In the dynamic landscape of patent trades within the corporate sphere, certain deals shine brighter than the rest. Leveraging Patentcloud’s exhaustive database, we keep a keen eye on litigations and IP transactions. The transfer of 548 US patents from KCI Licensing to 3M Innovations on August 24, 2023, emerges as a pivotal event, foreshadowing 3M’s eventual buyout of KCI’s parent firm in 2019. Let’s dissect the subtleties of this acquisition and its ramifications for 3M’s IP strategy.

Table of contents

- Historical Overview

- The Essence of the Patents

- Market Dynamics Post-Acquisition

- Value Proposition

- The Competitive Landscape

- Patent Quality Concern

- Conclusion

Historical Overview

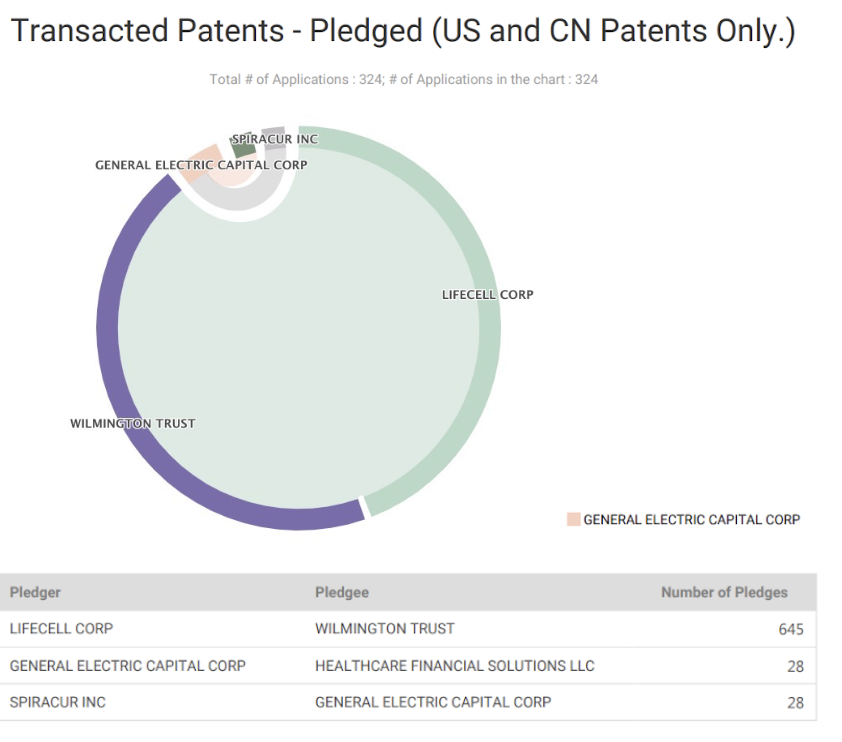

While the bulk of the patents originated from KCI, noteworthy additions came from Spiracur Inc. (with 21 patents) and MoMelan Technologies (holding 5 patents). Interestingly, Lifecell Corp, a subsidiary of KCI’s parent company, Acelity, had previously pledged approximately 60% of these patents.

The Essence of the Patents

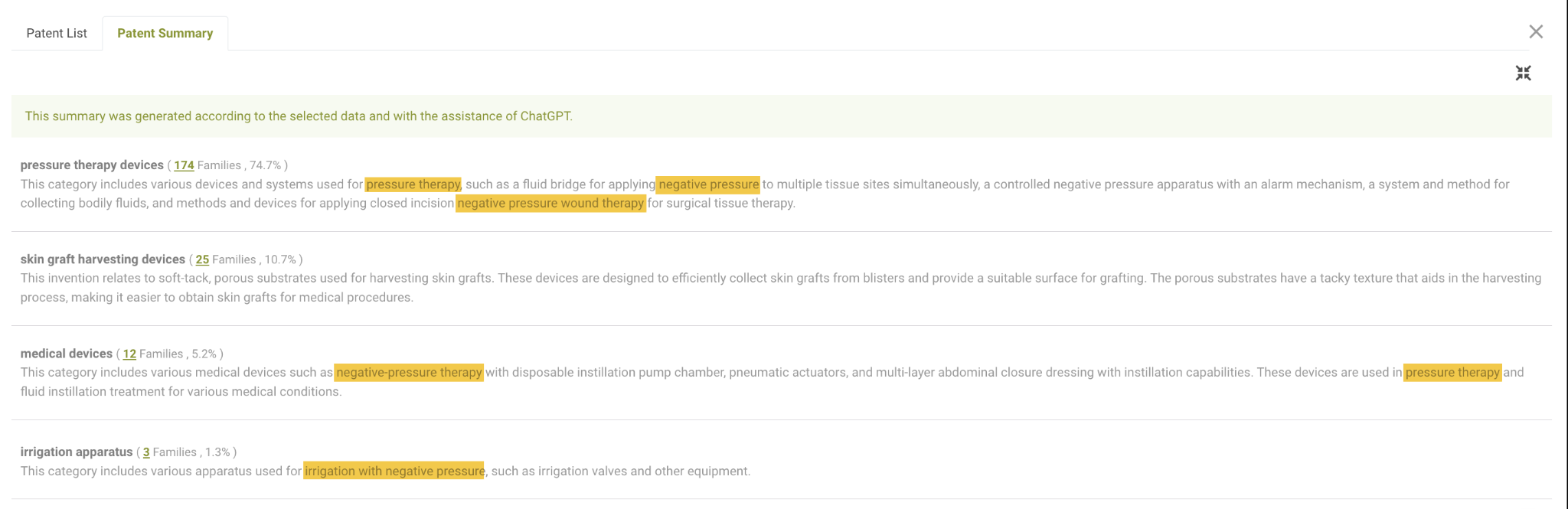

Reading the patents with “Patent Summary” feature:

Most of these patents in this transfer orbit the realm of negative pressure, particularly pressure therapy devices, accounting for a staggering 80%. Dive more profoundly, and you’ll find medical devices (5.2%) and irrigation apparatus (1.3%) forming the rest of the mix.

Market Dynamics Post-Acquisition

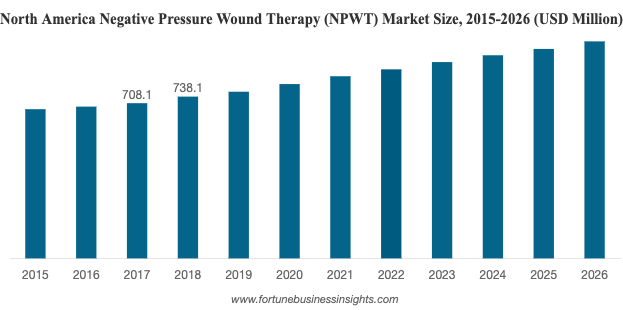

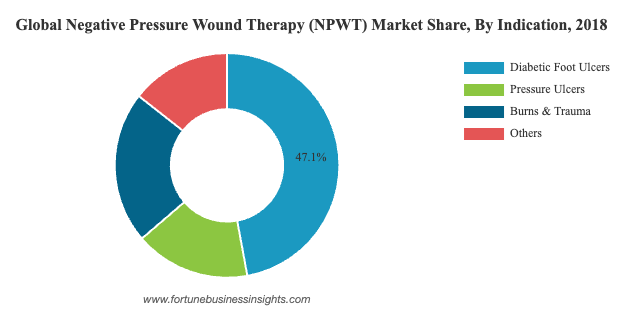

Based on market reports. Post the acquisition, 3M (with KCI under its umbrella) shines as a market titan, flaunting an estimated market worth of an eye-popping $2.75 billion.

The global negative pressure wound therapy (NPWT) market size stood at USD 1.85 billion in 2018 and is projected to reach USD 2.74 billion by 2026, exhibiting a CAGR of 5.1% during the forecast period.

Value Proposition

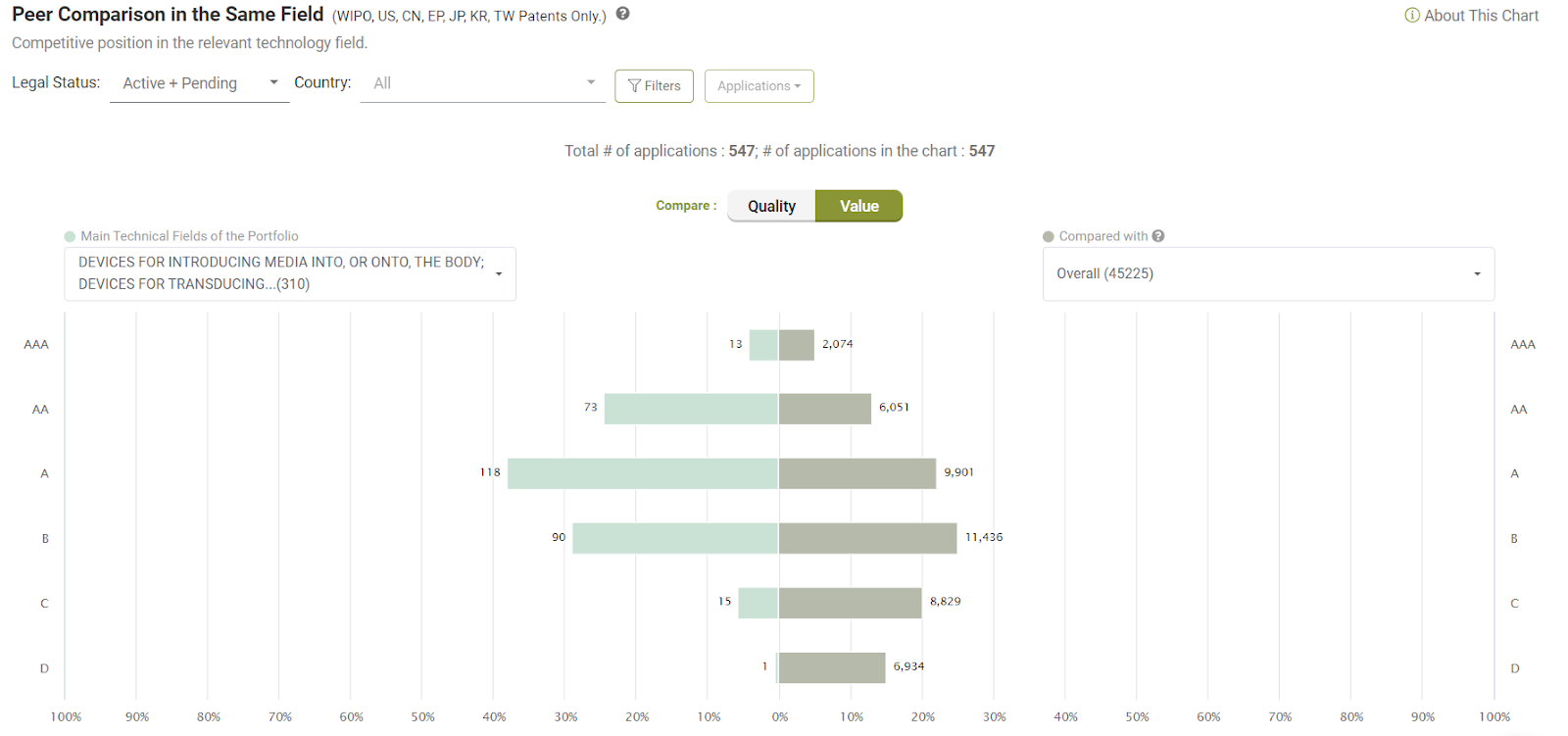

In a noteworthy benchmark, 65% of the transferred patents possess a Value Ranking of ‘A’ or higher, significantly surpassing the industry average of 37%.

The Competitive Landscape

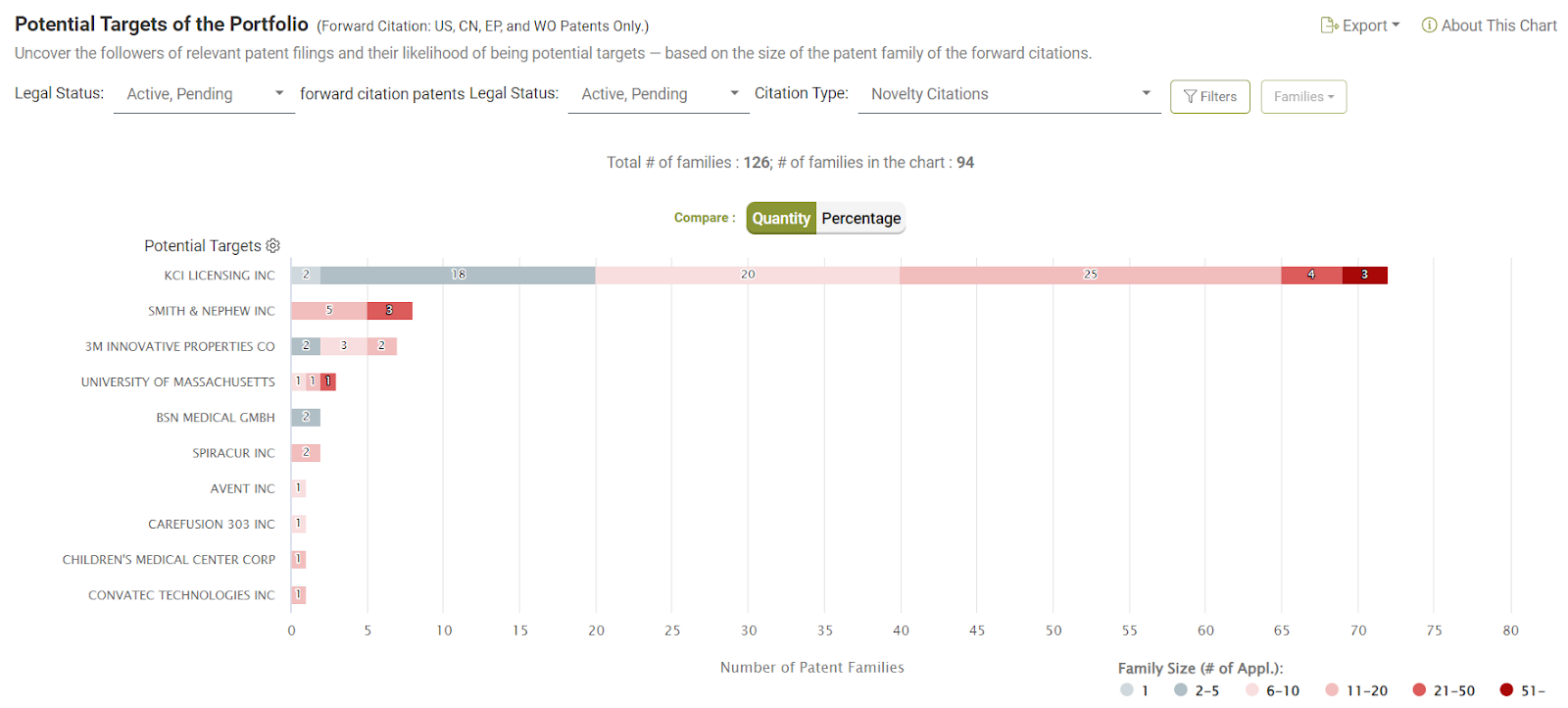

Smith & Nephew, another titan in the NPWT arena, has often been seen sprinting alongside KCI in the innovation race, signaling simultaneous technological leaps.

Spotlight on Patent Families

Notably, there are four significant patent families of KCI that merit attention:

It’s noteworthy to mention that aside from their internal self-novelty rejection issues, another key player in NPWT, Smith & Nephew, has also filed similar inventions. They are positioning themselves as technology followers and have expanded these innovations into extensive patent families.

Patent Quality Concern

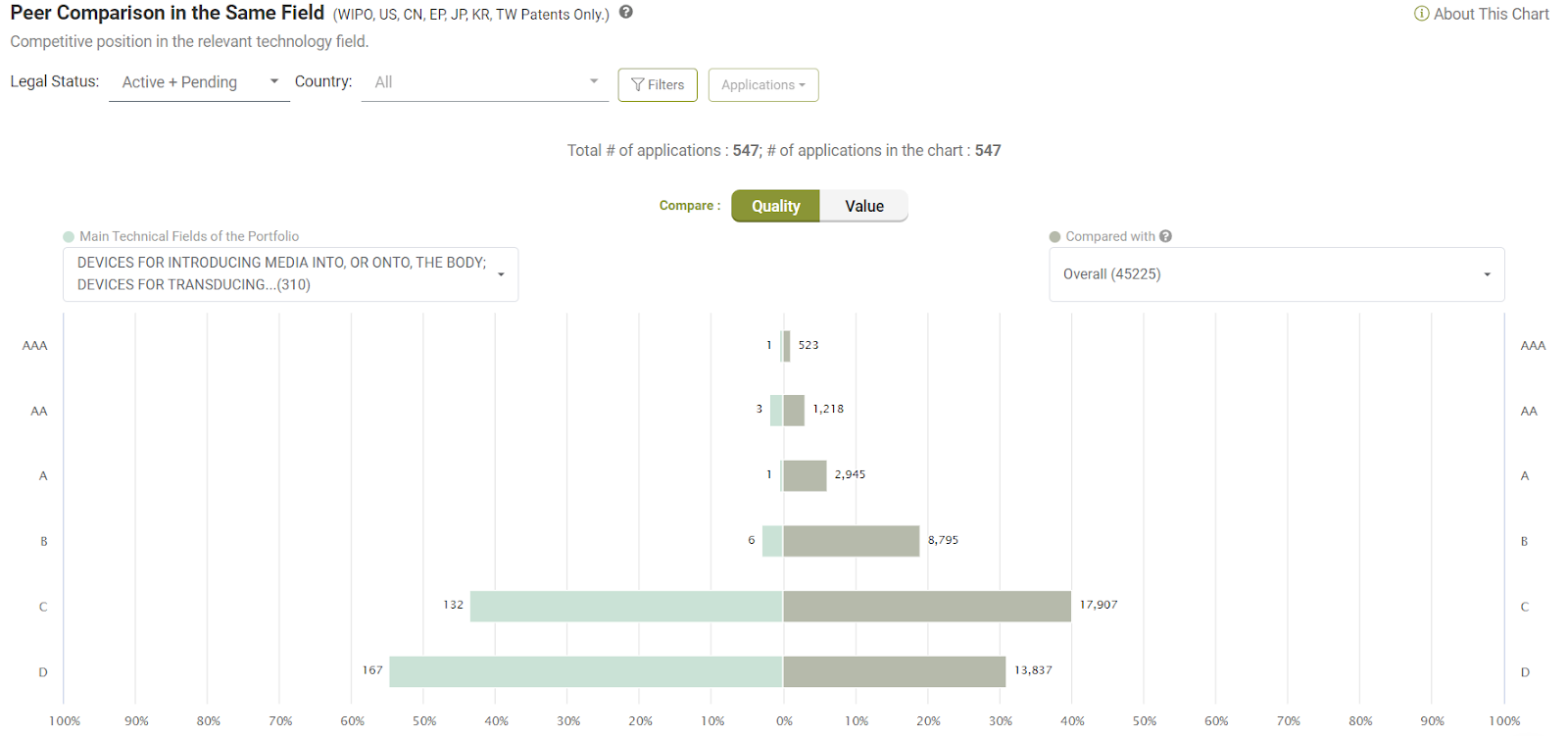

Despite its vast patent portfolio, KCI shows vulnerabilities: over 50% of their patents fall into the ‘D’ category, well above the industry’s 30% average. This raises questions about KCI’s strategic positioning and potential implications in the wider industry.

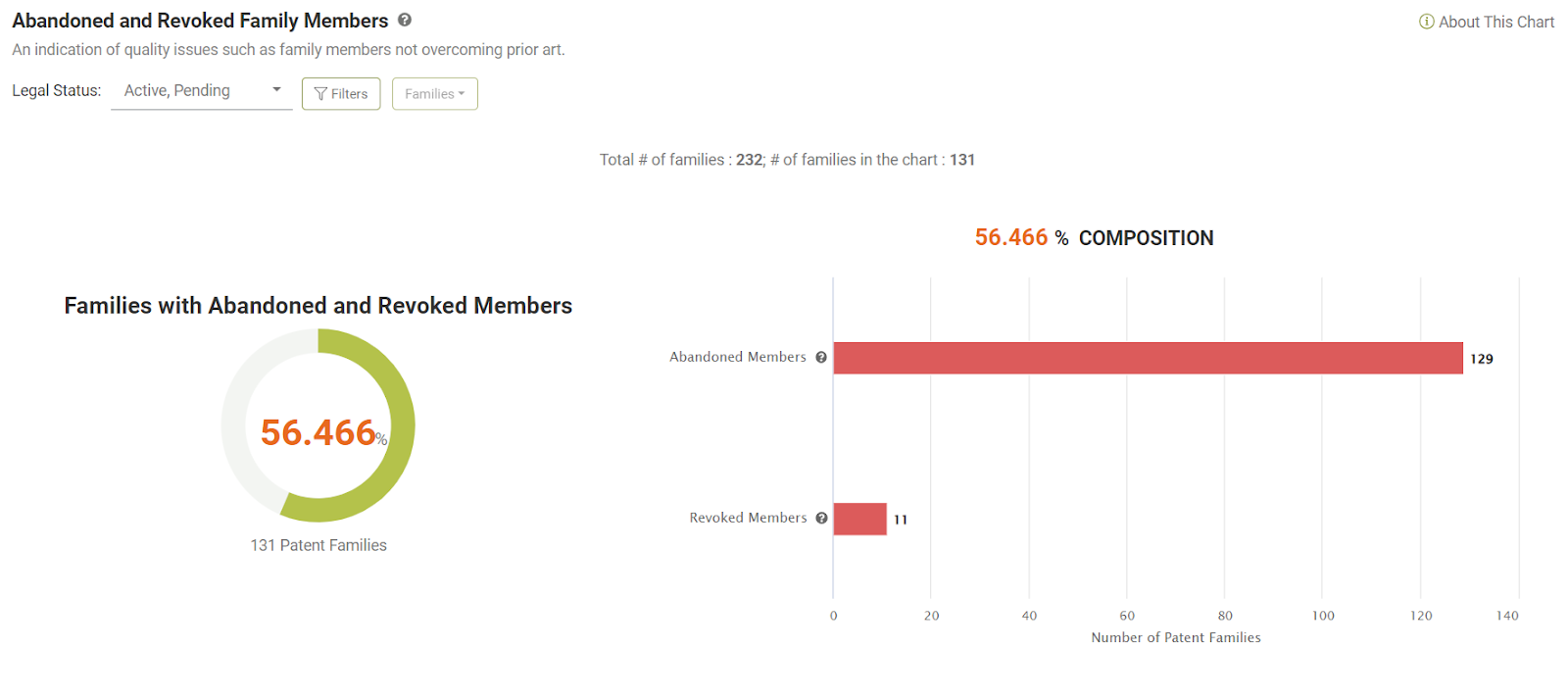

56% of the families have members that struggled to overcome examination hurdles. The prevalent self-novelty citations suggest that the overarching strategy might have been too focused on repetitive filings, possibly leading to these challenges.

Conclusion

The 2023 patent transfer from KCI to 3M accentuates 3M’s strategic foresight from its 2019 KCI acquisition. This step not only cements 3M’s domain in intellectual property but also underscores their ambition in negative pressure wound therapy. For 3M, it was more than a mere expansion; it was about harnessing KCI’s innovations.

Want to check it out? Try the Patent Summary feature in our free interactive Due Diligence demo report for a limited time only!

Or schedule a demo to assess your patent portfolio.

*the Patent Summary Feature:

Please note that the Patent Summary feature within the Due Diligence is currently available at no extra cost as part of your Due Diligence subscription.

However, we would like to inform our valued customers that in the future, this particular feature may be subject to additional charges. Any changes to the pricing structure will be communicated in advance, and users will have the opportunity to review and accept the updated terms and conditions.

We encourage users to take advantage of this feature during this complimentary access period. If you have any questions or need further clarification, please don’t hesitate to contact our support team.