If there’s one company that’s been in the news as of late, it would have to be Huawei Technologies. And though the US has seemed to soften its hard-line stance on Huawei a bit recently, with the US president Donald Trump stating the US companies would be allowed to resume selling Huawei technology that did not pose “a great national emergency problem,” many questions still remain about what the future will bring for one of China’s biggest technology companies.

One Billion US Dollars in Royalty Fees?

On June 12, according to an article in The Wall Street Journal, Huawei stepped up pressure on the American carrier Verizon Communications to accept a licensing agreement on 238 patents. Reports say that in February, an IP executive from Huawei had already contacted Verizon to “solve the patent licensing issue,” even though Verizon is not a direct customer of Huawei. All told, Huawei is demanding more than one billion US dollars in royalty fees.

The dispute actually stems from infringement claims on the equipment provided to Verizon by at least twenty separate vendors. The patents at issue in the case range from core network equipment and wireline infrastructure to internet-of-things (IoT) technology, according to the WSJ article.

Did this move indicate a new tactic by Huawei, especially in light of its ongoing conflict with the US government? Was this a signal to the US that by pressuring one of America’s biggest phone-services providers, a defiant Huawei could stand up for itself?

Or was this done, as some have suggested, simply because Verizon has been quick to launch 5G services for it customers in the US, and Huawei, as a holder of patents in this area, is simply doing what it has the right to do under US patent law—monetize its patents?

Or does this mark a new direction for the company, with a strategic decision by Huawei to take a more aggressive approach to ramping up its patent licensing activities in the US?

Already, legislation has been filed in the US that would prevent companies on US watch lists, such as Huawei, from “bringing legal action over patent infringement,” although this viewpoint has been widely criticized by many.

Six Billion US Dollars Paid Out in Licensing Fees Since 2001 . . .

Not long after, perhaps in response to current events, Huawei released the Huawei White Paper on Innovation and Intellectual Property, which was subtitled “Respecting and Protecting Intellectual Property: The Foundation of Innovation.”

In this white paper, Huawei revealed that it had paid more than six billion US dollars to a variety of companies since 2001. These companies included big names like Apple, AT&T, Qualcomm, Nokia, Ericsson, and Samsung. All told, eighty percent of that six billion US dollars in royalties has ended up being paid to US companies.

. . . But More Than One Billion US Dollars in Royalties Earned Since 2015

At the same time, the white paper showed that Huawei itself is developing licensing streams of its own. The 1.4 US billion dollars that Huawei has earned since 2015 came from ten different deals with companies from the US, Europe, and Asia.

Of course, this number is more than respectable, especially for a company that is a relative newcomer when it comes licensing its IP in the global marketplace. Yet, it does make the recent one billion US dollars demanded of Verizon seem like quite a large demand.

One Hundred and Five Billion US Dollars in Revenue in 2018

As noted in the New York Times, Huawei is one of the world’s biggest technology companies, with a reported one hundred and five billion US dollars in revenue alone in 2018. This puts Huawei firmly on the top ten list of global technology companies by revenue, joining the likes of tech giants like Google and Microsoft. It also makes the company, arguably, the biggest tech player in China, overshadowing big-name Chinese internet companies like Alibaba, Tencent, and Baidu.

In addition to this growth in yearly revenue, Huawei also reported a profit of eight billion US dollars in 2018.

Thirty Billion US Dollars in Lost Revenue?

Yet, a few days after the company had pressured Verizon on IP payments, Huawei’s founder and CEO Ren Zhengfei seemed to take a less aggressive–and more pessimistic–stance. Ren stated that the US ban on Huawei would reduce the company’s revenue by thirty billion US dollars. Ren also admitted that the US’s commitment to trying to “crack” the company had been seriously underestimated.

This surprising admission (or perhaps strategic move) by Ren caught many off guard, since in months past, Huawei officials had strongly suggested that the company was more than capable of remaining self-sufficient, despite the many setbacks thrown its way. In fact, earlier in 2019, one Huawei official claimed that “external pressure” would unite the company internally and “make us even stronger.”

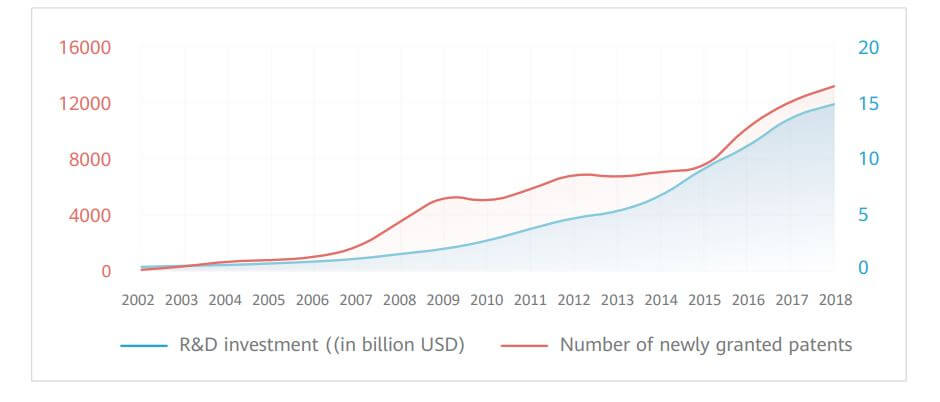

Fifteen Billion US Dollars on R&D in 2018

Huawei certainly does seem to be committed to the long-term growth of the company.

In 2018, the company is reported to have spent almost fifteen billion US dollars on research and development (R&D). This amount was equal to fourteen percent of the company’s sales.

Some experts have even suggested that recent events, such as Google’s decision to rescind Huawei’s Android license; Intel’s and Qualcomm’s decision to stop supplying Huawei with laptop CPUs; and ARM’s decision to stop selling Huawei chip-design IP, will actually cause Huawei to ramp up its own internal innovation to an even greater degree.

The company is reported to have already started work on developing its own operating system, and it is likely that when it comes to intellectual property (IP), the company will be looking to build up an even bigger patent portfolio.

A Patent Portfolio of More Than 87,000 Granted Patents . . .

In fact, Huawei has already amassed quite a large patent portfolio. As disclosed in its most recent white paper, Huawei currently has more than 87,000 granted patents in its arsenal.

“As of the end of 2018, Huawei held 87,805 patents, of which 11,152 were granted in the US and over 6,600 patent families were granted in Europe.”

Source: Huawei White Paper on Innovation and Intellectual Property

Huawei also claims to hold the most Chinese patents in the world.

In fact, as Huawei’s investment in R&D has continued to grow, so has the number of granted patents in its portfolio.

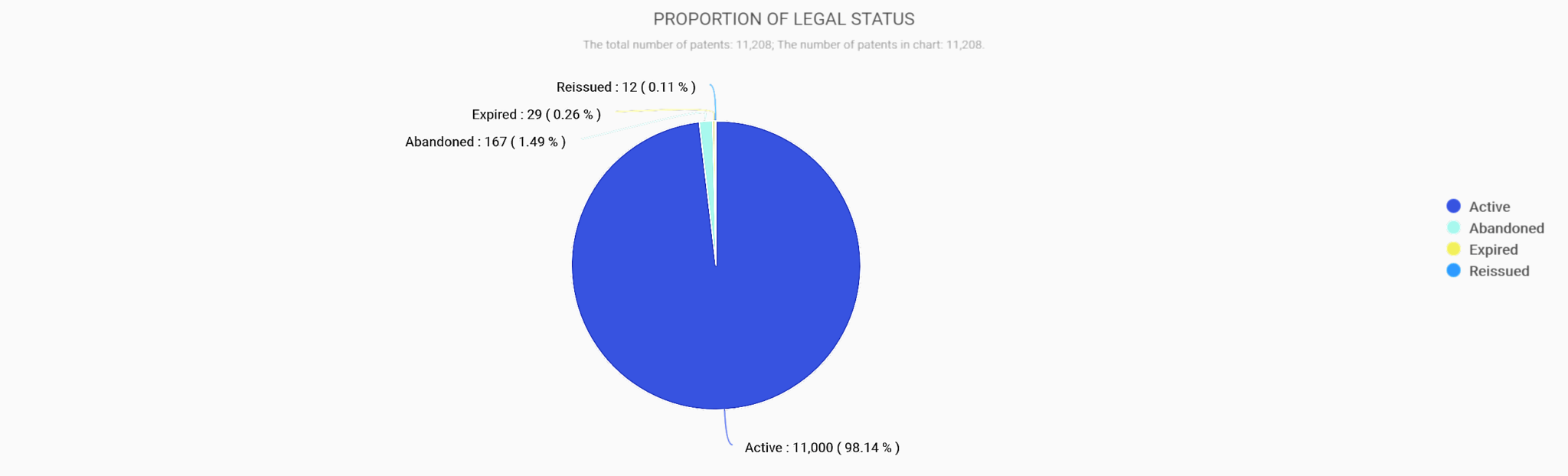

More Than 11,000 Granted US Patents

Since Huawei is currently caught up in the trade war between the US and China, it can be instructive to take a closer look at its 11,000-plus granted US patents.

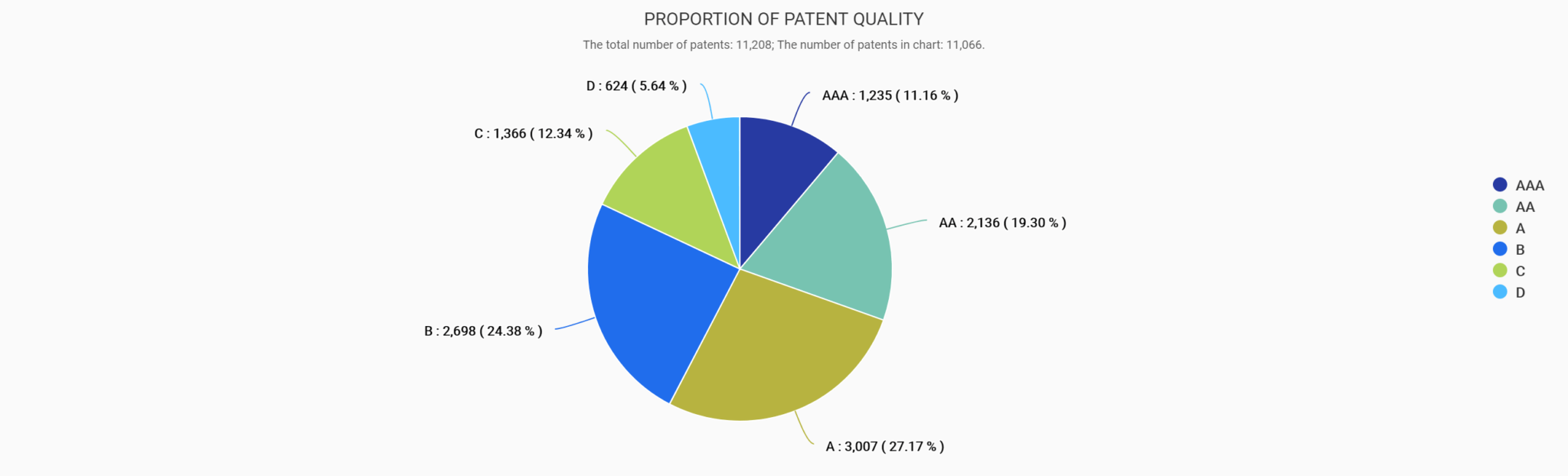

As the pie chart shows, the vast majority of the patents in this portfolio are active, and only a few have been abandoned or left to expire.

And according to research done on Patentcloud, Huawei also has nearly 5,000 pending US patents.

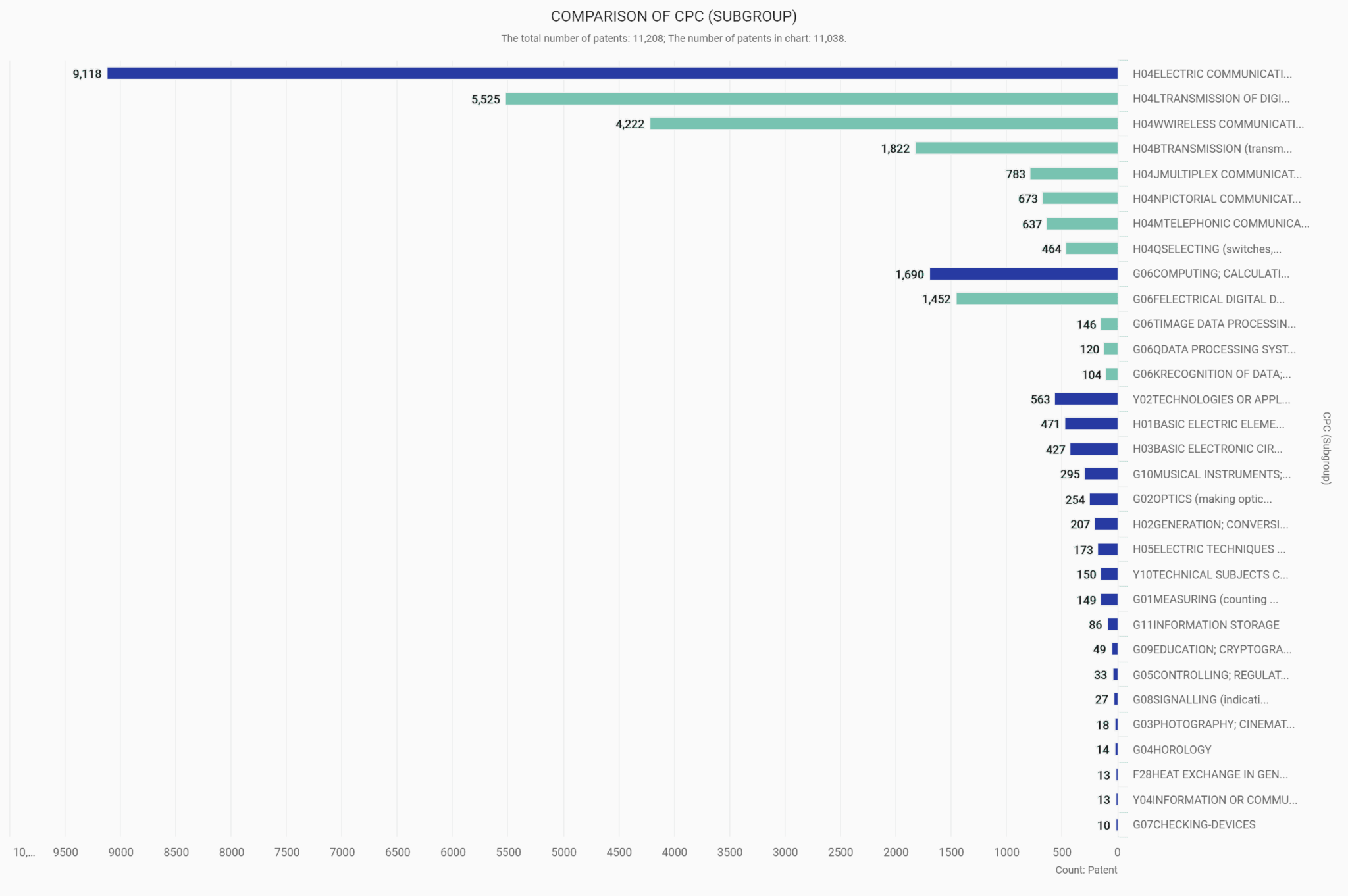

Types of Technology (CPC)

Examining Huawei’s portfolio through the different technology categories that company has patents in actually reveals no real surprises.

It makes sense that the world’s largest telecommunications-equipment manufacturer and second-largest smartphone manufacturer would have a large number of CPC subgroup H04 (Electric Communication Technique) and G06 (Computing; Calculating; Counting) patents in its US portfolio, as seen in the chart above.

In particular, the vast majority of Huawei’s H04 parents are in three categories: H04L (Transmission of Digital Information, e.g., Telegraphic Communication); H04W (Wireless Communication Networks); and H04B (Transmission), with the first two making up the lion’s share of Huawei’s granted US patents.

As well, in the G06 category, patents for G06F (Electrical Digital Data Processing) dominate.

And there are no indications that Huawei has strayed from this focus, by obtaining large amounts of patents in other unrelated technology categories.

From this patent portfolio perspective, it seems clear that Huawei has remained focused on its core business and core technologies.

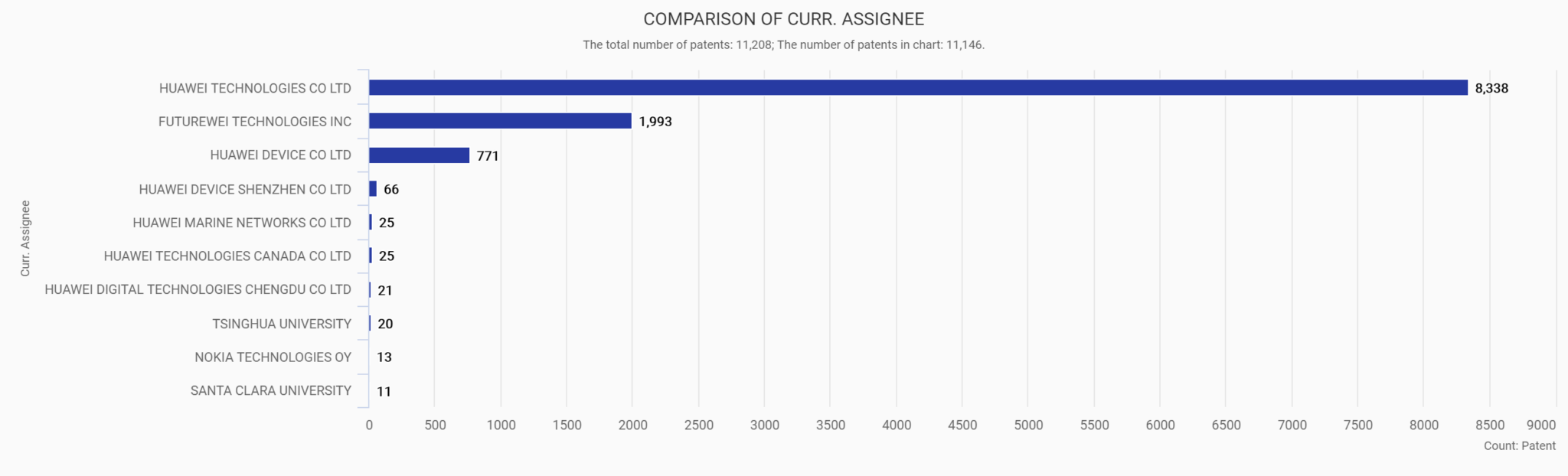

Who Owns the Patents in Huawei’s US Patent Portfolio

Again, there are no surprises here as the largest amounts of patents in the portfolio are owned by either Huawei Technologies itself or its US subsidiary Futurewei Technologies.

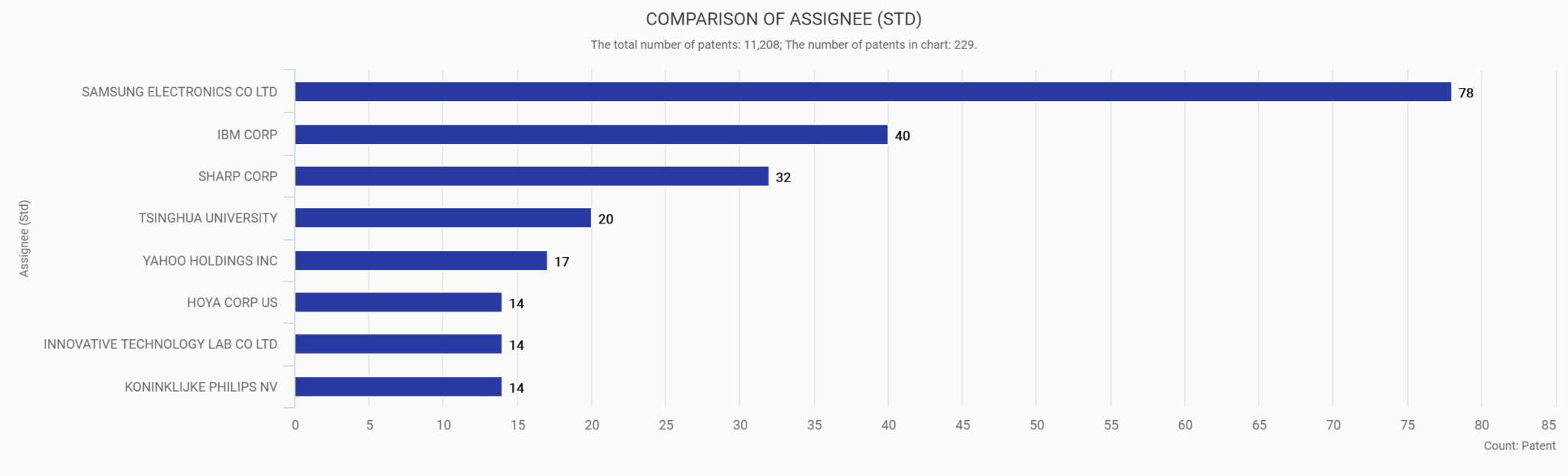

Who Huawei Has Acquired Patents From

What may be more interesting is to look at the patents in the Huawei patent portfolio that have been acquired from others. This list includes big names like Samsung, IBM, and Sharp.

Yet, perhaps even more salient is the low amount of acquired patents overall, especially in relation to such a large patent portfolio.

This would seem to indicate that Huawei has developed many of its own US patents over the years and that it has not had to bolster or build up its US patent portfolio through large patent acquisitions.

It may also indicate that the company’s sustained R&D efforts, as highlighted in its white paper, have yielded fruit in the form of large numbers of US patents.

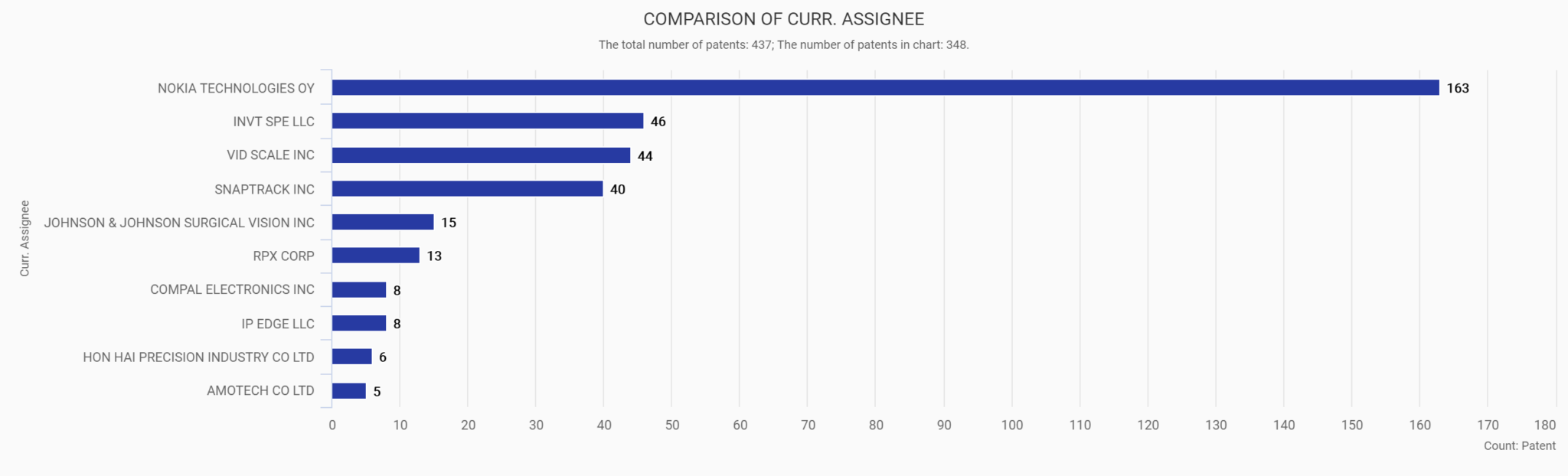

Who Huawei Has Sold Patents To

In the same way that Huawei has not acquired many patents from others, it has also not sold many of the patents in its US portfolio. As seen in the chart above, Nokia has been the largest recipient of Huawei’s US patents, but only 163 in total.

But, again, the overall number of US patents that have been sold to others is quite low in relation to the 11,000-plus total portfolio.

Perhaps this means that Huawei has not needed to rely on this type of monetization to increase its revenue.

Or perhaps the company’s business strategy has not included this type of patent monetization tactic.

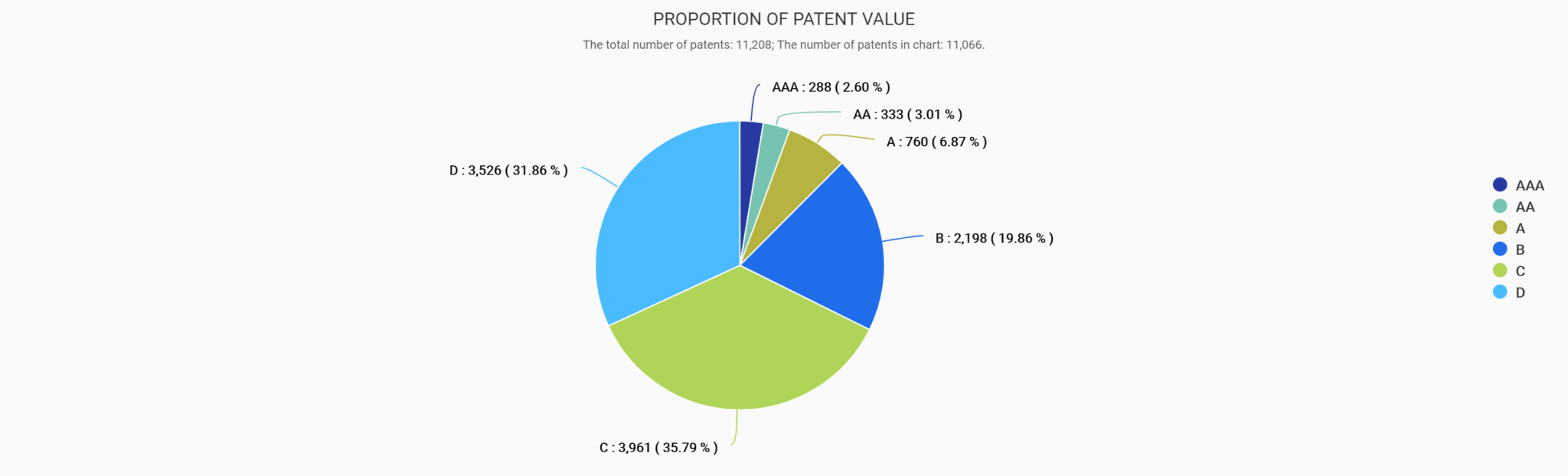

The Huawei Patent Portfolio: Value Analysis of Huawei’s Granted US Patents

However, a value analysis of Huawei’s issued US patents (before the year end of 2018) reveals that it is mostly low-value patents that make up this portfolio. In fact, nearly 70 percent of Huawei’s issued US patents fall in the C and D categories.

Yet, at the same time, it should be noted that Huawei does have more than 1,200 patents with a value ranking of A or higher, which is significant.

As well, it should be noted that Huawei has already shown its strength in 3G and 4G, and as more of Huawei’s 5G patents are published or issued, the value of Huawei’s entire 5G patent portfolio may soon be revealed.

Perhaps we can conclude that Huawei has taken an aggressive approach to obtaining US patents, which has resulted in large amount of low-quality patents, but also a significant number of high-value patents.

The Huawei Patent Portfolio: Quality Analysis of Huawei’s Granted US Patents

In contrast, the overall quality of Huawei’s US patent portfolio is quite high. In fact, almost 65 percent of the portfolio falls in an AAA, AA, or A category.

What this means is that Huawei holds many US patents that would likely be very difficult to invalidate in patent litigation, based on this quality-analysis model.

So, if you are a company and Huawei comes knocking on the door with a licensing agreement, as it has done with Verizon, it may be good to know that Huawei does, in fact, hold many high-quality US patents, many of which may be hard to invalidate in litigation.

The Huawei Patent Portfolio Closing Observations

By examining The Huawei Patent Portfolio, in particular Huawei’s US patent portfolio, some of the company’s recent actions start to make a bit more sense.

Let’s look at it this way:

Caught in a trade war between China and the US and placed on the US blacklist, Huawei currently cannot sell many of its products in the US market.

It does have a large number of US patents that it could possibly sell, but as our analysis shows, most of them fall in low-value categories, at least before Huawei’s 5G patents, many of which are still pending, are taken into consideration. What’s more, we can see that the company doesn’t really have a history of selling large amounts of US patents, and as an operating company, it seems unlikely that it will turn to this avenue as a revenue stream.

What Huawei does have is a large number of high-quality US patents. And it has also spent billions on its R&D, as discussed earlier in the article, and it probably is looking for a return on this investment. As well, from the company’s own white paper, it’s clear that its patent licensing efforts have been on the rise since 2016, and that they were pretty much non-existent prior to this.

Therefore, licensing its US patents seems to be a natural choice for Huawei. In this light, the company’s pressure on Verizon for one billion dollars in royalty fees this June should not really come as a shock. In fact, it might be just the first of many such actions in a concerted effort to increase the company’s patent licensing activities.

Seen in this way, the release at the end of June of Huawei’s White Paper, in which it clearly outlined its past licensing activities, including royalties paid and royalties earned, might be seen as a signal that the company will increasingly turn to licensing its patents to earn revenue.

In some ways, Huawei may simply want to join the ranks of heavyweights such as Nokia and Ericsson, who are reported to make more than one billion US dollars annually from their licensing activities.

And based on the Quality Analysis of Huawei’s US patent portfolio–and its yet-to-be completely revealed 5G patent portfolio, they may just have the high-quality patents needed to do so.

The Huawei Patent Portfolio: 5G SEP Patent Portfolio Is The Key to the Company’s Future?

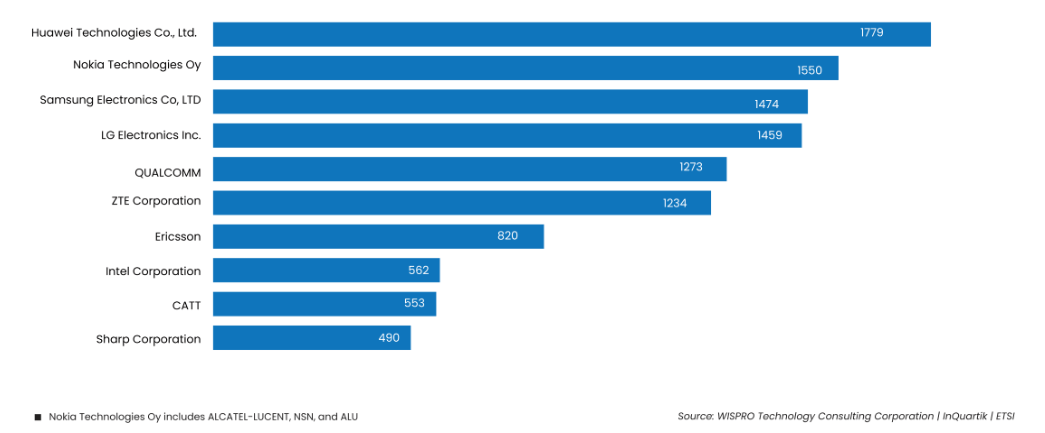

By most accounts, Huawei is clearly a leader when it comes to 5G standard-essential patents (SEP). In fact, in Huawei’s own White Paper, the company reports holding 10 percent of the world’s 4G SEPs and up to 20 percent of the 5G SEPs.

Other 5G SEP reports have also put Huawei in a leading position when it comes to 5G SEP, as seen in the chart above.

Clearly, Huawei’s 5G SEP patent portfolio is crucial to the company’s future, and in the second part of this article, we will take a closer look at Huawei’s 5G SEP portfolio as well as current 5G SEP trends.