Welcome to Part 2 of our Ericsson vs. Apple article!

In Part 1, we examined the quality of the patents Ericsson and Apple brought out from their weaponry in the lawsuits and found that Ericsson’s patents-in-suit show better quality, especially the standard essential patents (SEPs) Ericsson used.

If you want a recap of events in the fight, you can link back to our first article: The Dispute.

In this installment, we will be looking at the broader scope of things — Ericsson’s and Apple’s 5G and cellular standard essential patent portfolios.

August 2022 Update: Check out our Part 3 follow-up on the PTAB petitions Apple launched against Ericsson’s patents for more recent happenings and new patent analysis.

Table of contents

- Preface

- Growth of the two companies’ SEP portfolios

- Global 5G SEP Declarations

- Ericsson’s 5G SEP portfolio

- Apple’s 5G SEP portfolio

- Determining the position of the two companies’ 5G SEP portfolios

- Diamond portfolios

- Findings

- Concluding thoughts

Preface

In Apple’s countersuit against Ericsson (EDTX-2:21-cv-00460), Apple argues that it should get better terms (especially lower fees) than the previous agreement since it now owns fives times as many cellular SEPs.

Here is an excerpt from Apple’s complaint:

“63. Since the parties’ 2015 agreement, Ericsson’s overall share of declared cellular SEPs has decreased by approximately 25% while Apple’s share has increased by approximately 500%. Today, Apple holds a share of declared 5G patent families that is comparable to Ericsson’s share. Given these facts, under any cross-license between Ericsson and Apple, Apple’s net payments to Ericsson should decrease as compared to under the 2015 license.”

The two main points Apple brought up are:

- Apple’s declared cellular SEPs have increased in number, while Ericsson’s number has declined.

- Apple’s current 5G patent portfolio is comparable to Ericsson’s.

Is Apple’s claim true? Is Apple’s 5G SEP portfolio now comparable to Ericsson’s?

This article will first examine the growth of cellular SEPs declared by the two companies and then determine Ericsson and Apple’s actual position 5G SEP landscape as a better stance provides SEP owners better bargaining power in licensing agreements.

Note: We will mention SEP OmniLytics’ various filters in this article, such as the “Well Maintained” and “Widely Deployed” filters. You can see the definition for each filter in our SEP data article.

Growth of the two companies’ SEP portfolios

First, let’s examine the first claim:

Apple claimed that its share of declared cellular SEPs had grown by approximately five times since the 2015 agreement with Ericsson and that Ericsson’s share had declined by approximately 25%

Declarations

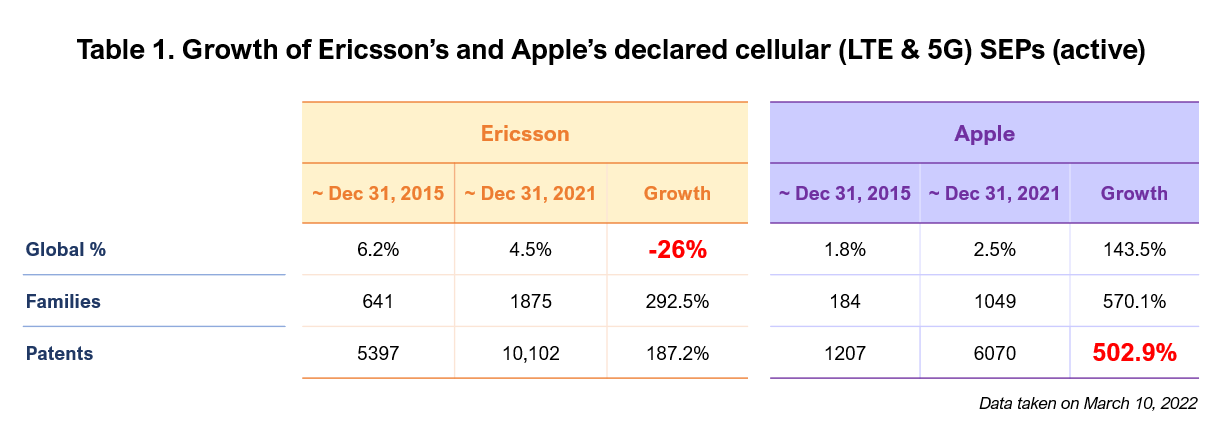

The numbers in the table below show the LTE and 5G (cellular) SEPs that are active and were declared by Ericsson and Apple.

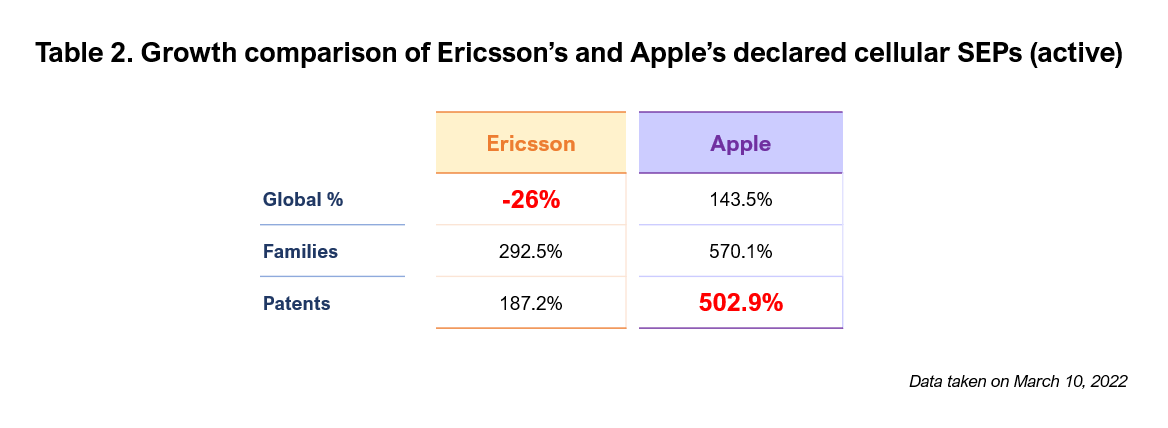

Here are the growth numbers only for better comparison:

As you can see, we found the growth percentages that are most likely the ones mentioned by Apple in its complaint (highlighted red in the table). However, the two percentages do not seem to be parallel in comparison, as Apple’s 502.9% growth is in the number of SEPs and Ericsson’s 26% decline is in its global share (%).

If we look at the growth of the two companies more objectively, the two companies have continued to grow in terms of their LTE and 5G SEP portfolio sizes, both in families numbers and in patents. Apple’s portfolio did grow 500% in terms of SEP numbers, but Ericsson also grew by almost 200%.

Although it seems that Apple shows a bigger growth spurt, the total of SEPs it declared still falls greatly behind Ericsson’s (Apple’s 6,070 SEPs compared to Ericsson’s 10,102 SEPs by the end of 2021).

Cellular SEPs that go beyond just declarations

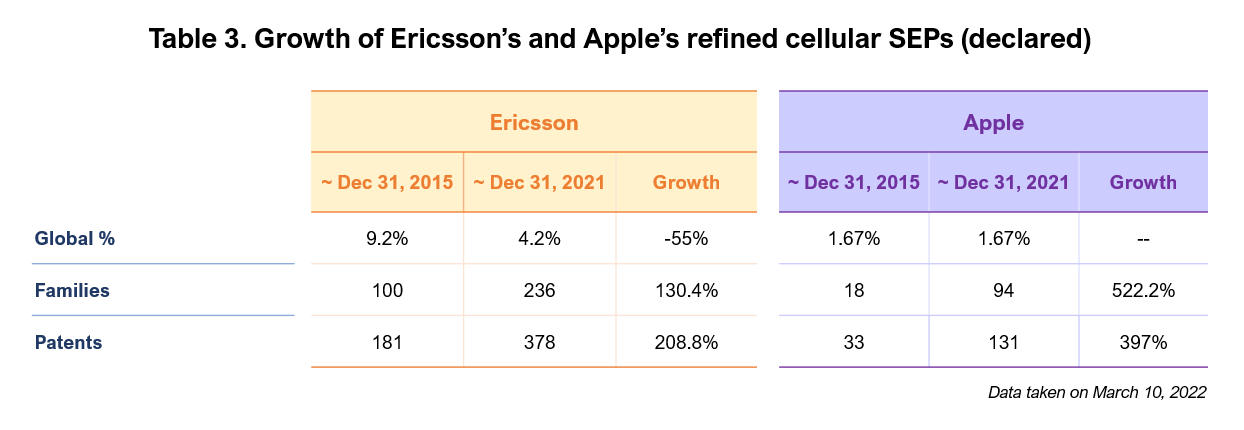

We also wanted to see if Apple was investing more and concentrating its efforts on its cream-of-the-crop SEPs instead of merely adding more SEPs to its portfolio for quantity’s sake. In other words, we wanted to find out if Apple’s refined SEPs show better growth.

To do this, we examined Ericsson’s and Apple’s LTE & 5G SEP portfolios that are active, Well Maintained, and rank high in Essentiality Rankings.

The Well Maintained filter in SEP OmniLytics indicates SEPs without any abandoned, lapsed, withdrawn, or revoked family members. This is behavioral data based on the patent owner’s self-assessment and reflects the owner’s perception of a SEP’s essentiality or potential value.

Here we compare the growth of the two companies’ refined cellular SEP portfolios:

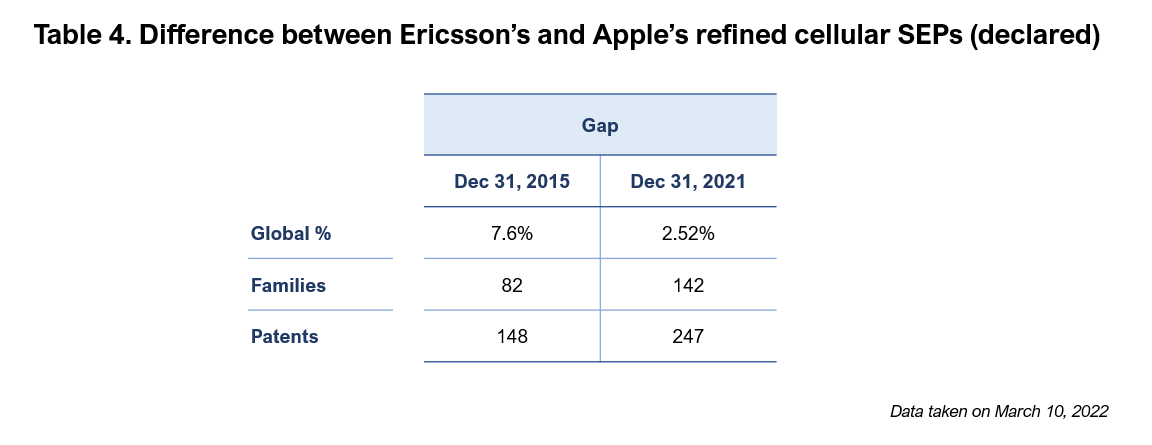

Let’s look at the difference between the two portfolios to see if Apple is catching up to Ericsson.

These findings indicate that Apple is already closing the gap between the two companies in terms of global share (%), but will need to add more refined cellular SEPs to catch up to Ericsson.

Onto the next claim — let’s see if we can determine whether the two companies’ 5G SEP portfolios are comparable or not.

Global 5G SEP Declarations

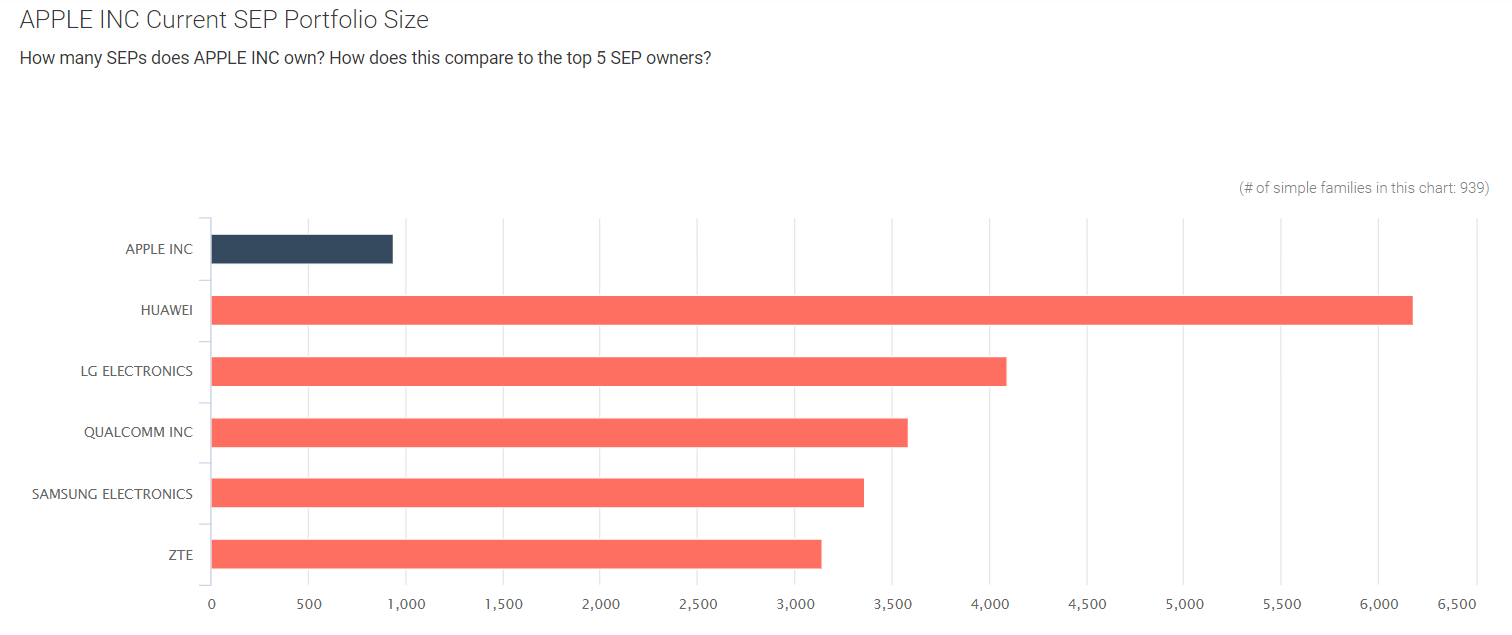

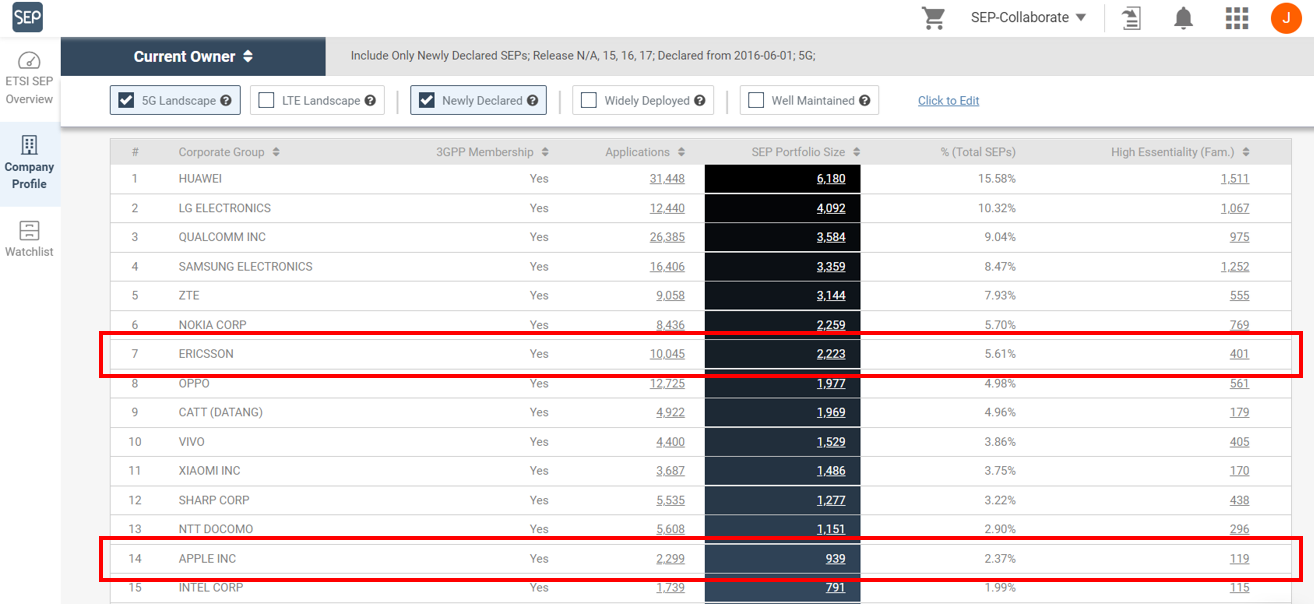

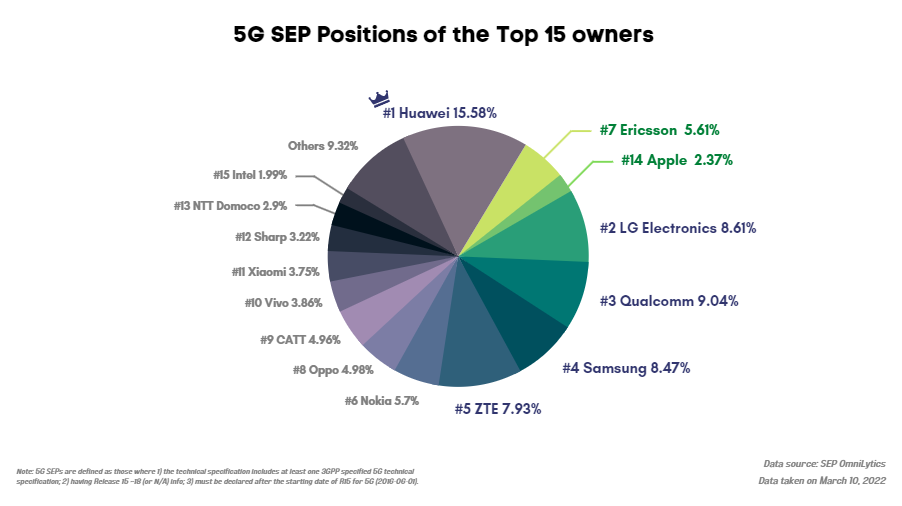

First, let’s look at the global 5G SEP landscape as a whole and where Ericsson and Apple stand. The top 15 companies with the most 5G newly-declared SEP families are as follows.

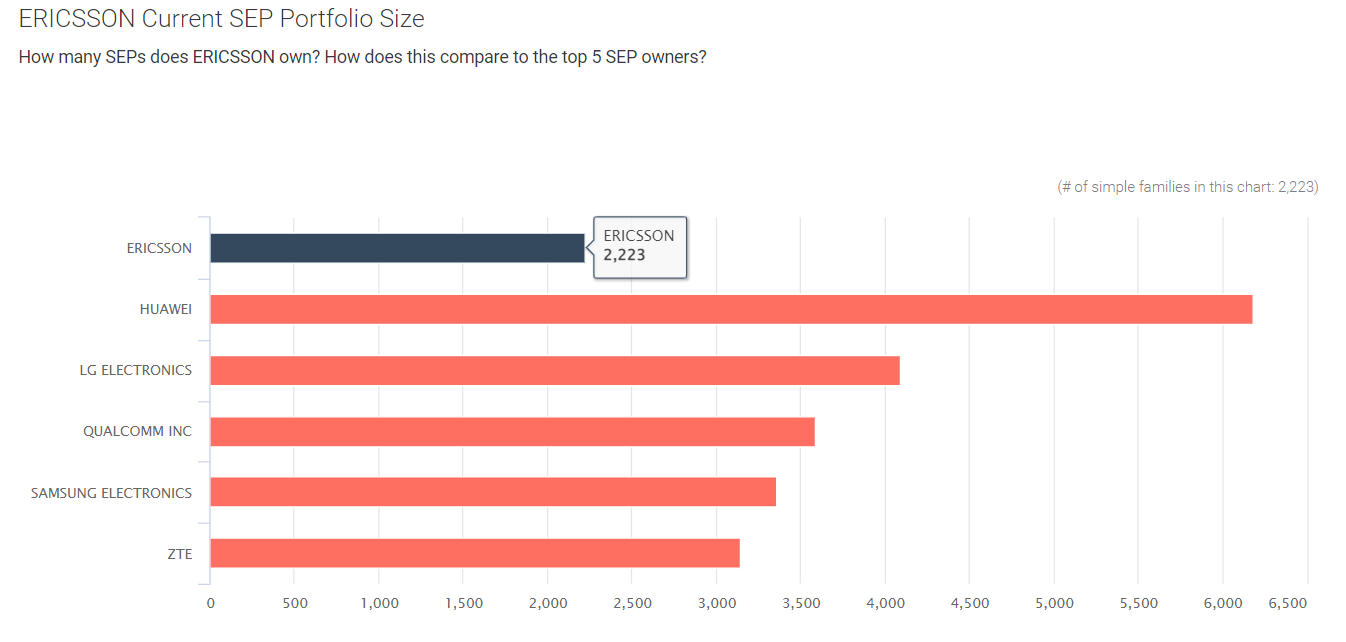

The leader in the 5G race is Huawei, with 15.58% of the global share. Ericsson is in seventh place with 5.61% and Apple in 14th with 2.37%.

Here is how Ericsson and Apple compare to the top 15 5G SEP owners:

Ericsson’s 5G SEP portfolio

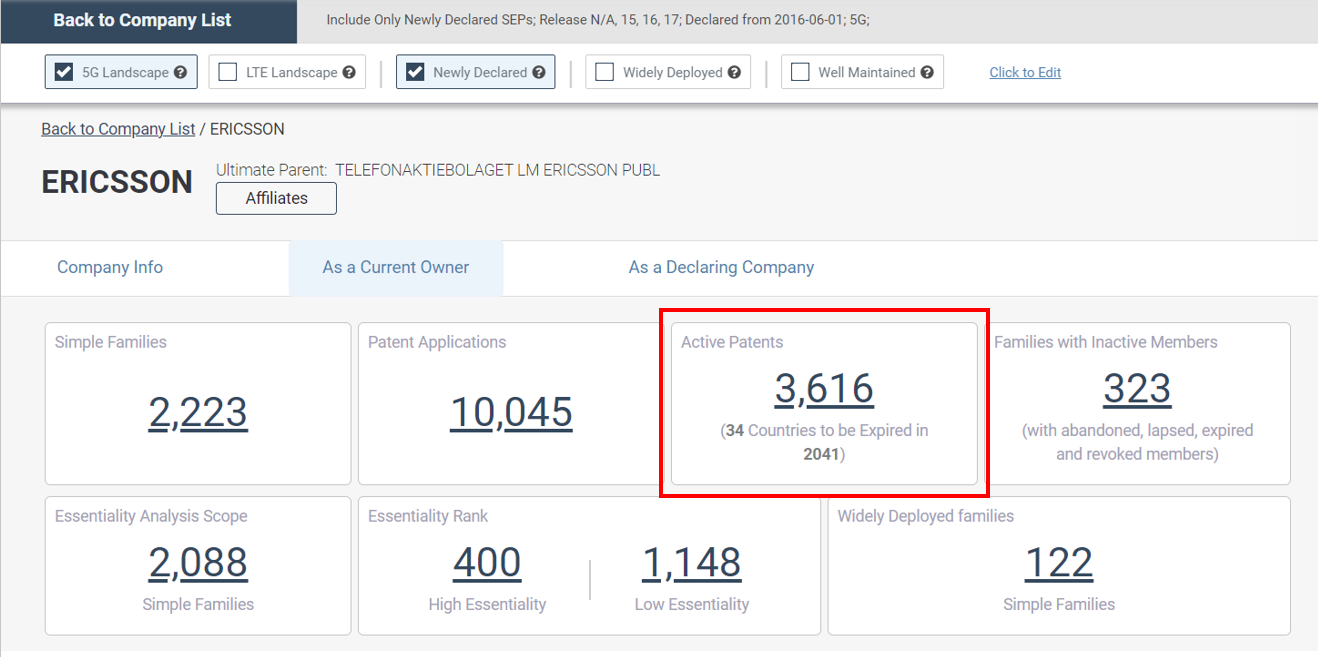

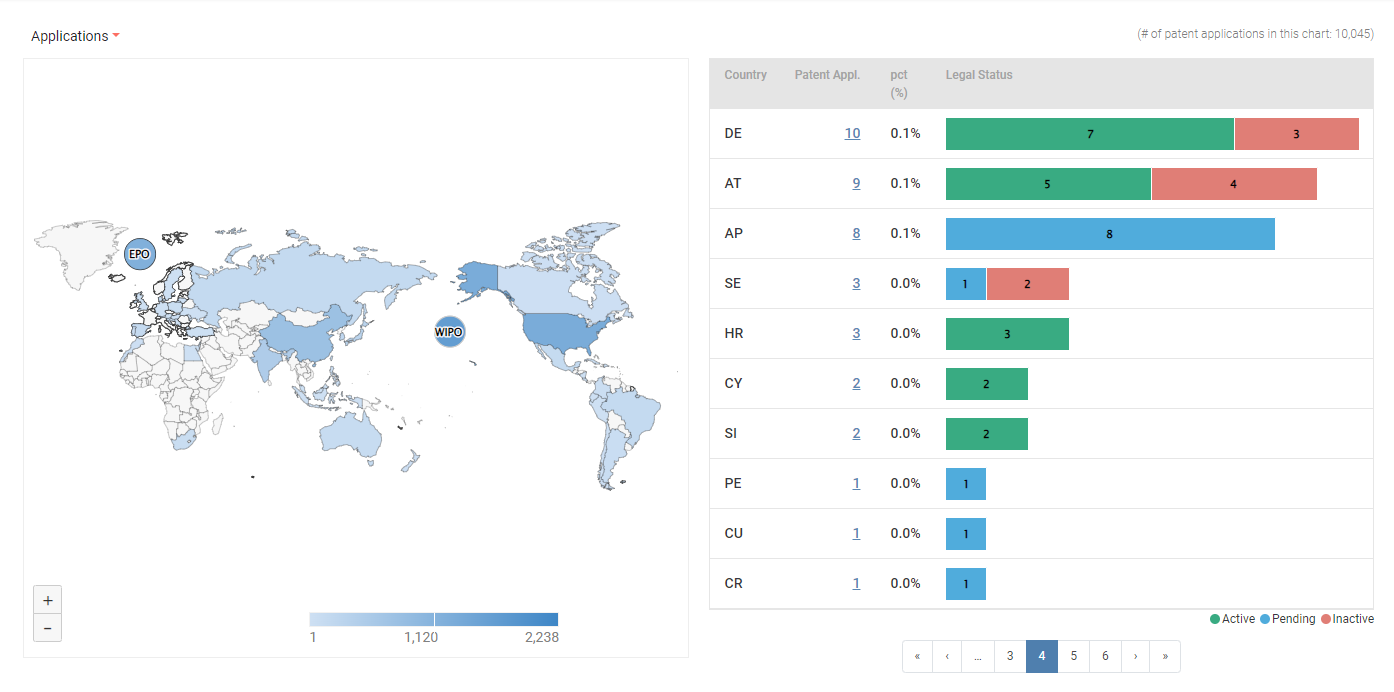

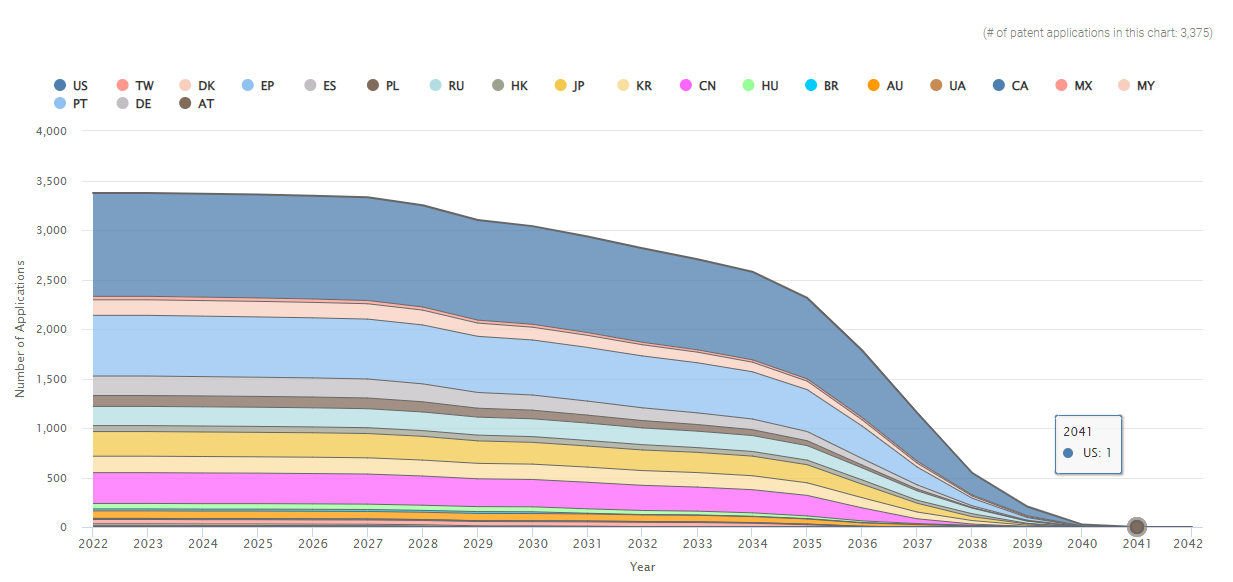

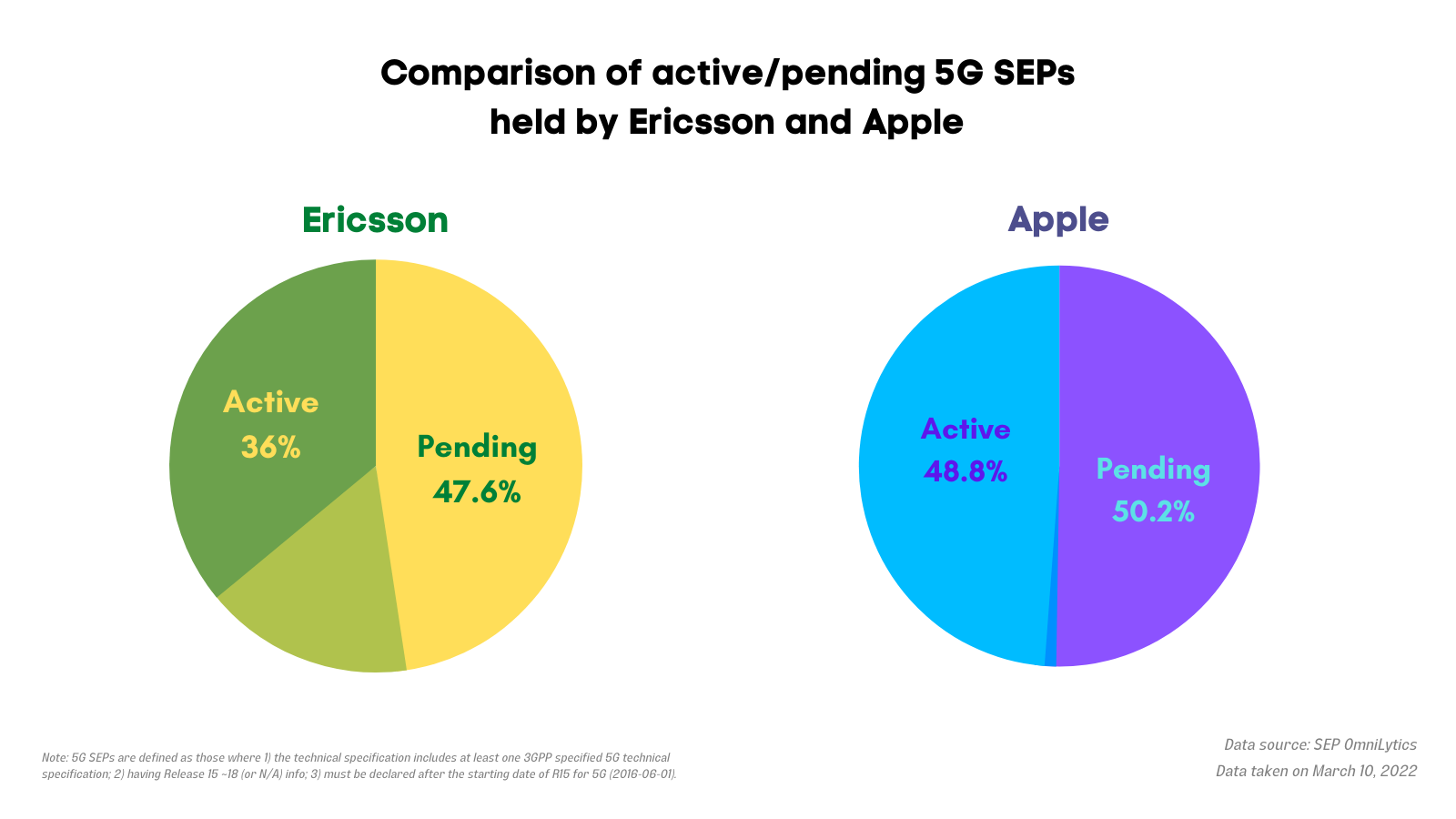

As a current owner, Ericsson’s 5G SEP portfolio consists of 2,223 patent families and 10,045 applications. Among these applications, Ericsson has 3,616 active patents (36% of its portfolio), taking up 4.1% of the global 5G SEPs.

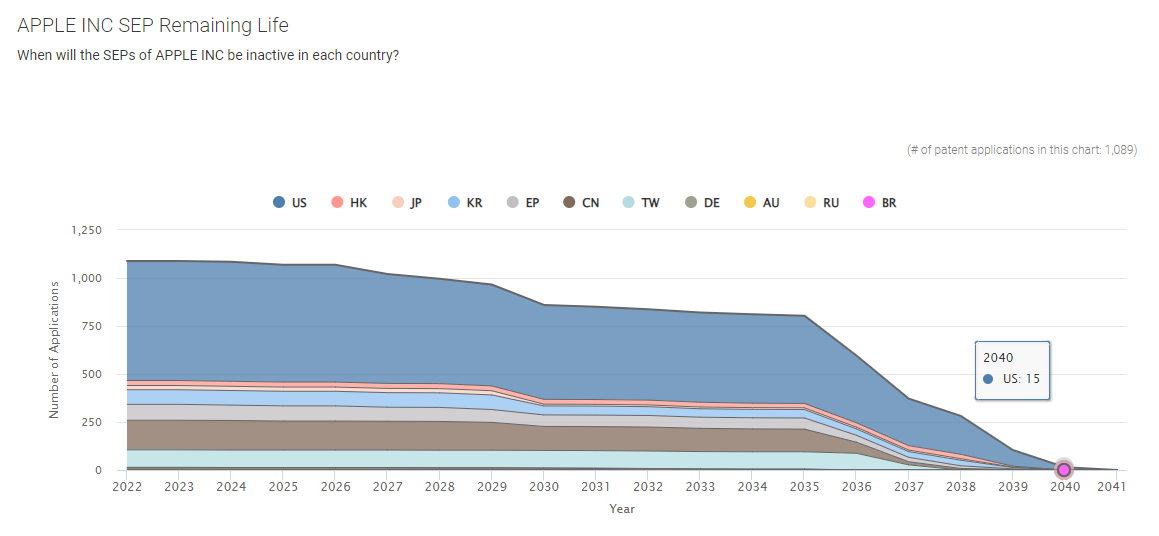

Looking at the coverage status and remaining life of the SEPs, Ericsson’s 5G portfolio is deployed in 52 countries, with over 37 countries having more than two applications. Its active 5G SEPs cover 34 countries. All patents will expire by 2041, with the last patent expiring in the U.S. in 2040.

Apple’s 5G SEP portfolio

Now, let’s take a look at Apple’s 5G SEP portfolio.

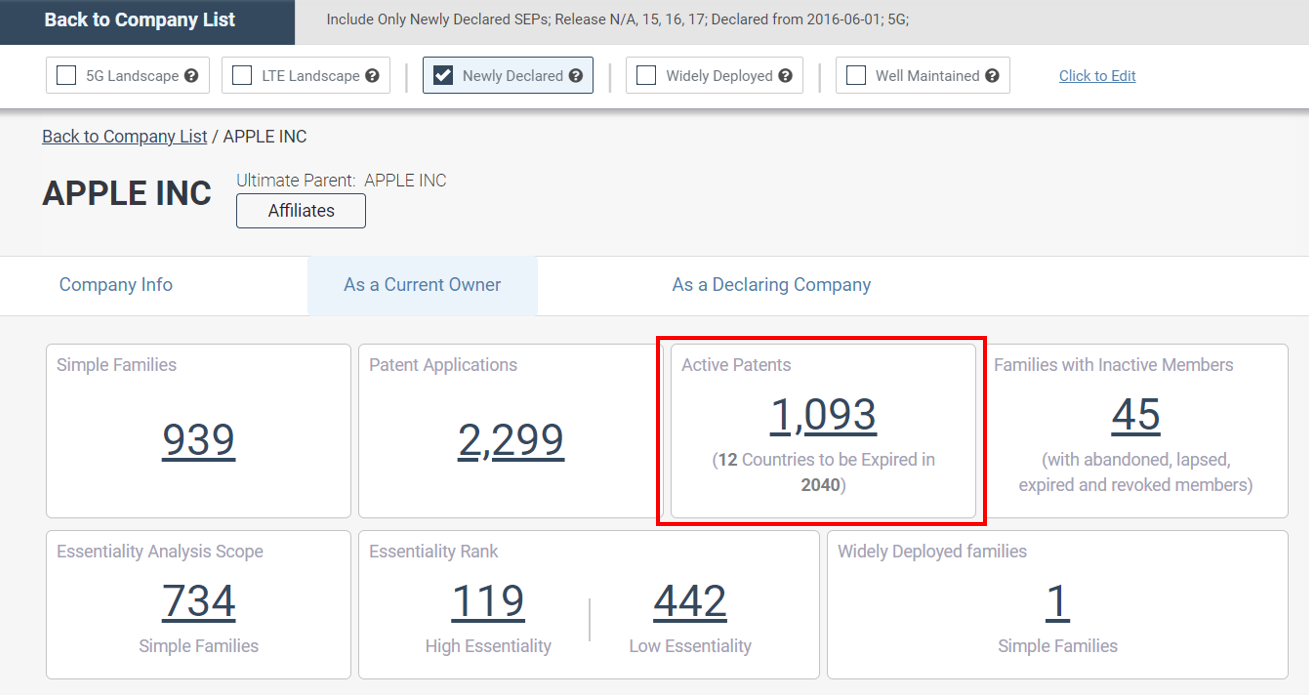

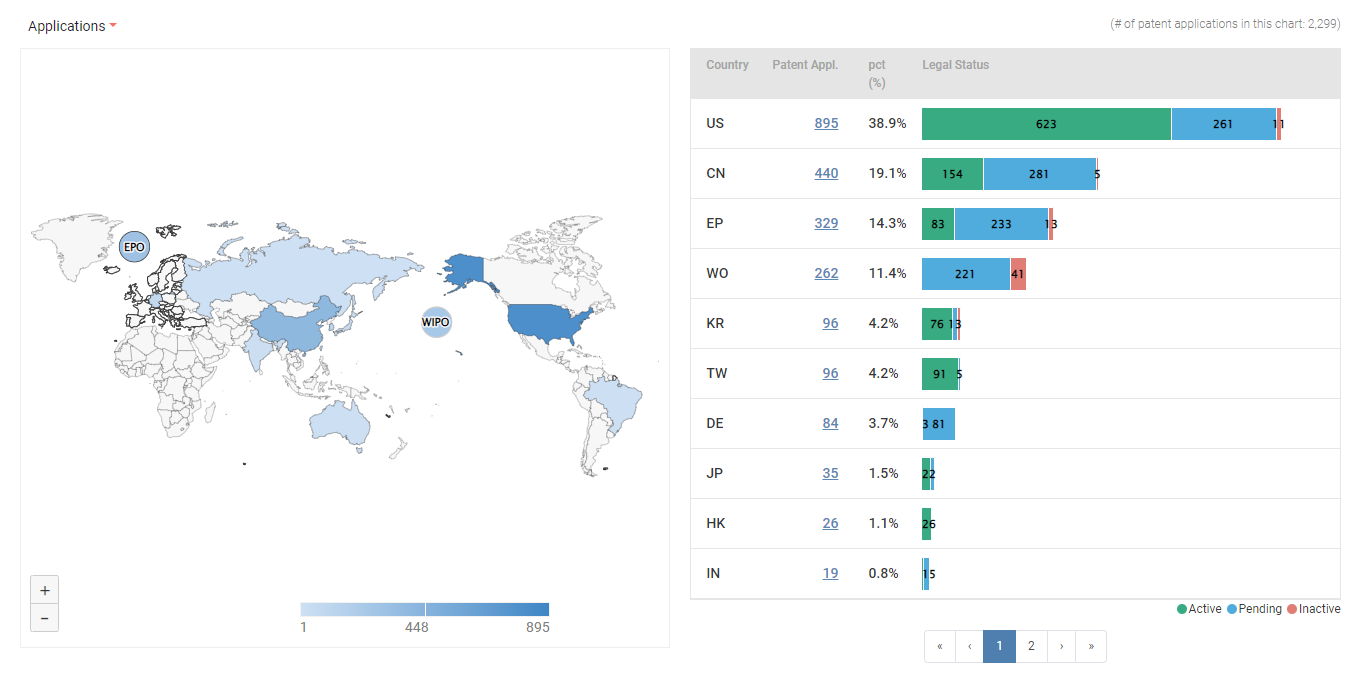

Apple’s 5G portfolio includes 939 families, with 2,299 applications. Of its applications, 1,093 are active patents (48.82%) and take up 2.1% of the global number of 5G SEP families.

Apple’s 5G portfolio is deployed in 14 countries, with its active standard essential patents covering 12 countries. Except for Singapore, which has only one application, all other countries have a coverage of over two applications.

Like Ericsson, all of Apple’s 5G SEPs will expire by 2041, with the last 15 patents expiring in the U.S. in 2040.

We can also get a glimpse into the two companies’ current pending applications to get an idea of their portfolios’ future potential with the pie charts below.

Determining the position of the two companies’ 5G SEP portfolios

After getting an overall idea of the size of each 5G SEP portfolio, let’s look a bit deeper at the quality of the portfolios and what kind of position each company holds.

The numbers

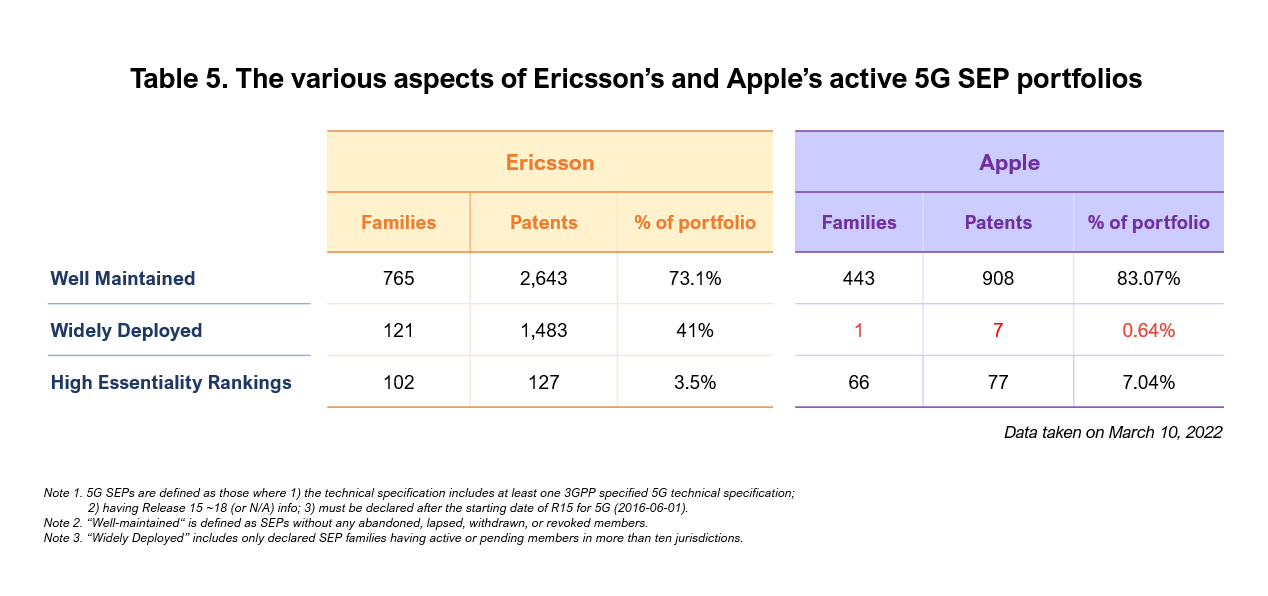

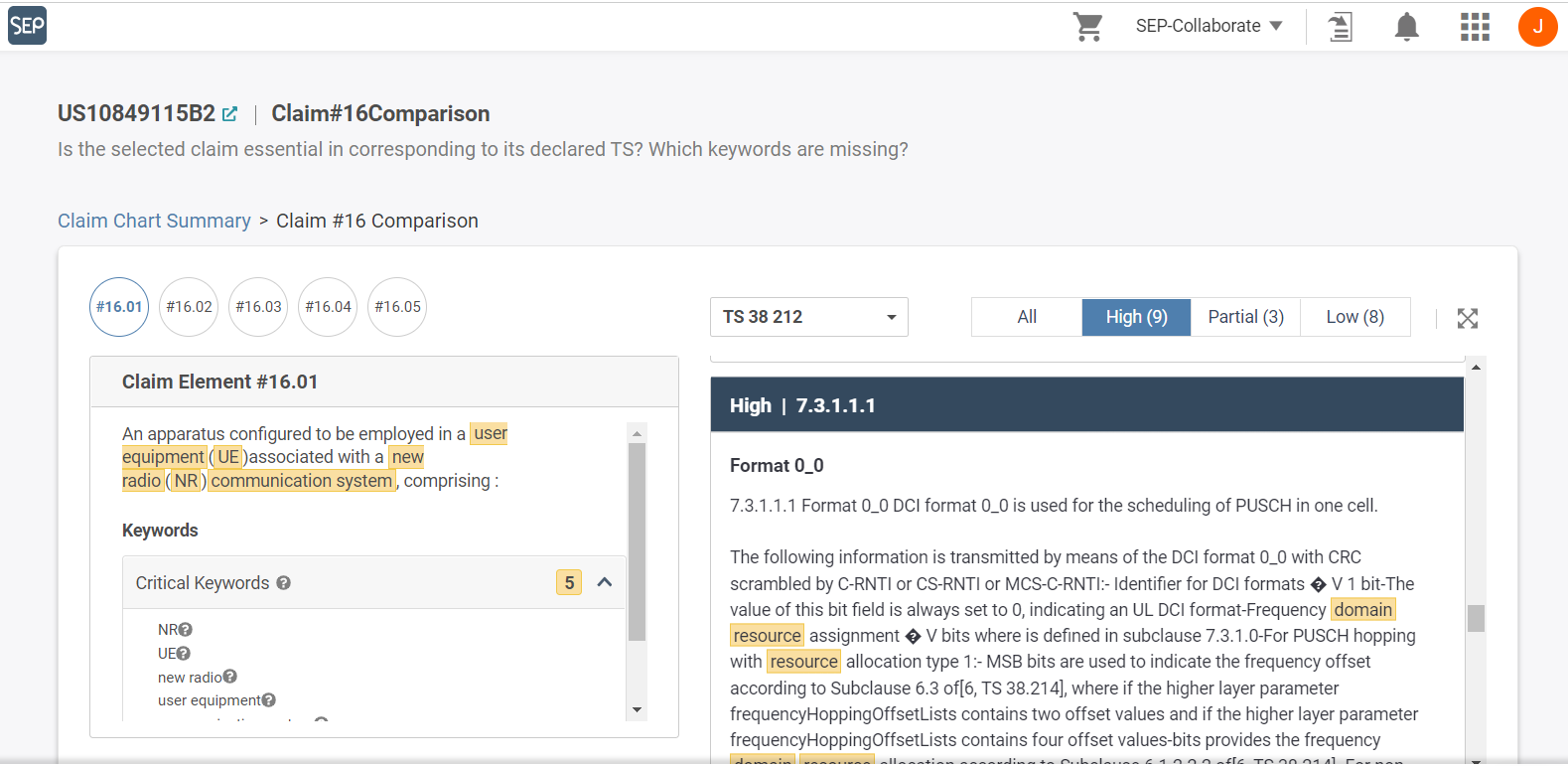

We used SEP OmniLytics’ “Well Maintained” and “Widely Deployed” filters along with our Essentiality Rankings to find how the two companies’ active 5G SEP portfolios perform in quality and to filter out those 5G SEPs that seem to be “merely” declared.

Our results show:

- Well maintained 5G SEPs

Both companies have a pretty high percentage of 5G SEPs that have no family members abandoned, lapsed, withdrawn, or revoked, indicating that they are actively maintaining their active SEPs. Apple’s percentage is slightly higher with almost 10% more than Ericsson’s. - Widely deployed 5G SEPs

Using the Widely Deployed filter, we found the percentage of 5G SEP families deployed in over ten jurisdictions drops drastically for both companies, especially Apple, to only 0.64%. Apple only owns one family (7 SEPs) that has a broader coverage status. - 5G SEPs with High Essentiality Rankings

Apple’s percentage of high Essentiality Rankings is twice the percentage of Ericsson’s, indicating that Apple’s 5G SEPs have a higher number of independent claims that can be mapped to its corresponding technical specification (TS Relevancy), and the SEP’s claims are better supported by their own specifications (Claim Scope Support).

The TS Relevancy and Claim Scope Support indicators are further elaborated in our SEP OmniLytics’ exclusive Essentiality Rankings article.

On a side note, if we look at the coverage of each company’s well-maintained 5G SEPs, we can get a glimpse of how well the companies are at looking after their patents. In Ericsson’s case, we found that 32 out of 34 countries (5G active SEPs) have well-maintained 5G SEPs. On the other hand, all of Apple’s 5G SEPs are well-maintained (12 out of 12 countries covered).

A quick summary

Looking at our preliminary findings, we found that the factor that affected the results the most is the Widely-Deployed filter. Apparently, Apple’s widely-deployed 5G portfolio is much smaller than most SEP owners, dropping to 26th place (among 33 companies).

In comparison with Ericsson’s 5G portfolio, Apple’s 5G SEPs do not cover country jurisdictions such as Spain, Canada, Poland, Hungary, Mexico, Denmark, Malaysia, and several more. This will not significantly affect Apple’s licensing negotiations if discussing a global royalty rate, however, Ericsson will definitely have the advantage when negotiating for regional rates. For example, if Apple imports or sells a significant volume of its products in Spain, where Apple’s portfolio is not deployed, Ericsson will have more bargaining power.

With this in mind, we will be excluding the “widely deployed” factor from the following comparisons and the “diamonds” mentioned in the following sections. Also because the dispute between the two companies is in the U.S., excluding the coverage factor can give us a fairer view of the two companies’ portfolios.

Now that we have sorted out the 5G SEPs that show better quality let’s pinpoint the two companies’ diamond 5G SEP portfolios.

Diamond portfolios

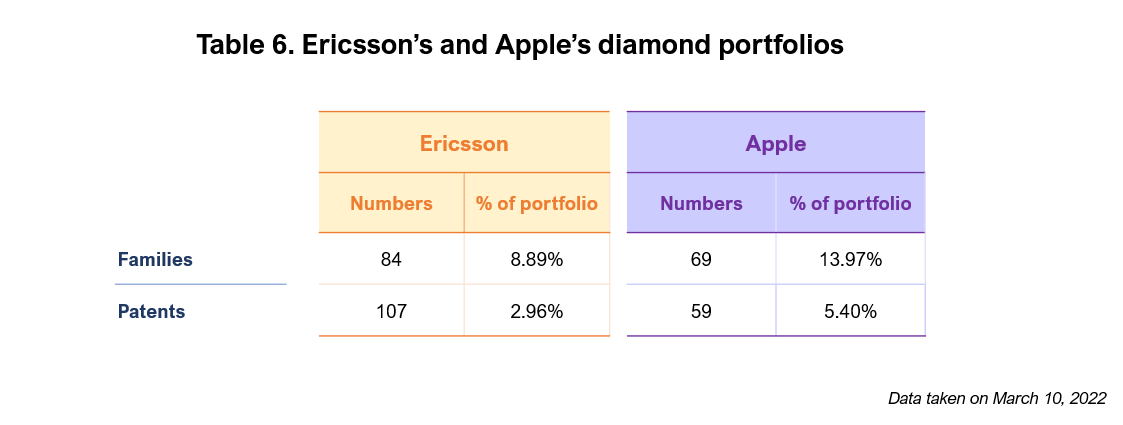

Diamond portfolios, as its name suggests, are more substantial in quality and can better withstand challenges. Diamond SEPs in this article are defined as those which are “Well Maintained,” have high Essentiality Rankings, and are, of course, active (excluding “Widely Deployed”).

Here are the numbers for Ericsson and Apple’s 5G diamond portfolios:

From this table, we can see that the 5G diamond SEPs families both companies own are quite close in numbers, but despite having a lower number of 5G SEPs, Apple’s diamond percentage exceeds that of Ericsson’s.

Ericsson’s number of 5G diamond SEPs families that are active, well maintained, and have high Essentiality Rankings drops considerably more than Apple’s.

We can also see that Apple’s portfolio has a larger percentage of high-quality SEPs.

Portfolio history

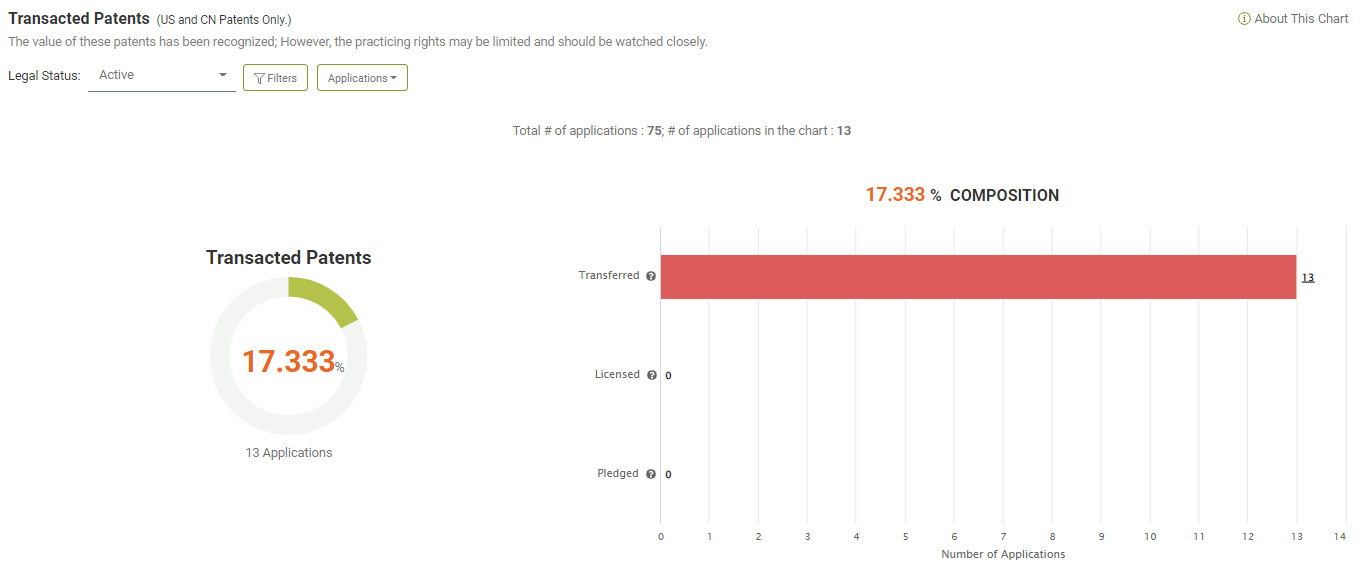

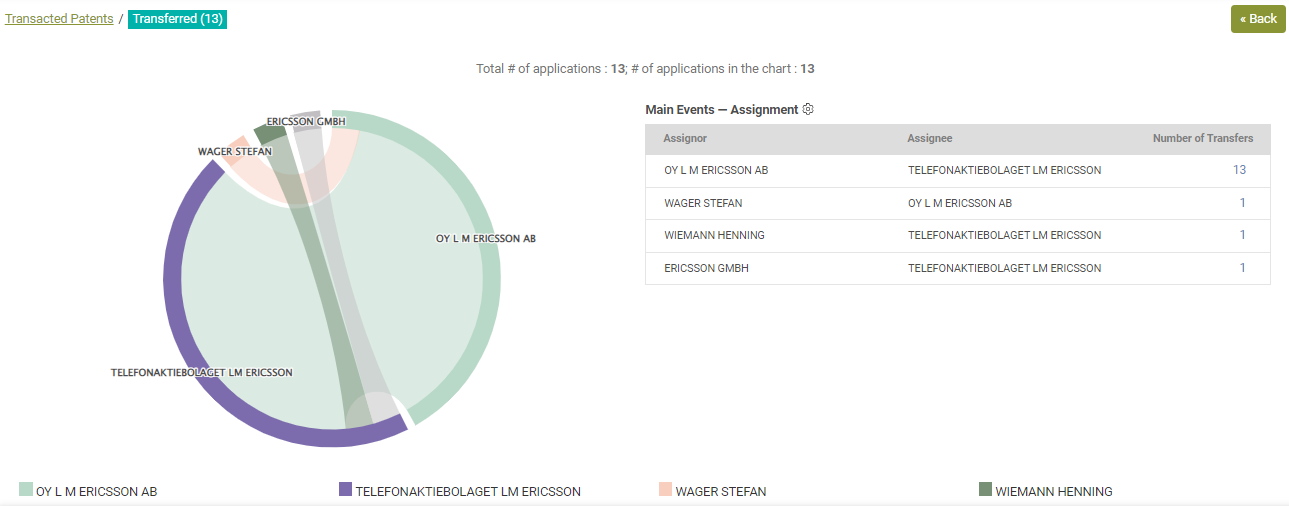

On a side note, we also looked at the U.S. transaction history of each company’s diamond portfolios and found that Ericsson’s 13 SEPs with transaction history were only internal transfers — indicating that these patents were self-developed.

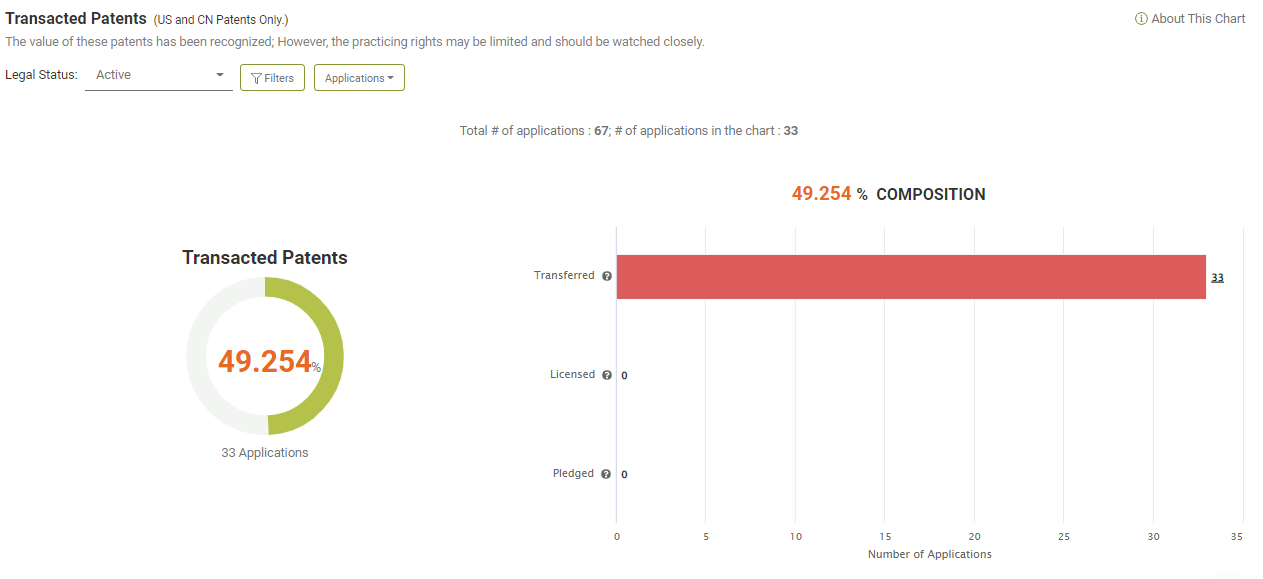

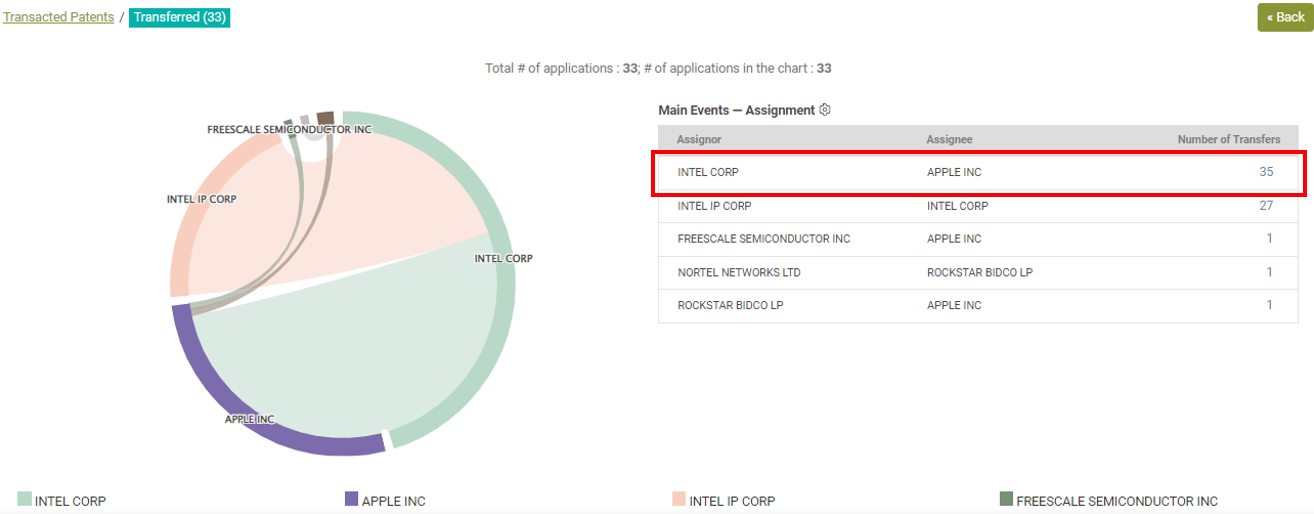

Meanwhile, Apple’s portfolio shows around 49% of its diamond 5G SEPs deployed in the U.S. have a transaction history. If we look a bit closer, we can see that most of the transferred patents were acquired from Intel.

Findings

Ericsson is perceived to have a better 5G and cellular SEP global position in terms of SEP share than Apple. However, our findings give us more insights into the two companies’ actual position in the 5G and cellular SEP landscape. Here is a summary of our findings:

- Apple’s cellular SEP portfolio is indeed growing at a rapid pace, with a 500% growth from 2015 in its number of SEPs. Ericsson also shows a 187% growth in the number of cellular SEPs it owns, and not a decline as Apple’s complaint suggests.

- Although the growth of Apple’s cellular SEP portfolio does not seem to be enough for Apple to catch up, its high-quality cellular SEP portfolio is indeed rapidly gaining upon Ericsson. The gap between the two companies has narrowed to 2.52% from the 7.6% in 2015, in terms of global share (%).

- Overall, Apple has a 2.37% global share of active 5G SEPs (compared to Ericsson’s 5.61%). Although Apple has fewer 5G SEPs, 13.97% of its active 5G SEP families are diamond SEPs — those that are active, well maintained, and have high Essentiality Rankings, which is higher than Ericsson’s has 8.89% of diamond 5G SEP families.

- Apple’s 5G SEP portfolio has a lower coverage, with much fewer 5G SEPs deployed in over ten countries. Its portfolio currently doesn’t cover country jurisdictions such as Spain, Canada, Poland, Hungary, Mexico, Denmark, and Malaysia, which may reduce its bargaining power when negotiating licenses, especially when discussing regional rates.

Concluding thoughts

Coming back to Apple’s claims, we found that:

- Apple is indeed closing the gap with its cellular SEPs, with a growth rate nearly double that of Ericsson’s.

- Just looking at numbers, Apple’s current 5G patent portfolio still has some catching up to do since Ericsson has almost two times the number of declarations (for both SEPs and SEP families) and much more global coverage.

However, if we factor in the 5G SEPs that are well maintained, are active, and have high Essentiality Rankings, we can deduce that, yes, in terms of diamond 5G SEPs, Apple’s 5G portfolio IS comparable to Ericsson’s.

Compared to other 5G SEP owners, Ericsson has announced a higher royalty rate of US$ 2.50 ~ US$ 5.0 per device. Just last year (2021), Huawei announced its 5G royalty rate at a cap of US$2.50 for each unit, which is the lowest minimum for Ericsson.

In Apple’s complaint, Apple argues that it should get better terms for a licensing agreement with Ericsson, implying that Ericsson’s proposed royalty rates are too high. This brings to light the question of how reasonable Ericsson’s 5G royalty rates are and may become a future ground for other SEP implementers to challenge Ericsson with in the future.

Update: You can continue reading about this case in Part 3 — Getting a Glimpse of the PTAB Petitions Apple Launched Against Ericsson.

We hope you gained some interesting insights in this two-part article. If you would like to navigate through SEP OmniLytics to find more insights or just to examine a certain SEP’s claim chart, click the button below and contact your Client Success Specialist now!

Or Contact Us if you have any questions or want to know more about our bundle plans!