Key Points

- We examined the asserted patents and patent portfolios in the Dexcom vs. Abbott patent infringement lawsuit over continuous glucose monitoring technology.

- Our analysis suggests that Dexcom needs to be wary of Abbott’s defense and PTAB challenges.

- Patent analysis shows that Dexcom has more than 20 patent families whose members have been cited as novelty prior art to reject Abbott’s patent applications. On the other hand, Abbott has a similar number of families whose members have been used to reject Dexcom’s applications.

Table of contents

- The Legal Dispute Between Dexcom and Abbott

- Reviewing The Patents-In-Suit

- Reviewing Dexcom’s and Abbott’s Patent Portfolios

- Both Sides Have More Patents At Their Disposal If The Legal Battle Escalates

- Conclusion

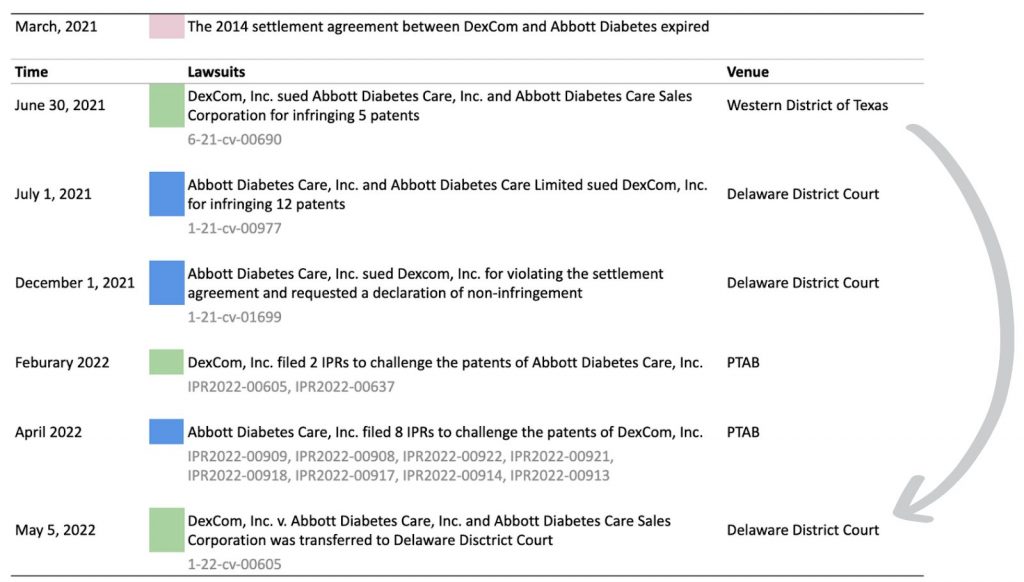

On May 5, 2022, Dexcom’s patent lawsuit against Abbott in the United States District Court for the Western District of Texas was terminated and transferred to the Delaware District Court. The suit marks a new patent dispute between Dexcom and Abbott in the U.S. over Continuous Glucose Monitoring (CGM) devices.

According to a report by ResearchAndMarkets, the U.S. CGM market was estimated at around US$ 2.8 billion in 2021 and is predicted to hit US$ 6 billion by 2028. Dexcom and Abbott are two key players in this growing market. As the CGM market continues to grow, the fight between the two long-time competitors will have significant implications for the U.S. and European CGM markets. In this article, we focus on Dexcom and Abbott’s fight in the U.S.

The Legal Dispute Between Dexcom and Abbott

On June 30, 2021, Dexcom filed a lawsuit against Abbott in the Western District of Texas, alleging that Abbott’s FreeStyle Libre, a Continuous Glucose Monitoring (CGM) system, infringed five of its patents.

The lawsuit is the first patent suit over CGM technology after the 2014 settlement and license agreement between the two companies expired in March 2021.

The day after Dexcom filed the lawsuit, Abbott sued Dexcom, claiming Dexcom’s G6 product line infringed 12 patents of Abbott.

Dexcom and Abbott’s Fight Over CGM Technology in the U.S.

On December 1, 2021, Abbott sued Dexcom, claiming that Dexcom violated the 2014 settlement agreement and that Abbott did not infringe on Dexcom’s patents. Dexcom filed two IPRs against Abbott in February 2022, and Abbott later filed eight IPRs against Dexcom in April 2022.

Reviewing The Patents-In-Suit

At the end of the year, on December 1, 2021, Abbott sued Dexcom again, claiming that Dexcom violated the 2014 settlement agreement and that Abbott did not infringe on Dexcom’s patents.

In 2022, Dexcom filed two IPRs against Abbott in February, which was followed by Abbott’s eight IPR petitions filed against Dexcom in April.

Using Quality Insights, we examined if a patent has been rejected over novelty prior art reference(s) and the potential novelty prior art that might be used to challenge its patentability. The analysis was conducted on August 5, 2022.

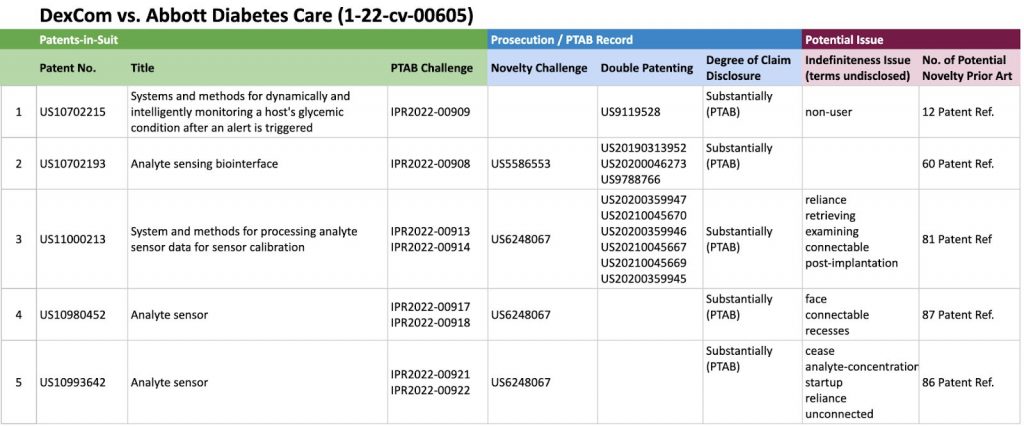

We first took a look at Dexcom’s patents-in-suit. According to the patents’ prosecution and PTAB records, four of the five Dexcom‘s patents have been found with novelty issues by the patent examiners. Each of the five patents has its claims substantially disclosed by its prior art references. The five patents have a substantial level of disclosure because they were challenged and made public at the PTAB.

Using Patentcloud’s Quality Insights, we found 12 to 87 potential prior art references highly relevant to Dexcom’s asserted patents (see “No. of Potential Novelty Prior Art”). These prior art references are generated mainly from a patent novelty citation network. They have never been considered as prior art before, and their eligibility as prior art has been verified.

Novelty Citation Network

A novelty citation network is made of the first, second, and third-degree prior art references of a patent. The prior art references cited by the examiners to reject a patent-at-issue during prosecution are first-degree prior art references. Prior art references cited to reject the first-degree prior art references are the second-degree prior art references. In our analysis, the potential novelty prior art references include up to the third-degree prior art.

From the perspective of patentability, the patents Dexcom asserted against Abbott have significant quality issues. Four of the five patents-in-suit have been rejected over prior art based on 35 U.S.Code § 102 during prosecution. Using Quality Insights, we found that the five patents each have several potential prior art references.

Table 1. Dexcom’s Patents-In-Suit

Source: Quality Insights

Source: Quality Insights

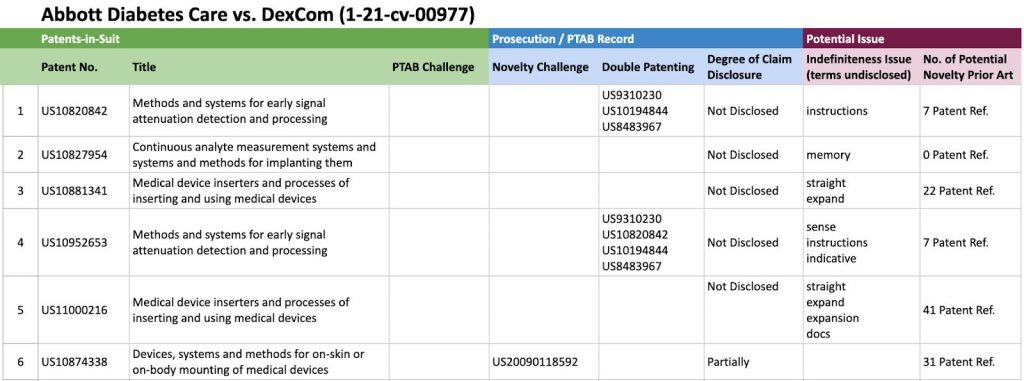

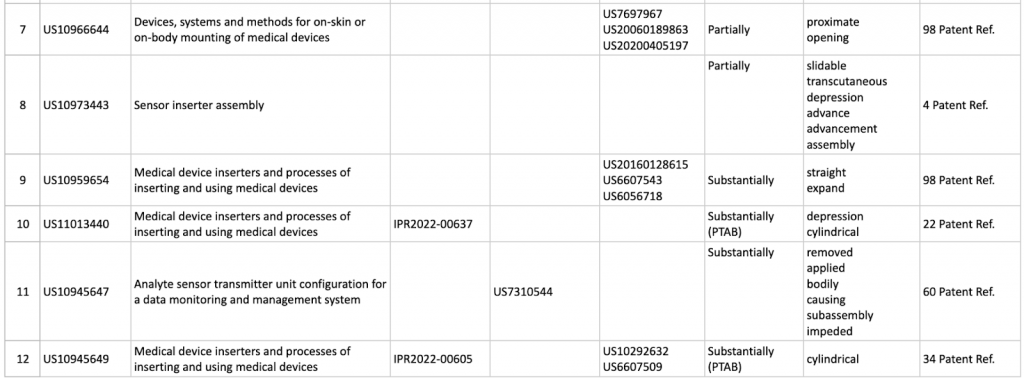

In comparison, one of Abbott’s asserted patents, US10827954, is found with no significant quality issues. Some of the asserted patents, such as US10820842, US10952653, and US10973443, have much fewer highly relevant prior art references, and they were not found with novelty prior art during prosecution. Most of Abbott’s asserted patents have a smaller number of highly relevant prior art references than Dexcom’s asserted patents.

Table 2. Abbott’s Patents-In-Suit

Source: Quality Insights

Source: Quality Insights

In sum, all of Dexcom’s patents-in-suit have potential novelty prior art, based on what we found with Quality Insights. In contrast, one of Abbott’s patents-in-suit, US10827954, was found with no potential novelty prior art, and some of the patents have relatively fewer potential novelty prior art references than Dexcom’s asserted patents.

However, it should be noted that two of Abbott’s asserted patents each have 98 prior art patents. The number is much higher than the rest of Abbott’s patents-in-suit and Dexcom’s asserted patents.

Clearly, both parties have weak spots regarding their asserted patents. Our findings show that Dexcom needs to be more cautious with Abbott’s counterclaims and challenges in court and at the PTAB based on the patent analysis.

If you are interested in examining the novelty or non-obviousness (§102/§103) grounds or want to find more prior art details of the patent-in-suit, just click on button to reach out to your dedicated Client Success Specialist now!

Reviewing Dexcom’s and Abbott’s Patent Portfolios

Using Due Diligence, we examined Dexcom’s and Abbott’s patent portfolios in the aspects of patent deployment, quality, and value to evaluate their standings.

Source: Due Diligence

Source: Due Diligence

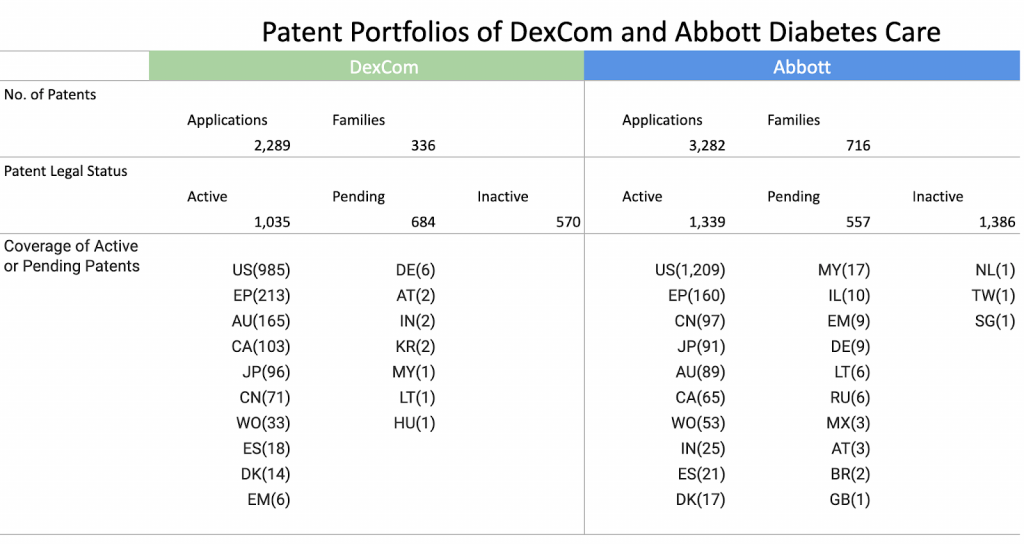

The size of Abbott’s portfolio is larger than Dexcom’s. Dexcom has 2,289 patent applications covering 336 patent families, whereas Abbott has 3,282 patent applications and 716 patent families. It should be noted that there are 1,386 inactive patents in Abbott’s portfolio, which account for 42.2% of Abbott’s patent applications.

If we only include active and pending patents, the number of Dexcom’s patent applications is close to Abbott’s. If we exclude inactive patents, Dexcom has 1,719 patent applications, and Abbott has 1,896.

In terms of regional deployment, it seems Dexcom and Abbott have common interests in the U.S., Europe, Australia, Canada, Japan, and China. Abbott maintains its patent portfolio in more jurisdictions. Abbott owns patents that are active or pending in 23 countries, and the number for Dexcom is 17.

Besides the six primary patent jurisdictions, both companies hold a limited number of patents in the remaining patent offices. It might not be worthwhile for Dexcom and Abbott to enforce their patents in these jurisdictions.

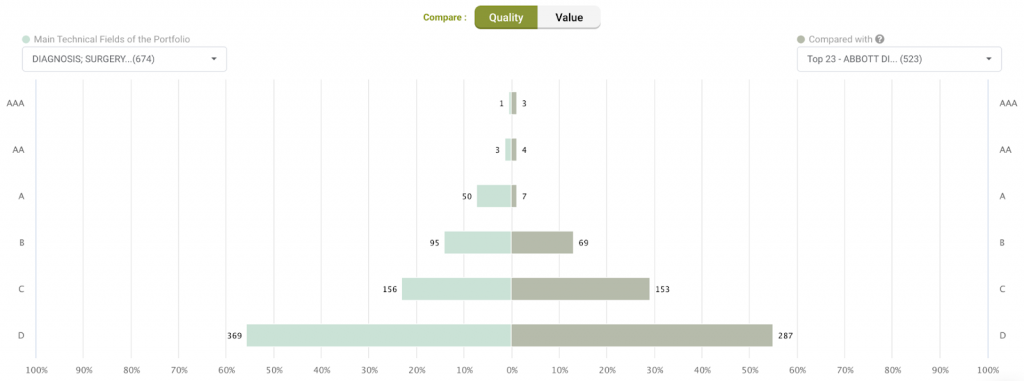

In addition to portfolio size, we compared the proportions of high-value and high-quality patents between Dexcom and Abbott.

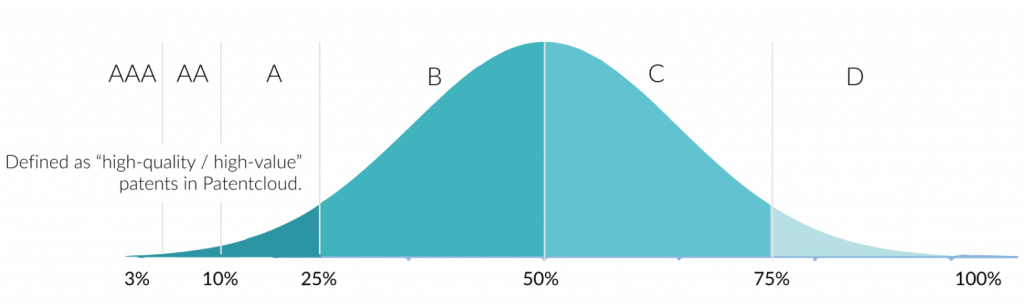

Patent Value and Quality Rankings

- High-value patents are defined as patents that are more likely to be monetized through transaction, litigation, or licensing.

- High-quality patents are defined as patents that are less likely to be invalidated.

Based on the proprietary algorithm developed by InQuartik, each patent in the database is assigned one of the six value/quality rankings: AAA, AA, A, B, C, or D. Patents ranked A, AA, or AAA with the Patent Value Ranking have a patent value score that is greater than or equal to 75% of the patents.

Patents ranked A, AA, or AAA with the Patent Quality Ranking have a patent quality score that is greater than or equal to 75% of the patents (see the graph below).

The Patent Value and Quality Rankings are generated by deep learning. See the white paper to see how we develop and validate the Patent Value and Quality Rankings.

Using Due Diligence, we analyzed Dexcom’s and Abbott’s patents regarding “diagnosis; surgery; identification” (International Patent Classification A61B), the field in which both companies have the most patents. We focused our analysis on U.S. patents since it is the primary market for Dexcom and Abbott.

We first compared the proportions of high-value U.S. patents between Dexcom and Abbott. According to the value comparison chart below, around 85.3% of Dexcom’s U.S. patents in diagnosis, surgery, or identification are ranked A or above, much higher than that of Abbott (66.3%).

Source: Due Diligence

Both Dexcom and Abbott have a substantial proportion of high-value patents. By definition, patents high in Patent Value Ranking are more likely to be litigated. Since both companies have actively enforced their patents, it can be expected that the two companies have a large proportion of high-value patents.

Source: Due Diligence

As for quality ranking, the proportion of high-quality U.S. patents in IPC A61B is fairly small for Dexcom and Abbott, and the ratio of D-ranked patents is high for both companies.

From a macro perspective, Dexcom and Abbott have close numbers of active/pending patents, and Abbott owns patents in more patent jurisdictions than Dexcom. Regarding patent value and quality, Dexcom has a larger proportion of high-value patents in its portfolio than Abbott, but both sides hold a small proportion of high-quality patents.

You can check out the full interactive Due Diligence reports we used in this article for free.

Just click the links to each company’s report below!

[ Dexcom’s patent portfolio ] / [ Abbott’s patent portfolio ]

Both Sides Have More Patents At Their Disposal If The Legal Battle Escalates

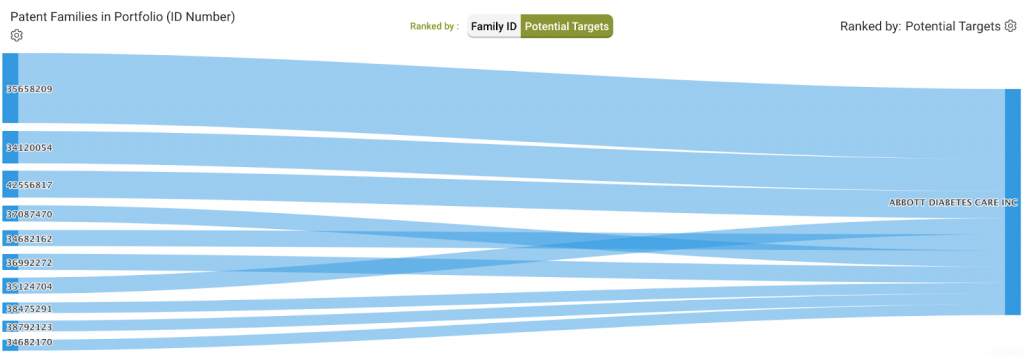

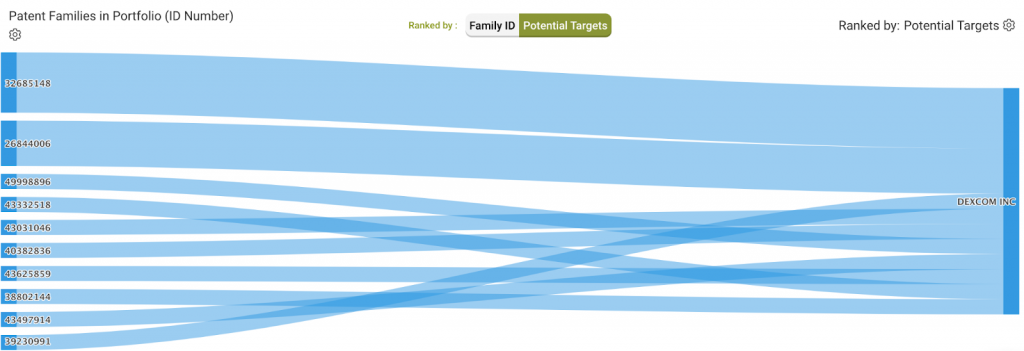

In the following section, we examined the patent families of Dexcom that have been cited by the patent examiners as novelty prior art to reject Abbott’s patent applications based on 35 U.S.Code § 102. We did the same analysis with the patent families of Abbott. The analysis allows us to identify the patents that Dexcom or Abbott could potentially enforce against each other if either party’s products are found to be using the patented technologies of the other party.

Using Due Diligence, we found that members of 30 patent families in Dexcom’s portfolio have been cited as novelty prior art in Abbott’s patent applications. The chart below lists the top 10 patent families with the most citations.

![]()

Source: Due Diligence

In the Dexcom vs. Abbott case (DDE-1-22-cv-00605), the five patents-in-suit correspond to four patent families and two of the four patent families are captured by our novelty citation analysis. Since two of the 30 candidate patent families have been used against Abbott in the patent suit, it is possible that some of the other 28 candidate patent families may also be used against Abbott if the legal dispute escalates.

![]()

Source: Due Diligence

Abbott has 26 patent families whose members have been cited as novelty prior art by the patent examiners when reviewing Dexcom’s patent applications. The top 10 patent families with the most citations are shown in the chart above.

In Abbott’s lawsuit against Dexcom (DDE-1-21-cv-00977), the 12 patents Abbott asserted correspond to six patent families, and three of them are found in the 26 candidate patent families that might be used to assert against Dexcom. The results show that some of the 23 patent families might have patents that could be asserted against Dexcom if the legal battle intensifies.

In short, both Dexcom and Abbott have plenty of patent families whose members might potentially be used to assert against each other. It suggests that more patents might be brought to court if the patent dispute between the two companies becomes more intense.

Also, in both Dexcom’s and Abbott’s cases, half of the patent families involved are captured by our novelty prior art citation data. The results suggest that novelty prior art data makes it easier to search for patents that might be asserted against potential target companies.

Conclusion

Using Patentcloud‘s Quality Insights, we examined the patents-in-suit for both cases and found many of the asserted patents, either by Dexcom or Abbott, have quality issues.

The results suggest that Dexcom needs to be attentive to Abbott’s defense. Most of Dexcom’s asserted patents are likely to be challenged. Four of the five patent-in-suit have been found with novelty prior art and have a large amount of potential novelty prior art references. In contrast, one of Abbott’s 12 asserted patents was found with no apparent novelty issues, and only two of the asserted patents have been found with novelty prior art references.

Portfolio analysis shows that Dexcom and Abbott have similar numbers of active or pending patent applications. We found that Abbott maintains patents in more patent jurisdictions than Dexcom and that Dexcom owns a larger proportion of high-value patents than Abbott in the area of diagnosis, surgery, and identification.

Finally, our findings show that both Dexcom and Abbott have a significant amount of patent families whose members might be used to assert against the other side. The results suggest that both parties might assert more patents against each other if the patent dispute intensifies.

We hope you have found our patent analysis and insights interesting! You can generate a report for any company’s patent portfolio by clicking on the button below to reach out to your dedicated Client Success Specialist now!