfolio and what considerations need to be taken into account?

Why build a global patent portfolio?

Different sized companies build patent portfolios for different reasons. Large corporations, for example, will build a patent portfolio to enhance market share in a particular sector or to gain a footprint in a certain area, to broaden their claims and patent coverage, litigation defence and offence purposes and diversity.

Small companies and start-ups, on the other hand, will build a patent portfolio to increase valuation in preparation for acquisition or investment, as both acquirers and investors alike favour patents as a possible recourse for litigation, and for their intrinsic value.

What makes a strong global patent portfolio?

Most global patent portfolios are managed according to the corporate goals and objectives, meaning the optimal size of a patent portfolio is specific to each company.

However, patent portfolios should be a continued evolving process that incorporates diversity, scaling, outside market factors and stabilisation tactics.

Scaling a portfolio includes many filings in a given subject matter and is a time-proven tactic to increase market leadership and reduce litigation risks as any number of patents can be used for supporting counterclaims.

The principles of a great patent portfolio

According to Larry M. Goldstein, a US based Patent Attorney and author of the book “Patent Portfolios – Quality, Creation, and Cost”, there are ten key principles of great patent portfolios.

Principle 1: A technology company must determine its strategy with regards to patents.

Often overlooked and not practised, a company must make a conscious decision that it wants a strategy for its patents, it must decide what that strategy will be, and it must then implement the strategy. The strategy will include at least target results and budgets, but may extend up to licensing income, specific financial returns on R&D, disincentives for competitors to initiate patent lawsuits or inhibiting them from freely developing their own R&D.

Principle 2: A good patent portfolio matches the strategic focus of its owner.

A good patent strategy is made as a result of the corporate strategy and in support of the corporate strategy, not made separately. This means that communication and direction is key on certain aspects, such as:

- Technologies, markets and products to be protected.

- Size of portfolio.

- Geographic balance.

- Balance over time.

- The company’s competitive position on relative quantity and quality of the portfolio.

Above all else, the two most crucial elements that need to be included in any patent strategy are targeted results and targeted investment.

Principle 3: Invest the right amount in patents.

It can be difficult to gauge what the right amount is and how to arrive at that figure. A number of principles can be applied to determine an estimated range of investment with various benchmarks.

One possible rule for a standard technology company is that the investment in patents should be about 1% of the amount invested in R&D, as there is a large amount of material that supports 1% as a benchmark. However, this figure is only a benchmark and will depend on the specific needs of the company.

Factors that see an increase in the standard 1% are: Very rapid technology change, groundbreaking discoveries, new companies and new industries, system integration, consumer sales, patent attacks from competitors, and an aggressive patent strategy by the company.

Conversely, a slow rate of technology change, incremental technology, mature companies, mature industries, component sales only, and a relatively complacent industry with regard to patents, would all suggest a possible investment of less than 1% of R&D investment.

Patents are generally intended to support the R&D effort, although other benchmarks can be used with some companies taking a standard ratio for R&D to revenue of approximately 7%. Using the same 1% guide against the 7% for R&D to revenue benchmark would give the investment for patents at .07%.

It is worth remembering that patent costs are a fraction of the cost of litigation, which typically run into the millions of dollars, without the added potential of losing a case (and the rights to the patent) and having to forfeit anywhere from tens of millions to billions of dollars in damages and/or prohibited from operating in that particular field.

Principle 4: Balance of quality and quantity.

A global patent portfolio should be judged according to both the quality and quantity of its patents. While quantity speaks for itself, two common mistakes are often made related to quality.

The first being that the quality of the portfolio is usually overlooked, with the focus being on the quantity only. This is common in companies of all sizes. The main problem is that quality is often perceived to be difficult to judge and hard to measure. Therefore, quantity is used as a proxy for quality.

So, what can a company do to ensure the quality of its patents as opposed to quantity? Identifying the Key Claim Terms in every application and specifically explain each such term in the way most favorable to you, or review every application for the most common quality mistakes, those mistakes that infect a large number of patents, then remove them from the applications. Using claim parallelism to insurance the most powerful protection possible for the key Points of Novelty.

There are ways to judge the quality of a patent. At a minimum, a high-quality patent has good claims that are well-supported in the written description, and the patent does well in a VSD evaluation. These traits are defined in greater detail in Larry M. Goldsteins earlier book titled “True Patent Value”, which is available on the website below.

A company should always understand the relative quality of its patent portfolio, and should know whether the general trend of the portfolio is towards increasing or decreasing quality.

Second, companies sometimes boast about and strive to obtain only the highest quality patents. Realistically, this is not possible and would require a great deal of financial investment, effort, and engineering development, which wouldn’t make sense and companies simply could not justify.

The truth is that the strength of every patent portfolio is judged on both quality and quantity. This means that the strongest patent portfolios will include several outstanding patents, whilst the rest of the patents will contribute to the quantity and support the outstanding patents.

The outstanding patents should be identified as the leading and most important inventions, and should be protected by very strong patents for relevant Points of Novelty. The remaining patents should not be over-invested in that they defy logic.

One method to determine which patents are the most prolific within a company’s patent activities is to employ a ranking system which rates inventions by type and potential impact. Those that are strategically important receive special attention – their applications are drafted and prosecuted with great care.

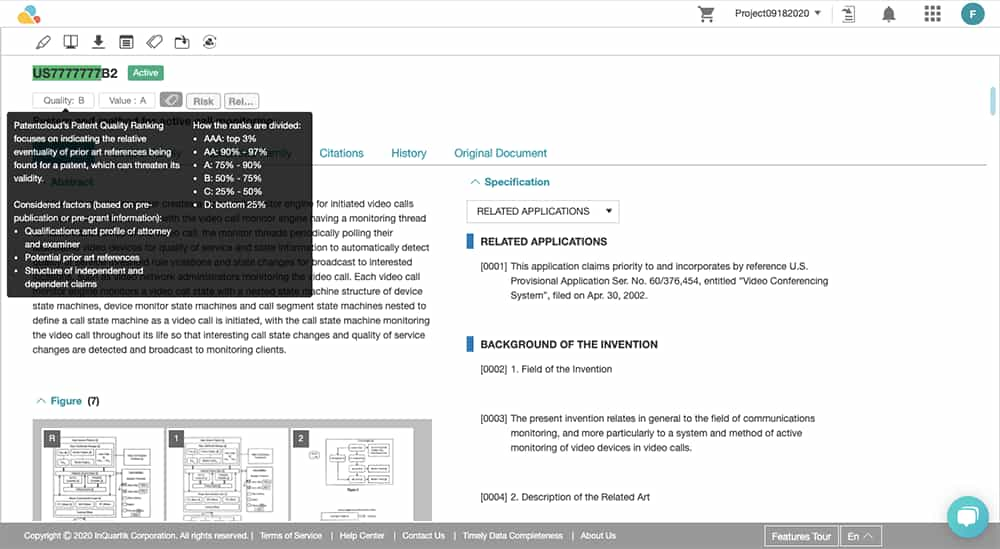

Patentcloud’s Patent Search and Due Diligence both feature an automated ranking system — the Patent Quality and Value Rankings — which gives details of the patent quality (pictured above) for all patents that are registered with the US, Europe, China and Japan patent offices. This feature uses state of the art AI technology which removes the possibility for human error when judging the quality of the patent.

Sign up now to explore the these features for free!

Other notable inventions such as those considered as breakthrough inventions, innovations that fall into the category of “Technology Inflection Points”, and inventions that cover critical features of technical standards should all be patented with great care.

For other, less strategically important inventions, the notion is to file quickly and get something on paper as soon as possible.

Don’t miss part two of our “The qualities of a perfect global patent portfolio” article next week, in which we reveal principles 5 – 10.

The “Ten Principles” outlined in this guide are taken, in full, or, in part, from the book titled “Patent Portfolios – Quality, Creation, and Cost”, written by US Patent Attorney Larry M. Goldstein who is based in Tel Aviv, Israel. “Patent Portfolios – Quality, Creation, and Cost”, and Goldstein’s other titles “True Patent Value”, and “Litigation-Proof Patents”, are available to purchase in English and Mandarin from the website www.truepatentvalue.com.

All quotes used are with the permission from the author Larry M. Goldstein.