Table of contents

- The Deal

- In Pursuit of Synergy

- Comparing the Merged GlobalWafers With Shin-Etsu Chemical

- Evaluating the Quality and Value Profiles of Both Companies

- Conclusion

The Deal

GlobalWafers—the largest supplier of 75-to-300-millimeter wafers in Taiwan—announced on Mar 4 that it had acquired a 70.27% share of Siltronic AG after a public bid. The acquisition of its German competitor, once completed, would make GlobalWafers the second-largest silicon wafer manufacturer in the world, second only to Japan’s Shin-Etsu Chemical.

The initial tender offer was 125 euros per share. It later increased to 140 and finished at 145 in cash—representing a 28% premium to the closing price of 113.55 euros on Nov 27, 2020. GlobalWafers financed the transaction along with a bridge loan from the Singaporean bank, DBS.

As of the end of May, the merger has been approved by the antitrust regulatory bodies in Germany, Austria, Korea, Singapore, Taiwan, and the Committee on Foreign Investment in the U.S. and is subject to regulatory approval in the U.S., China, and Japan. The transaction is expected to close in the second half of 2021.

In Pursuit of Synergy

After the combination, GlobalWafers will own 20 factories across 10 countries. With an expanded global presence, the company expects to almost double its total production capacity, grow its R&D capability, and vastly increase its revenue. As of Q3 2020, the combined revenue was 75% more than GlobalWafers’ revenue in the last twelve months (LTM.)

The acquisition will enable the company to better compete in the silicon wafer industry as more government-backed firms enter the market. After taking over Siltronic—which is in 4th place in terms of LTM revenue as of September 2020—GlobalWafers will surpass SUMCO of Japan to become the second-largest wafer manufacturer in the world (see slides page 3.)

The combined company is expected to challenge the leading position of Japan’s Shin-Etsu Chemical. After acquiring Siltronic, GlobalWafers’ LTM revenue as of September 2020 is only slightly behind Shin-Etsu. GlobalWafers CEO, Doris Hsu, has an impressive track record of turning loss into profit within 12-15 months, starting with her first acquisition—the American semiconductor firm Globitech—in April 2008.

The growing electric vehicles (EV) market has prompted a demand for silicon wafers. According to CNA, Siltronic has key technology that could better position GlobalWafers in the third-generation semiconductor market. However, the strength of GlobalWafers’ technology portfolio after acquisition remains unknown.

Comparing the Mergerd GlobalWafers With Shin-Etsu Chemical

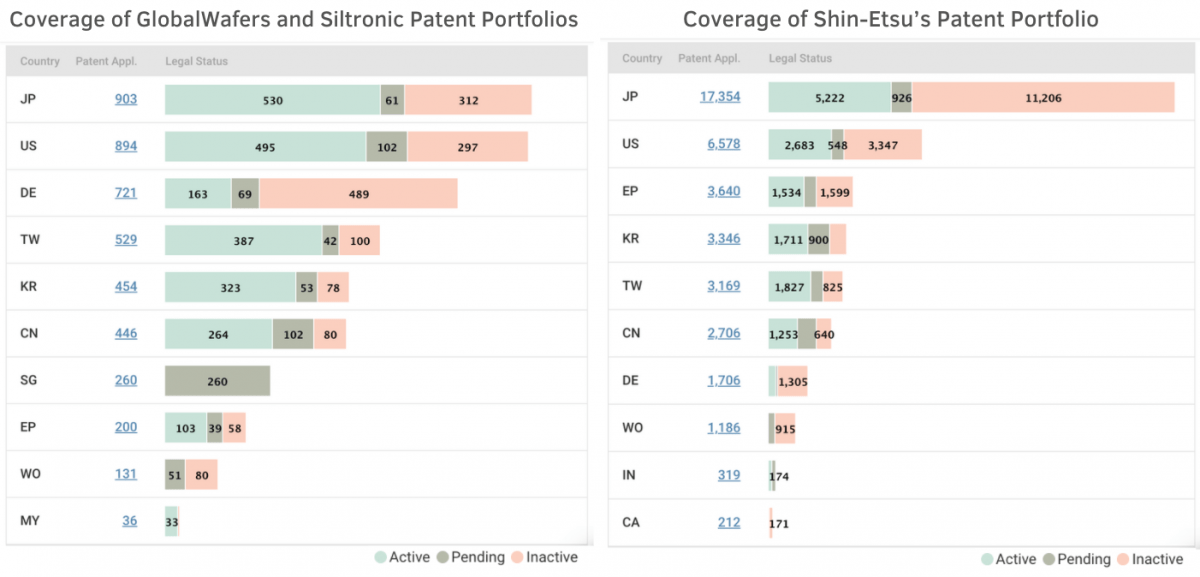

We combined the patent portfolios of GlobalWafers and Siltronic using Patent Search (PS) and compared it with Shin-Etsu’s portfolio with Due Diligence (DD). The analysis provides a glimpse into the technology profiles of the largest two players in the silicon wafers market.

Expanded Global Coverage for GlobalWafers

The merged GlobalWafers and Shin-Etsu both have many patents in the U.S. and Japan. Germany and Europe are in third place for GlobalWafers and Shin-Etsu, respectively. It should be noted that the majority of the patents have expired. Considering Shin-Etsu’s portfolio in Germany, it is apparent that the issue is not particular to GlobalWafers.

East Asian countries are rising in the silicon wafers market. Once the expired patents are excluded from the total, Taiwan, Korea, and China are the key players besides Japan and the U.S.

After taking over Siltronic, GlobalWafers will be able to supply semiconductor firms in Germany and Singapore, where it currently has no factories. Siltronic’s two production sites in Singapore will allow GlobalWafers to provide for GlobalFoundries locally—GlobalFoundries signed an MOU with GlobalWafers for 300mm SOI wafers in February 2020.

Once the deal is completed, GlobalWafers will have 260 pending patents in the country—with Siltronic having filed 243 of them. Given the data limitations of DOCDB, it is unknown whether these applications have been approved or not. Nevertheless, the granted ones would undoubtedly add to GlobalWafers’ patent deployment.

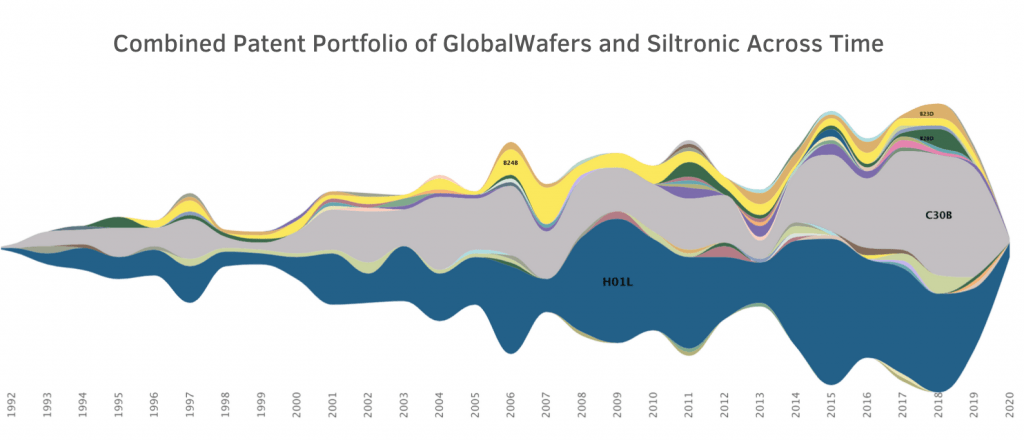

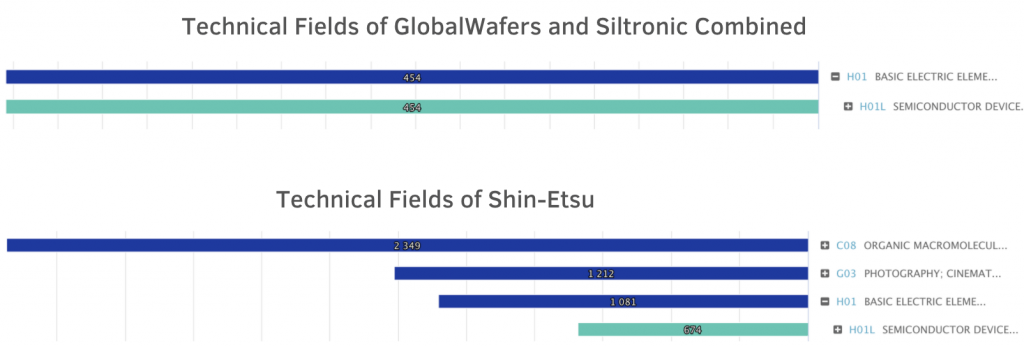

Based on the International Patent Classification (IPC,) the time-series technology profile shows that most patents of the merged GlobalWafers are about (a) the production of single crystals or homogeneous polycrystalline material—IPC code C30B, and (b) semiconductor devices—IPC code H01L. The technology profiles of both GlobalWafers and Siltronic are similar, and the areas of innovation are focused.

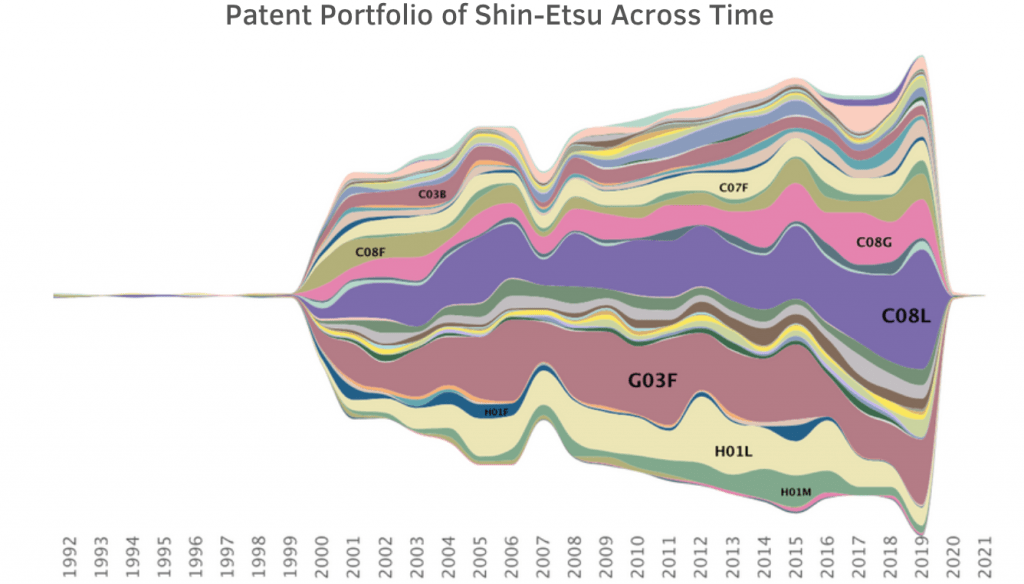

On the other hand, Shin-Etsu’s technology portfolio has always been diverse. As a chemical company, Shin-Etsu specializes in processing various materials, such as PVC, silicones, and rare-earth elements, to name but a few. The share of its inventions related to semiconductor devices, IPC H01L, has been decreasing.

Even so, the number of its H01L patents is larger than that of GlobalWafers and Siltronic combined. Shin-Etsu has more than 670 patent families in semiconductor devices, and the semiconductor silicon business was the largest revenue source, accounting for 35% of the revenue in fiscal year 2019. In contrast, the combined GlobalWafers company has 454 patents.

Evaluating the Quality and Value Profiles of Both Companies

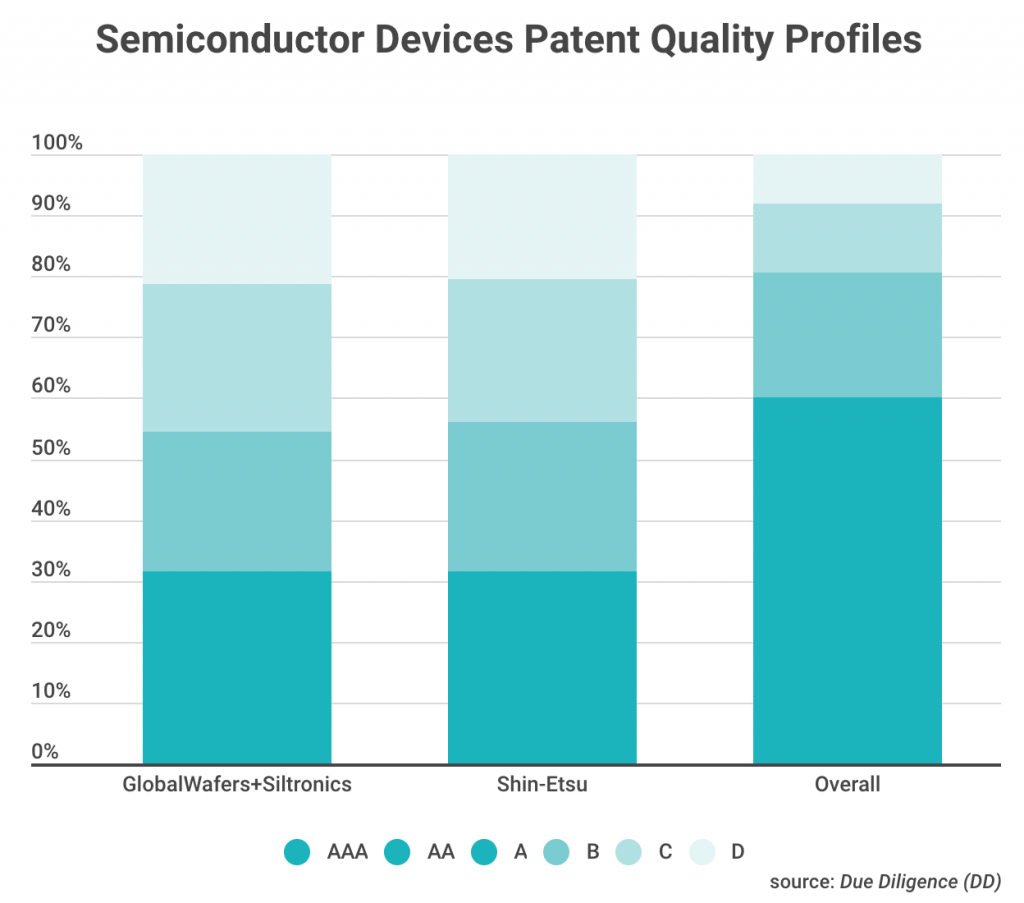

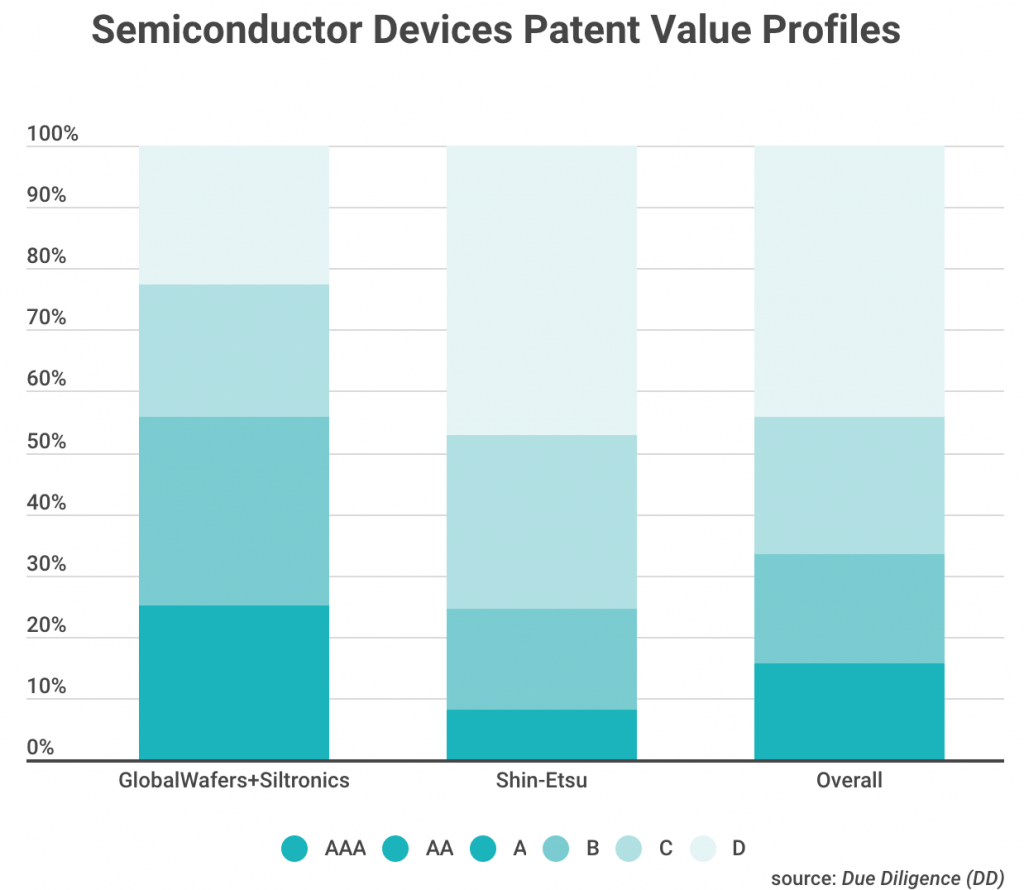

The peer comparison analysis is used to evaluate the quality and value profiles of patent portfolios. The scope of analysis is limited to semiconductor devices to compare the two companies fairly. Each patent in the portfolio is rated according to the quality and value rankings—AAA is the highest grade, whereas D is the lowest. The patents rated A or above are defined as high-quality or high-value patents. Expired patents have been excluded from the quality and value analysis.

Semiconductor Devices

The graph below shows the quality distribution of the H01L patent portfolio for the combined GlobalWafers, Shin-Etsu, and the overall market. Both companies have a proportion of high-quality patents at around 31.4 percent. The distribution of patent grades is similar, suggesting that the chances of these patents being invalidated are very close.

In terms of patent value, or the chances of patent monetization, the combined GlobalWafers has a 25% share of high-value patents while the share is only 8% for Shih-Etsu. It is clear that GlobalWafers has a patent portfolio of decent value since the proportion of its high-value patents is above average.

Overall Portfolios

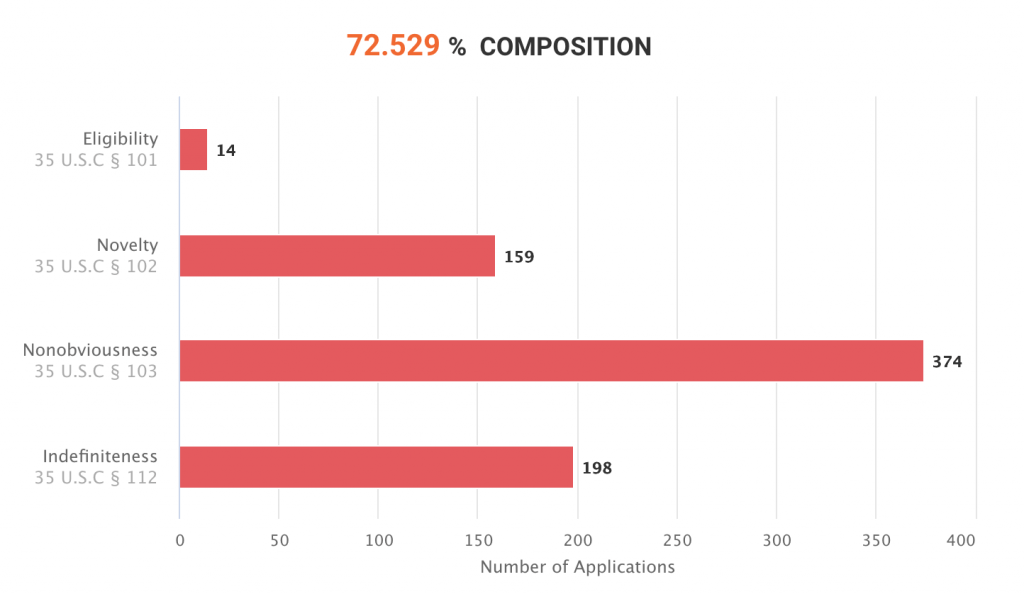

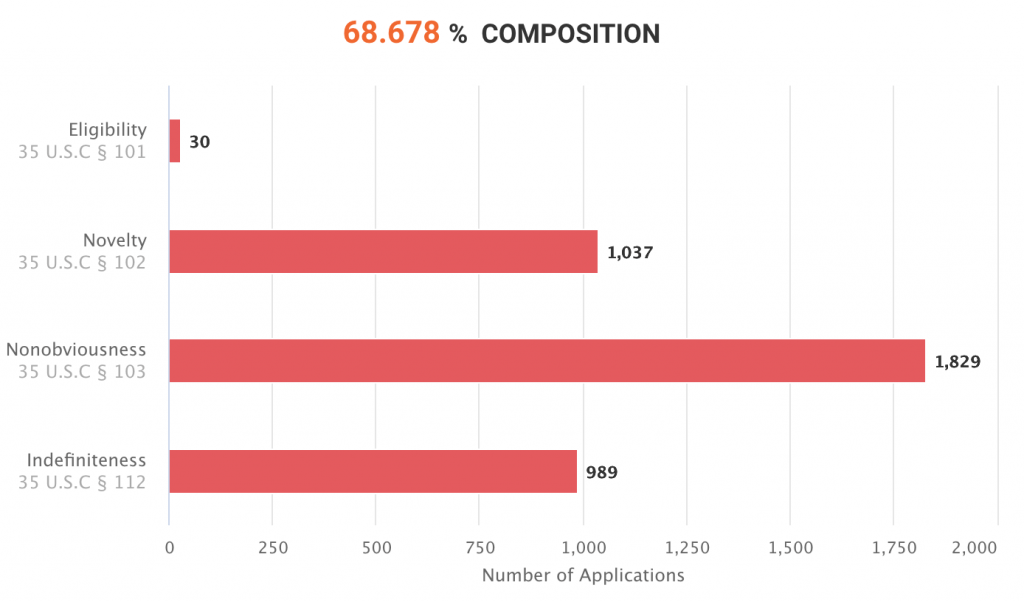

When it comes to the entire patent portfolio, post-merger GlobalWafers has a larger share of patents that have encountered quality issues in the U.S., including eligibility, novelty, nonobviousness, and indefiniteness. According to the graphs below, the proportion is 72.5% for the combined GlobalWafers and 68.7% for Shin-Etsu. Patent managers at GlobalWafers should pay attention to the potential risks of litigation or invalidation.

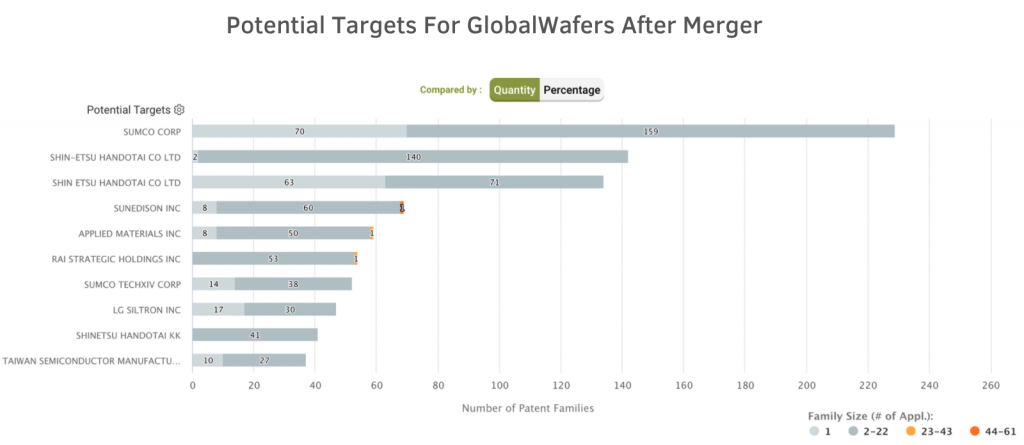

Finally, the acquisition of Siltronic adds to the number of patents that may be used against competitors. Based on the forward citation data from patent applications, the dashboard shows that GlobalWafers has more patents that could allow it to go after big players like SUMCO, Shin-Etsu, and TSMC.

Conclusion

As the worldwide chip shortage continues, GlobalWafers’ acquisition of Siltronic will increase its competitiveness. The likely production lines in Singapore and Germany will enhance its production capacity and revenue—providing that Siltronic is successfully integrated into the company.

For patents related to semiconductor devices, the merged company would still fall behind Shin-Etsu in terms of the patent numbers. However, it would have a more significant proportion of high-value patents than Shin-Etsu, suggesting that the company has more IP assets that it could cash in.

In terms of the overall patent portfolio, GlobalWafers has a higher proportion of patents ever encountering quality issues in the U.S. when compared to Shin-Etsu. Yet, the analysis of the potential targets suggests that it is likely for the company to pursue other prominent players in the field. If it intends to go after the competitors, the company should make sure of the quality of the bargaining chips.

Get a copy of GlobalWafers’ post-merger patent portfolio: