In our January 5, 2024 article, “2023’s 5G SEP Arena: Unveiling the Front-Runners in a Year of Intense Declarations,” we used SEP OmniLytics’ real-time data for Behavioral, Essentiality, and Quality analysis to review the dynamics of 5G SEPs in 2023, identifying the most active companies and comparing their SEP statuses.

Shortly after, on February 7, we released an analysis of patent trends in the SiC semiconductor industry, showcasing Patentcloud’s Patent Summary feature designed for Patent Landscape, which provides quick insights into the technological innovations behind patents.

Inspired by the potential insights from combining these two powerful tools, we decided to use SEP OmniLytics and Patent Summary together to track the 5G SEP developments from January 1, 2024, to April 30, 2024. Of course, our analysis focuses on publicly available patent publications, as the details of unpublished patents are not accessible for further examination.

Table of Contents

- Newly Declared 5G SEPs: January to April 2024

- Patent Summary Insights: Analyzing Newly Declared 5G SEPse

- Conclusion: Dynamic Shifts in the 5G SEP Landscape in Early 2024

- Taking the Next Step with AI-Driven 5G SEP Analysis

Newly Declared 5G SEPs: January to April 2024

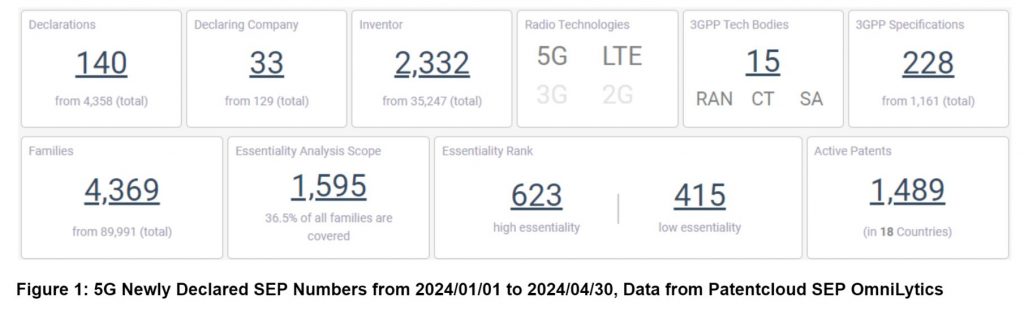

From January 1 to April 30, 2024, a total of 34 companies declared 153 SEPs. However, 13 of these declarations were duplicates. Using SEP OmniLytics’ “Newly Declared” feature, we filtered out the duplicates, resulting in 140 unique declarations covering 4,369 extended families, or 4,745 simple families. Among these, 1,489 patents across 18 regions have already been granted.

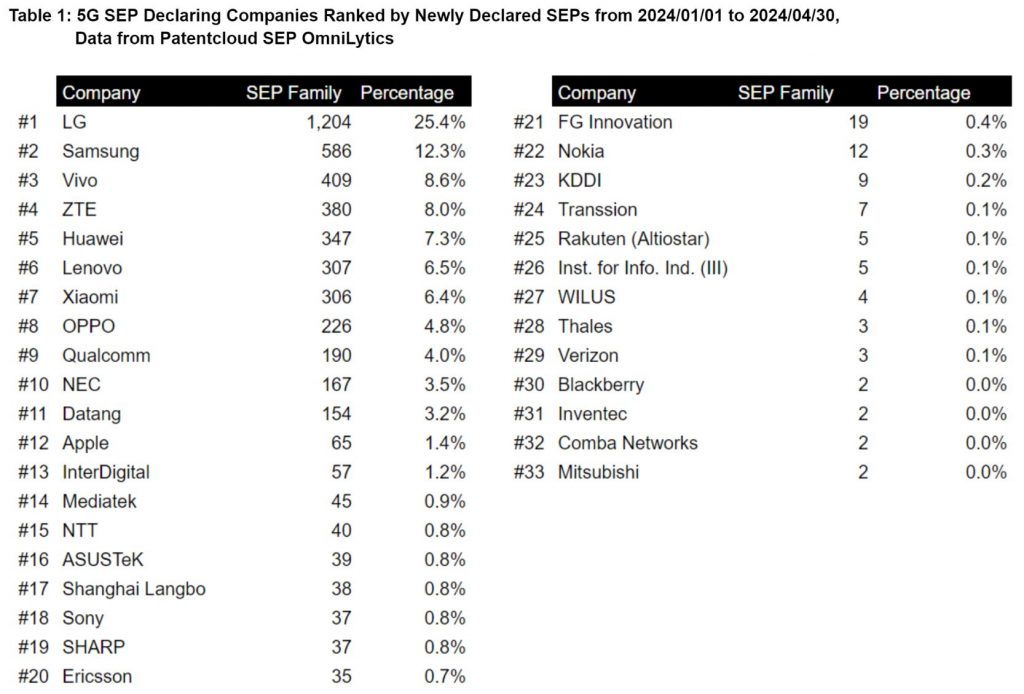

Among the 33 companies declaring these 4,369 families, two Korean companies, LG Electronics and Samsung Electronics, accounted for over 35%. Adding Chinese companies Vivo, ZTE, and Huawei, the top 5 contributors represent more than 60% of the total declarations. The top 10, which includes other Chinese companies like Lenovo, Xiaomi, and OPPO, along with Qualcomm and Japan’s NEC, comprise over 85% of the total declarations. Notably, if previous declarations were not considered, Qualcomm and Apple would have significantly higher numbers of 5G SEP declarations, but these do not affect their 5G SEP portfolios as they are already declared before 2024.

In our previous article, “2023’s 5G SEP Arena: Unveiling the Front-Runners in a Year of Intense Declarations,” we discussed the SEP portfolio rankings as of the end of 2023. Comparing this with the dynamics from the first four months of 2024, we find that LG’s 5G declared SEP portfolio, which had fewer than 5,000 families by the end of 2023, has increased by 1,204 families, reflecting nearly a 25% growth. NEC, with fewer than 650 families at the end of 2023, has added 167 families, surpassing 25% growth. Other top owners with more than 100 new families include Samsung (10.49%), Vivo (15.97%), Lenovo (17.20%), Xiaomi (10.34%), and Asustek (12.34%).

Of course, a four-month growth period provides only a snapshot. Other top owners may be preparing their SEP declarations for the coming months. However, this trend highlights significant growth for LG and NEC, and notable increases among several Chinese companies.

Patent Summary Insights: Analyzing Newly Declared 5G SEPs

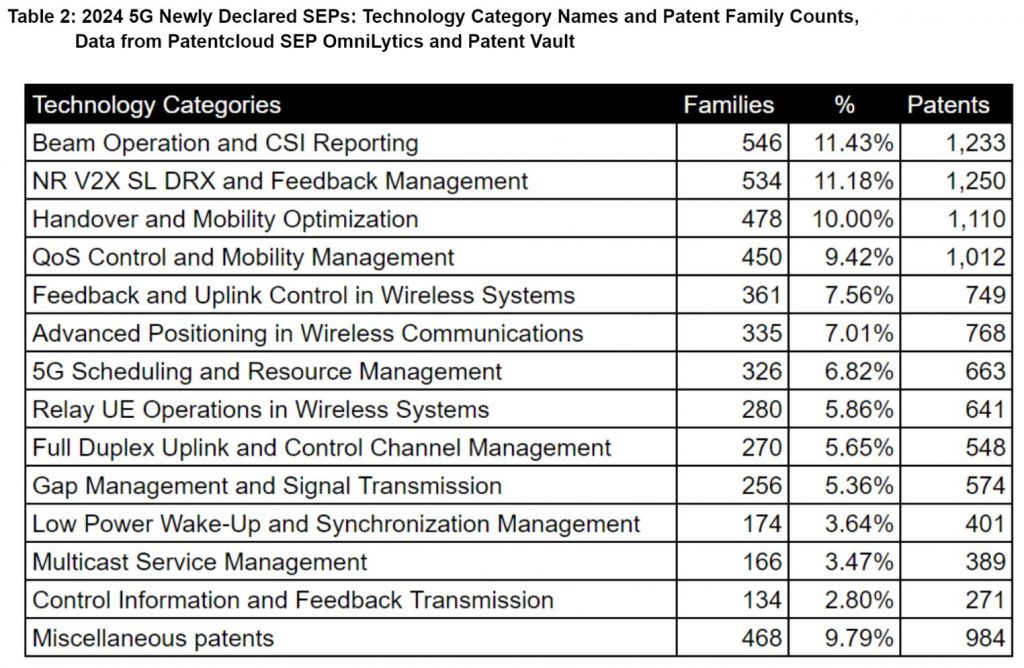

First, we used Patent Summary to categorize the 5G SEPs declared over these four months into the top 10 technological areas based on their correlations. These categories include “beam operation and CSI reporting,” “NR V2X SL DRX and feedback management,” and “handover and mobility optimization,” among others. The distribution across these categories is broad and evenly spread, indicating no particular technological emphasis.

It’s important to note that besides providing category names, the Patent Summary feature also offers summaries of the technologies within each category. We utilized these summaries and further refined the category names with ChatGPT-4, making them more readable and suitable for analytical reports. Although the system cannot fully automate this process yet, the summaries provided by Patent Summary facilitate users in further refining, optimizing, and combining patent technology classifications. If you are interested in the detailed summaries of each technology category, you can Contact Us to obtain access to the corresponding lists in Patent Vault.

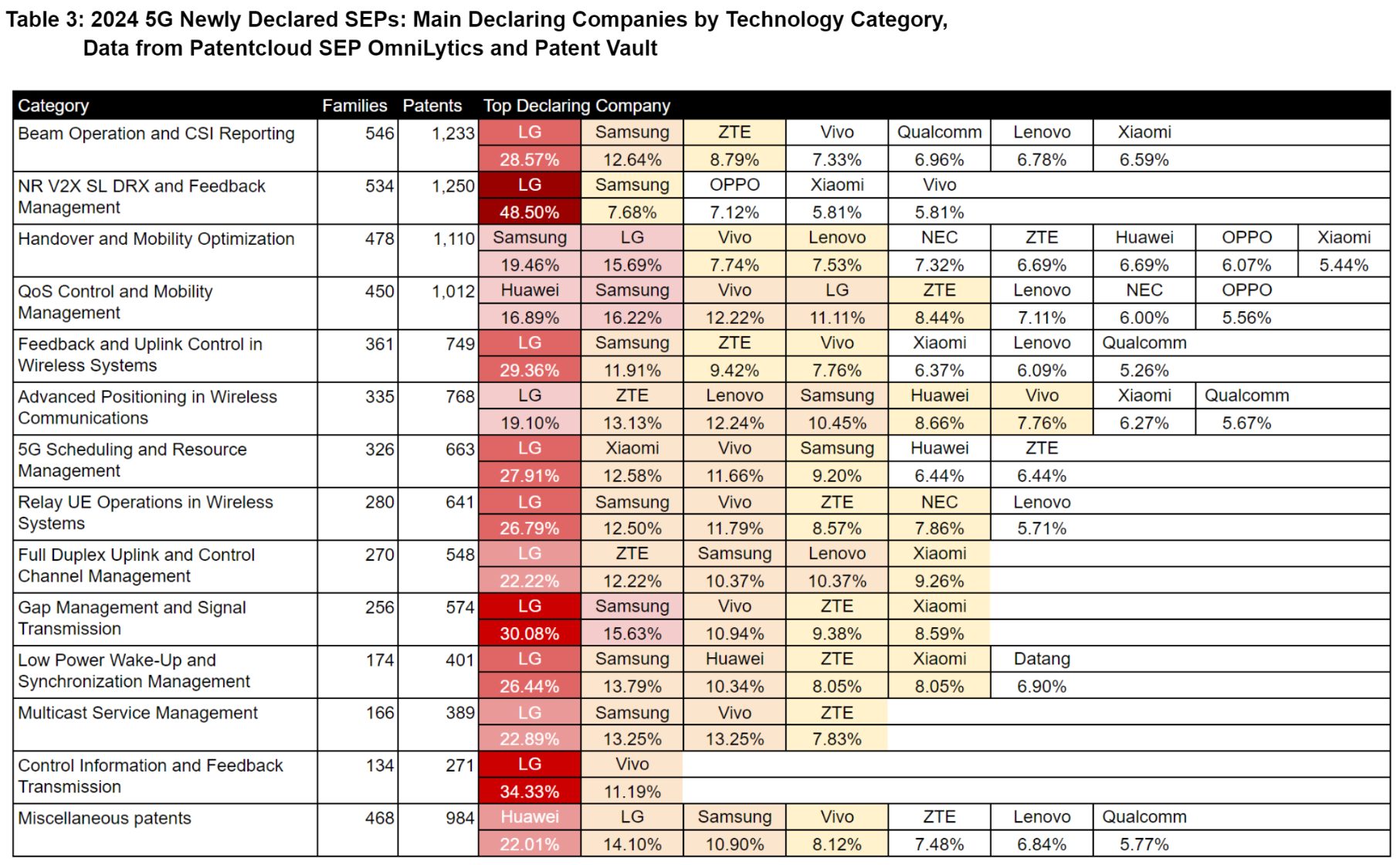

We further analyzed the main declaring companies within each technological category. LG declared 25% of the newly declared SEPs from 2024, while Samsung declared 12%, dominating the classification results. However, specific trends were observed:

- LG: Focused heavily on “NR V2X SL DRX and Feedback Management” and “Control Information and Feedback Transmission,” while showing less emphasis on “Handover and Mobility Optimization” and “QoS Control and Mobility Management.”

- Samsung: Had a significantly higher proportion of declarations in “Handover and Mobility Optimization,” especially compared to other companies, followed by “QoS Control and Mobility Management.”

- Huawei: Showed a higher proportion of declarations in “QoS Control and Mobility Management,” particularly compared to other companies.

- Other Key Declarants: Vivo had a more balanced distribution across several technological categories, while ZTE had a higher proportion in “Advanced Positioning” and “Full Duplex Uplink and Control Channel Management.”

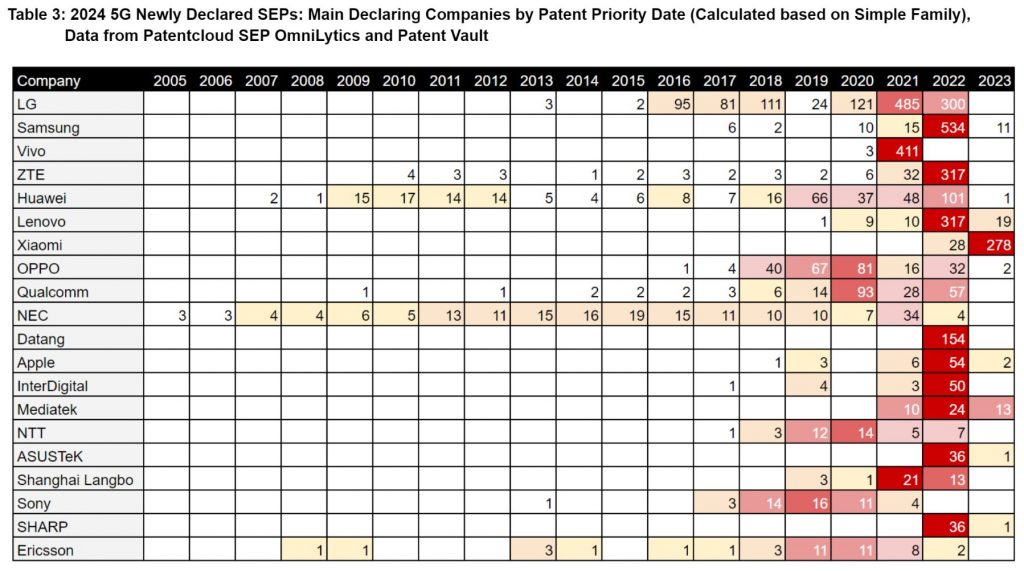

It is worth noting that 5G SEP declarations do not necessarily represent new inventions or patent applications. Patent holders might declare highly relevant or essential patents from their existing portfolios due to advancements in 5G technology. By utilizing the PatentMatrix feature in Patent Vault, which presents the relationship between declaring companies and the priority dates of patents, we found that:

- LG and NEC: Declared over 25% of their existing 5G SEP portfolios, including priority dates not only from recent years (2021, 2022) but also from earlier years. This suggests that besides new inventions, these companies also audited their existing patents for essentiality and declared them.

- Other Companies: Showing similar priority date patterns, likely conducting audits and declarations, include Huawei, OPPO, Qualcomm, NTT, Sony, and Ericsson.

Therefore, the technological classification of SEPs is more reflective of recent 5G SEP innovations and patent strategies by companies such as Samsung, Vivo, ZTE, Lenovo, Xiaomi, Datang, Apple, InterDigital, and SHARP. If you are interested in the technology distribution and trajectory of newly declared 5G SEPs by these companies, please contact us.

Conclusion: Dynamic Shifts in the 5G SEP Landscape in Early 2024

The snapshot of newly declared 5G SEPs in the first four months of 2024 reveals significant impacts on the SEP landscape for companies like LG and NEC. This highlights that the status of 5G SEPs is subject to frequent changes, driven by both new inventions and the strategic mining of existing patents.

Other observed dynamics extend trends identified in our previous article, “2023’s 5G SEP Arena: Unveiling the Front-Runners in a Year of Intense Declarations,” reflecting the efforts of major Chinese terminal companies to reposition themselves in the SEP licensing arena.

Using Patent Summary, we can delve deeper into the technological focuses of these newly declared SEPs. The relatively broad focus areas among different companies suggest that they are actively auditing their current or pending patent assets in response to new trends in standard development. Thus, the classification results mirror the current hot topics in 5G standards. With Patent Summary, we can efficiently extract and analyze this information.

Taking the Next Step with AI-Driven 5G SEP Analysis

In this article, we showcased how AI-driven automatic classification can be applied to 5G SEPs, demonstrating how to quickly capture new technological trends. By using our SEP OmniLytics and Patent Summary tools, we provided a snapshot of the newly declared SEPs in early 2024.

It’s important to note that while this analysis focuses on technological trends, the actual declared SEPs of various companies involve essentiality and quality issues. These topics, though beyond the scope of this article, are covered in detail in our previous article. For more information on these features or to explore related solutions, please refer to our earlier work or Contact Us directly.

The first four months of data provide a snapshot, and the impact of May’s declarations is minimal, with only two new declarations so far. Therefore, we selected the end of April as a cutoff for this analysis.

Stay ahead of the curve with the latest insights and strategic advantages provided by our cutting-edge tools. For further details, access to full lists, and in-depth analyses, please Contact Us.